- Switzerland

- /

- Banks

- /

- SWX:BLKB

Exploring Swiss Dividend Stocks In May 2024

Reviewed by Simply Wall St

As the Switzerland market experienced a downturn, extending losses with investors taking profits following a sustained period of gains, concerns about global economic indicators such as rising consumer prices in the U.K. have influenced market sentiment. In this context, exploring Swiss dividend stocks becomes particularly intriguing, as stable dividends can offer investors potential resilience amidst broader market volatility.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Roche Holding (SWX:ROG) | 4.14% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.60% | ★★★★★★ |

| Vontobel Holding (SWX:VONN) | 5.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.61% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.29% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.53% | ★★★★★☆ |

| EFG International (SWX:EFGN) | 4.55% | ★★★★★☆ |

| Luzerner Kantonalbank (SWX:LUKN) | 3.62% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 4.79% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.65% | ★★★★★☆ |

Click here to see the full list of 27 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

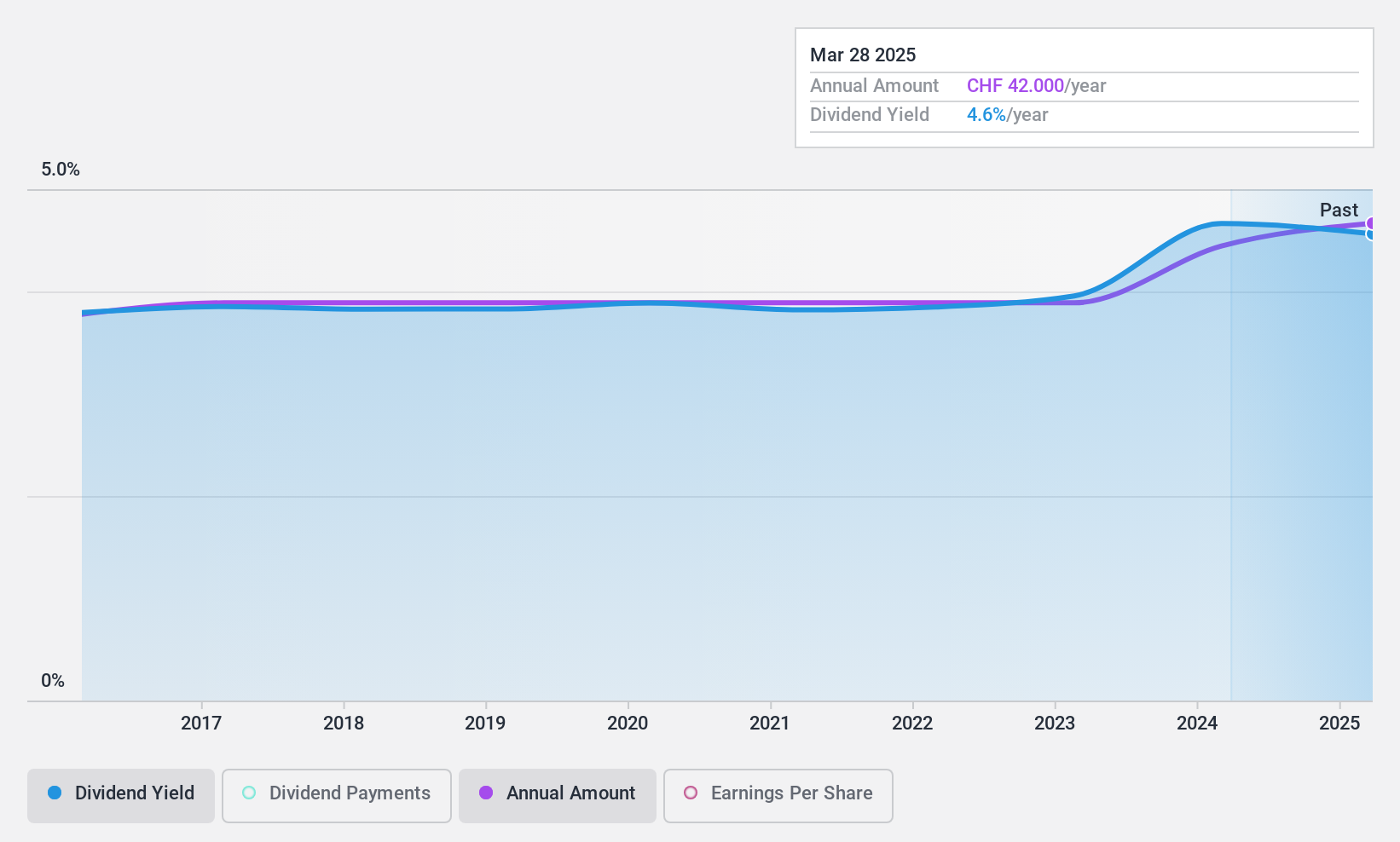

Banque Cantonale Vaudoise (SWX:BCVN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Banque Cantonale Vaudoise operates as a financial services provider in Vaud Canton, elsewhere in Switzerland, the European Union, North America, and internationally, with a market capitalization of approximately CHF 8.02 billion.

Operations: Banque Cantonale Vaudoise generates revenue from five primary segments: Trading (CHF 58 million), Retail Banking (CHF 231.50 million), Corporate Center (CHF 158.80 million), Corporate Banking (CHF 273.30 million), and Wealth Management (CHF 438.40 million).

Dividend Yield: 4.6%

Banque Cantonale Vaudoise offers a competitive dividend yield of 4.61%, ranking in the top 25% for Swiss dividend payers. The bank has demonstrated consistent growth with earnings up by 20.8% over the past year and dividends that have increased steadily over the last decade. Its payout ratio stands at 78.7%, ensuring dividends are well covered by earnings, with forecasts showing continued coverage at an 85.4% payout ratio in three years. Moreover, its Price-To-Earnings ratio of 17.1x is below the Swiss market average, enhancing its appeal as a value investment amidst stable and reliable dividend payments.

- Get an in-depth perspective on Banque Cantonale Vaudoise's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Banque Cantonale Vaudoise is trading beyond its estimated value.

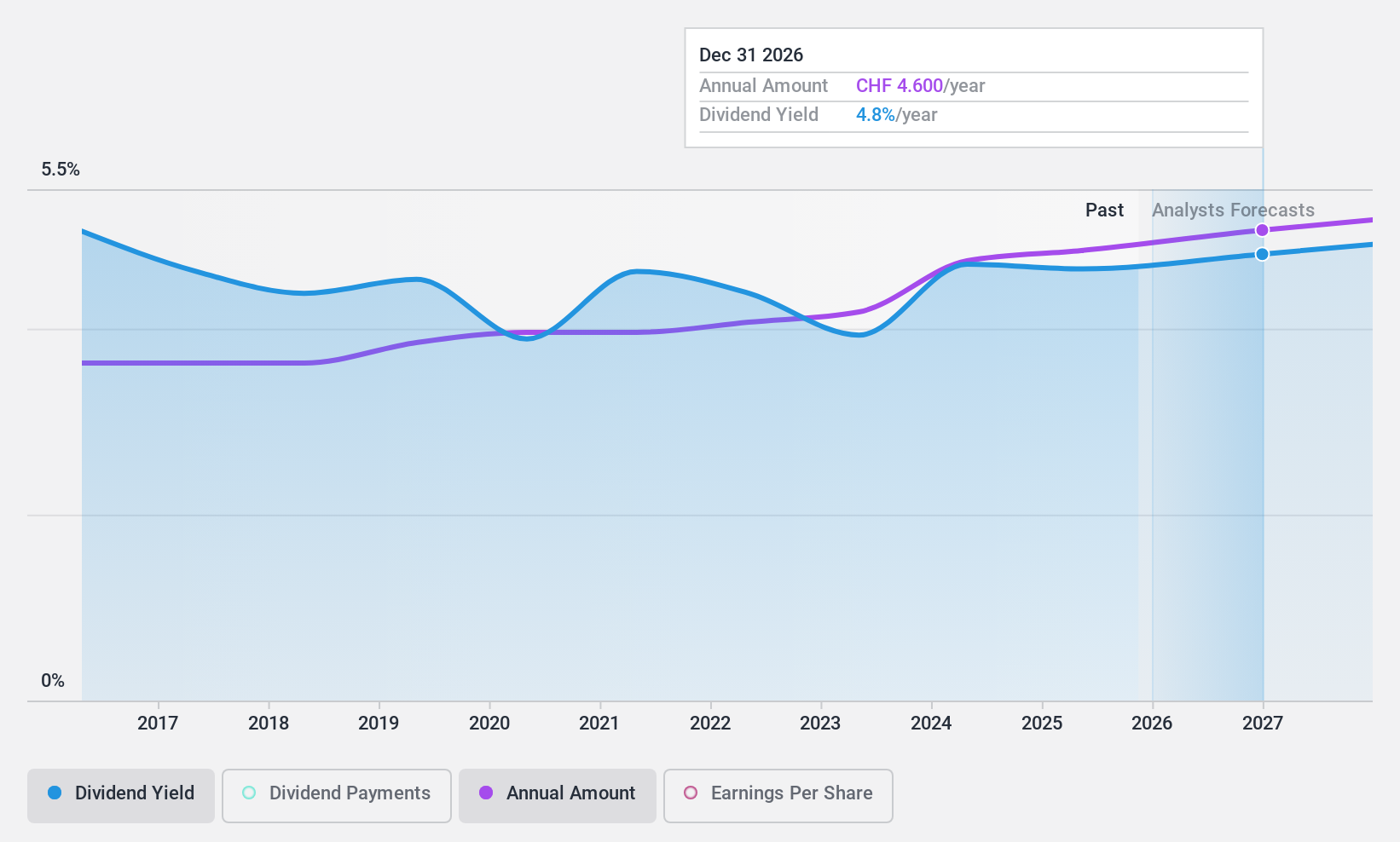

Basellandschaftliche Kantonalbank (SWX:BLKB)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Basellandschaftliche Kantonalbank offers a range of banking products and services to private, institutional, business, and public sector clients across Switzerland, with a market capitalization of CHF 1.86 billion.

Operations: Basellandschaftliche Kantonalbank generates CHF 458.55 million in revenue primarily through its banking operations.

Dividend Yield: 4.7%

Basellandschaftliche Kantonalbank reported a robust financial year with net interest income rising to CHF 333.72 million and net income reaching CHF 152.51 million, showing significant growth from the previous year. The bank maintains a strong dividend appeal with a yield of 4.65%, supported by a sustainable payout ratio of 56.7%. Despite trading at 29.3% below its estimated fair value, it has consistently increased its dividends over the past decade, underpinned by stable earnings growth and a low allowance for bad loans at 51%.

- Click here and access our complete dividend analysis report to understand the dynamics of Basellandschaftliche Kantonalbank.

- Our valuation report here indicates Basellandschaftliche Kantonalbank may be overvalued.

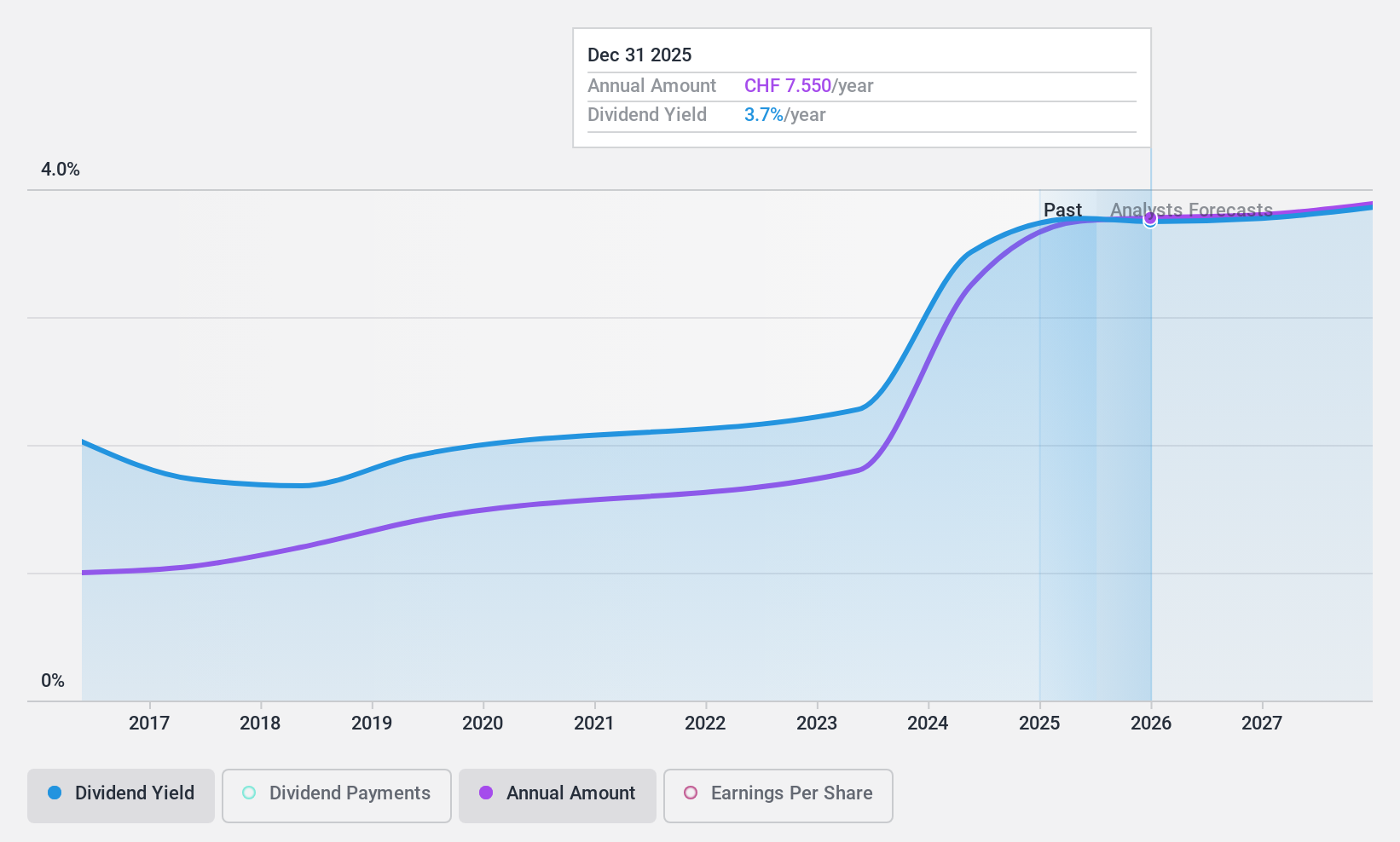

Jungfraubahn Holding (SWX:JFN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jungfraubahn Holding AG operates cogwheel railways and winter sports facilities in the Jungfrau region of Switzerland, with a market capitalization of approximately CHF 1.10 billion.

Operations: Jungfraubahn Holding AG generates revenue primarily from three segments: CHF 188.24 million from the Jungfraujoch - TOP of Europe, CHF 45.94 million from Experience Mountains, and CHF 41.26 million from Winter Sports activities.

Dividend Yield: 3.3%

Jungfraubahn Holding AG demonstrated substantial financial growth in 2023, with sales increasing to CHF 30.72 million and net income rising sharply to CHF 79.15 million. Despite a low dividend yield of 3.31%, the company's dividends are well-covered by earnings with a payout ratio of 47.8% and by cash flows at a cash payout ratio of 61.7%. However, its dividend track record over the past decade has been marked by volatility and unreliability in payments.

- Take a closer look at Jungfraubahn Holding's potential here in our dividend report.

- Our expertly prepared valuation report Jungfraubahn Holding implies its share price may be lower than expected.

Make It Happen

- Discover the full array of 27 Top Dividend Stocks right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basellandschaftliche Kantonalbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BLKB

Basellandschaftliche Kantonalbank

Provides various banking products and services to the private and corporate customers in Switzerland.

Solid track record established dividend payer.