We Take A Look At Why Schaffner Holding AG's (VTX:SAHN) CEO Compensation Is Well Earned

Key Insights

- Schaffner Holding to hold its Annual General Meeting on 10 January 2023

- CEO Marc Aeschlimann's total compensation includes salary of CHF425.0k

- Total compensation is similar to the industry average

- Schaffner Holding's EPS grew by 21% over the past three years while total shareholder return over the past three years was 45%

It would be hard to discount the role that CEO Marc Aeschlimann has played in delivering the impressive results at Schaffner Holding AG (VTX:SAHN) recently. Coming up to the next AGM on 10 January 2023, shareholders would be keeping this in mind. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. We think the CEO has done a pretty decent job and we discuss why the CEO compensation is appropriate.

View our latest analysis for Schaffner Holding

Comparing Schaffner Holding AG's CEO Compensation With The Industry

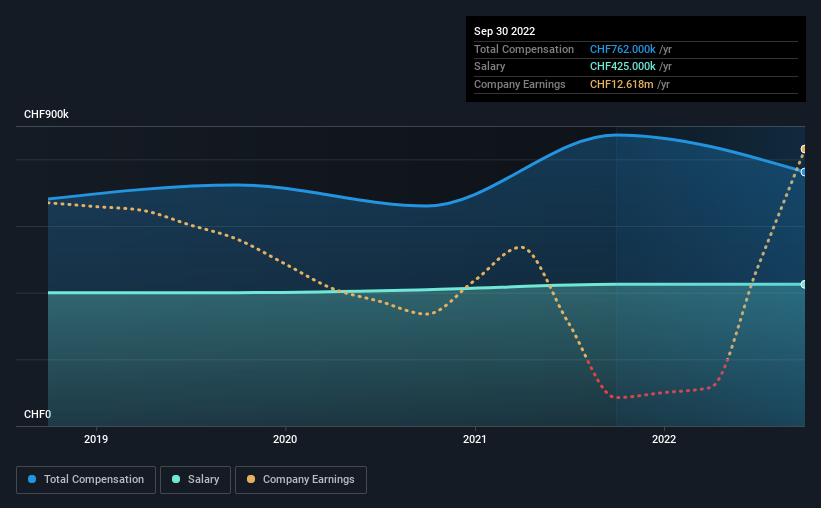

According to our data, Schaffner Holding AG has a market capitalization of CHF185m, and paid its CEO total annual compensation worth CHF762k over the year to September 2022. Notably, that's a decrease of 13% over the year before. Notably, the salary which is CHF425.0k, represents a considerable chunk of the total compensation being paid.

On examining similar-sized companies in the Swiss Electronic industry with market capitalizations between CHF92m and CHF370m, we discovered that the median CEO total compensation of that group was CHF1.1m. From this we gather that Marc Aeschlimann is paid around the median for CEOs in the industry. Furthermore, Marc Aeschlimann directly owns CHF615k worth of shares in the company.

| Component | 2022 | 2021 | Proportion (2022) |

| Salary | CHF425k | CHF425k | 56% |

| Other | CHF337k | CHF448k | 44% |

| Total Compensation | CHF762k | CHF873k | 100% |

Talking in terms of the industry, salary represented approximately 40% of total compensation out of all the companies we analyzed, while other remuneration made up 60% of the pie. Schaffner Holding is paying a higher share of its remuneration through a salary in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Schaffner Holding AG's Growth

Schaffner Holding AG's earnings per share (EPS) grew 21% per year over the last three years. Its revenue is down 8.3% over the previous year.

This demonstrates that the company has been improving recently and is good news for the shareholders. While it would be good to see revenue growth, profits matter more in the end. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Schaffner Holding AG Been A Good Investment?

We think that the total shareholder return of 45%, over three years, would leave most Schaffner Holding AG shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

In Summary...

Given the improved performance, shareholders may be more forgiving of CEO compensation in the upcoming AGM. However, despite the strong growth in earnings and share price growth, the focus for shareholders would be how the company plans to steer the company towards sustainable profitability in the near future.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 2 warning signs for Schaffner Holding you should be aware of, and 1 of them is a bit unpleasant.

Important note: Schaffner Holding is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:SAHN

Schaffner Holding

Schaffner Holding AG, together with its subsidiaries, develops, manufactures, and sells solutions for power electronic systems worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives