- Switzerland

- /

- Media

- /

- SWX:TXGN

Swiss Small Cap Gems Compagnie Financière Tradition And 2 More Hidden Treasures

Reviewed by Simply Wall St

The Switzerland market ended weak on Monday, moving in a tight band amid concerns about rising geopolitical tensions and awaiting key inflation data from Switzerland and the Eurozone. Despite this, the KOF Swiss Economic Institute's economic barometer indicated a more favorable outlook for various sectors, including manufacturing and financial services. In such an environment, identifying small-cap stocks with strong fundamentals can be particularly rewarding. This article will explore three lesser-known Swiss small-cap gems: Compagnie Financière Tradition and two other hidden treasures that show promise amidst current market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Compagnie Financière Tradition SA operates as an interdealer broker of financial and non-financial products worldwide, with a market cap of CHF 1.23 billion.

Operations: The company generates revenue primarily from three geographic segments: the Americas (CHF 352.67 million), Asia-Pacific (CHF 273.16 million), and Europe, Middle East, and Africa (CHF 452.85 million).

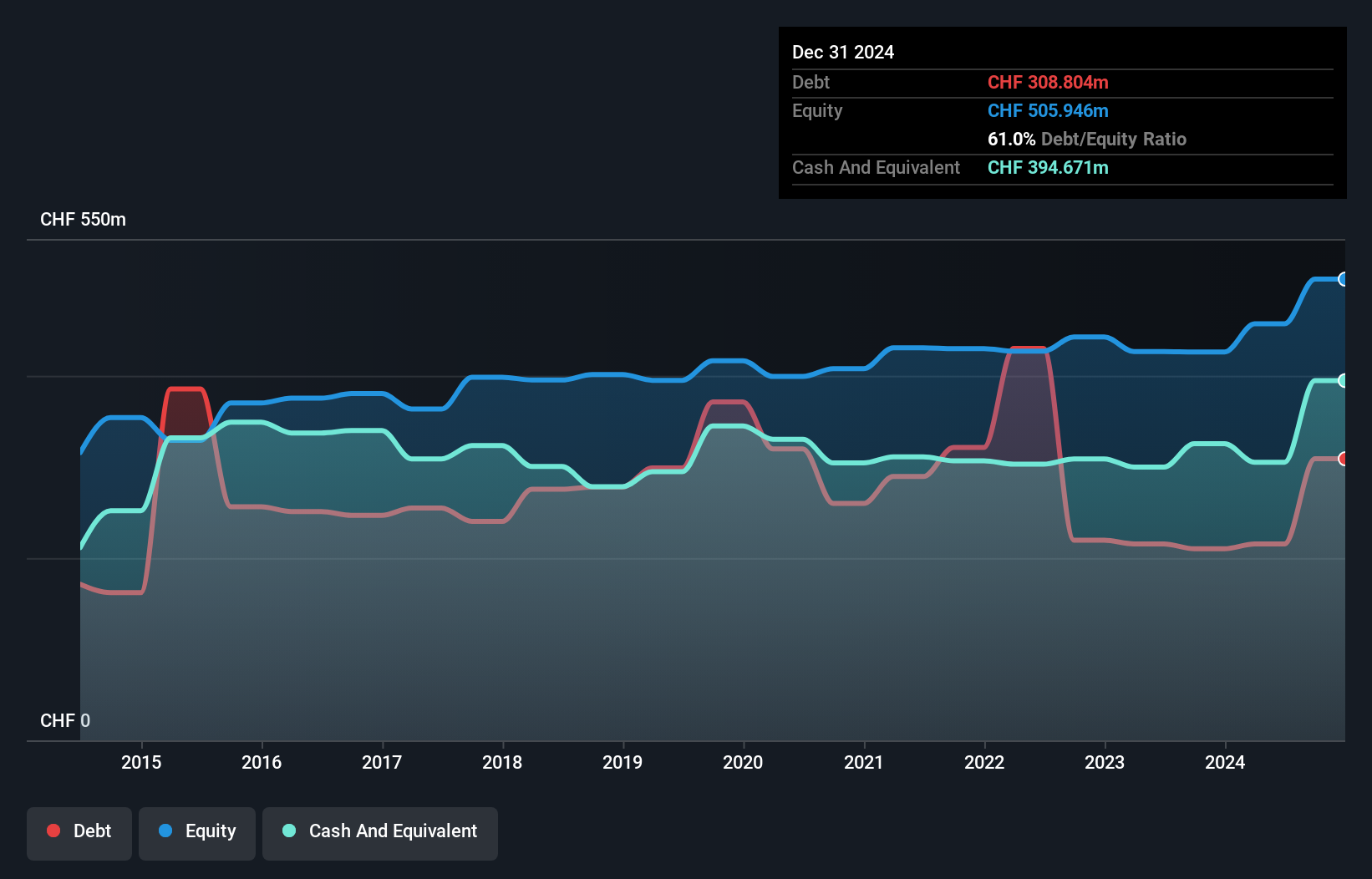

Compagnie Financière Tradition, a lesser-known financial entity in Switzerland, has shown impressive performance with earnings growth of 16.1% over the past year, surpassing the Capital Markets industry average of -12.1%. Trading at 29.7% below its estimated fair value, CFT's debt to equity ratio improved from 75.7% to 47.1% in five years. Recent half-year results reported revenue of CHF 538 million and net income of CHF 60 million, with basic earnings per share rising to CHF 7.98 from CHF 6.86 last year.

Romande Energie Holding (SWX:REHN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Romande Energie Holding SA engages in the production, distribution, and marketing of electrical and thermal energy in Switzerland, with a market cap of CHF1.26 billion.

Operations: Revenue for Romande Energie Holding SA is primarily driven by its Energy Solutions segment (CHF 539.70 million) and Grids segment (CHF 311.94 million), with additional contributions from Romande Energie Services (CHF 163.79 million) and Corporate activities (CHF 68.28 million).

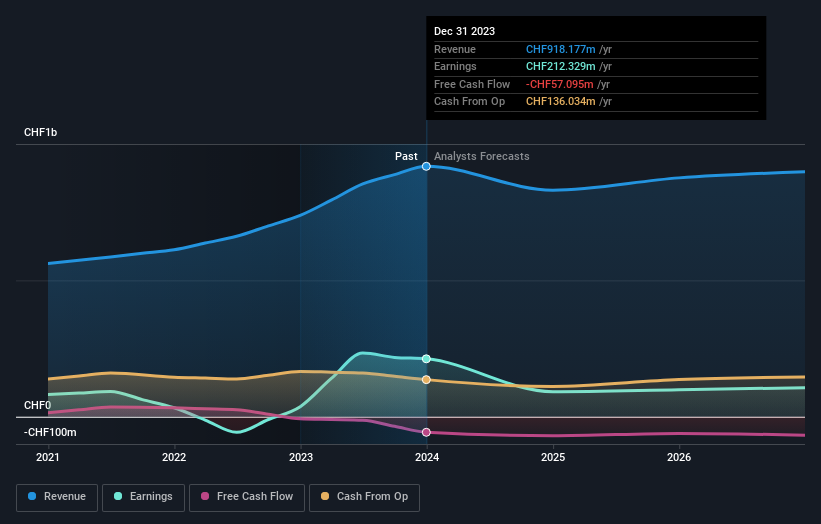

Romande Energie Holding, a small cap in the Swiss energy sector, has seen its debt to equity ratio rise from 6% to 9.2% over five years. Despite this, it trades at a favorable P/E ratio of 5.9x compared to the broader Swiss market's 22x. The company reported half-year sales of CHF 394.58 million and net income of CHF 65.28 million, reflecting a decrease from last year’s figures but still showing robust earnings growth of 476.6%.

- Get an in-depth perspective on Romande Energie Holding's performance by reading our health report here.

Assess Romande Energie Holding's past performance with our detailed historical performance reports.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

Overview: TX Group AG operates a network of platforms and participations that provides users with information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.50 billion.

Operations: Revenue streams for TX Group AG include CHF427 million from Tamedia, CHF299.10 million from Goldbach, CHF115.60 million from 20 Minutes, CHF126.40 million from TX Markets, and CHF159.40 million from Groups & Ventures segments.

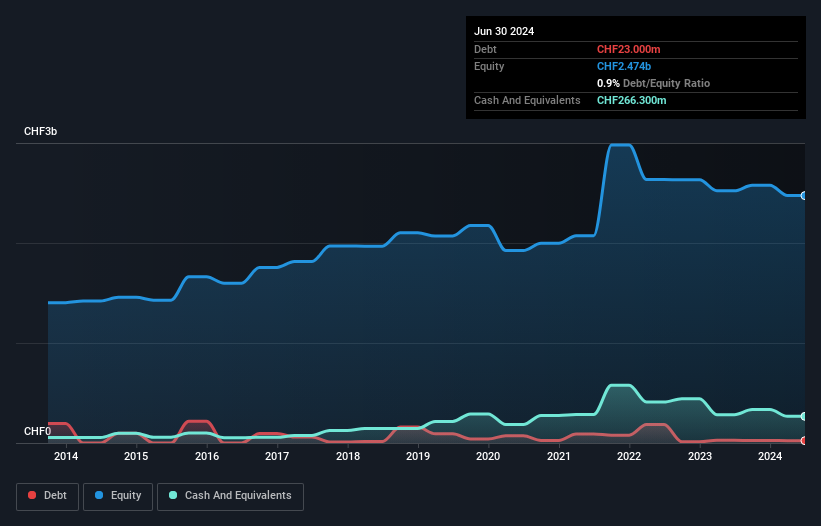

TX Group, a Swiss media company, recently reported a net income of CHF 9.6 million for the half year ending June 2024, reversing a net loss of CHF 1.4 million from the previous year. The company's debt to equity ratio improved significantly from 4.4% to 0.9% over five years, demonstrating robust financial health. Additionally, TX Group's earnings per share rose to CHF 0.9 compared to a loss per share of CHF 0.13 last year, reflecting its strong recovery and profitability trajectory

- Click here and access our complete health analysis report to understand the dynamics of TX Group.

Review our historical performance report to gain insights into TX Group's's past performance.

Where To Now?

- Take a closer look at our SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals list of 19 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TX Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:TXGN

TX Group

Operates a network of platforms and participations that provides users with information, orientation, entertainment, and support services in Switzerland.

Flawless balance sheet average dividend payer.