- Switzerland

- /

- Banks

- /

- SWX:BCVN

Banque Cantonale Vaudoise And Two More Leading Dividend Stocks

Reviewed by Simply Wall St

The Swiss market recently displayed resilience, closing moderately higher as investors anticipated key economic data, including an upcoming report on Swiss inflation. Amidst this optimistic backdrop, where indices like the SMI are showing gains, dividend stocks such as Banque Cantonale Vaudoise become particularly appealing for their potential to offer steady returns in a robust economic environment.

Top 10 Dividend Stocks In Switzerland

| Name | Dividend Yield | Dividend Rating |

| Vontobel Holding (SWX:VONN) | 5.55% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 5.18% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.46% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.37% | ★★★★★★ |

| Novartis (SWX:NOVN) | 3.35% | ★★★★★☆ |

| Roche Holding (SWX:ROG) | 3.84% | ★★★★★☆ |

| Julius Bär Gruppe (SWX:BAER) | 5.09% | ★★★★★☆ |

| Holcim (SWX:HOLN) | 3.50% | ★★★★★☆ |

| Basellandschaftliche Kantonalbank (SWX:BLKB) | 4.75% | ★★★★★☆ |

| Helvetia Holding (SWX:HELN) | 5.11% | ★★★★★☆ |

Click here to see the full list of 26 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Banque Cantonale Vaudoise (SWX:BCVN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Banque Cantonale Vaudoise operates as a financial services provider in Vaud Canton, across Switzerland, the European Union, North America, and internationally, with a market capitalization of approximately CHF 8.29 billion.

Operations: Banque Cantonale Vaudoise generates revenue through several segments, including Trading (CHF 58 million), Retail Banking (CHF 231.50 million), Corporate Center (CHF 158.80 million), Corporate Banking (CHF 273.30 million), and Wealth Management (CHF 438.40 million).

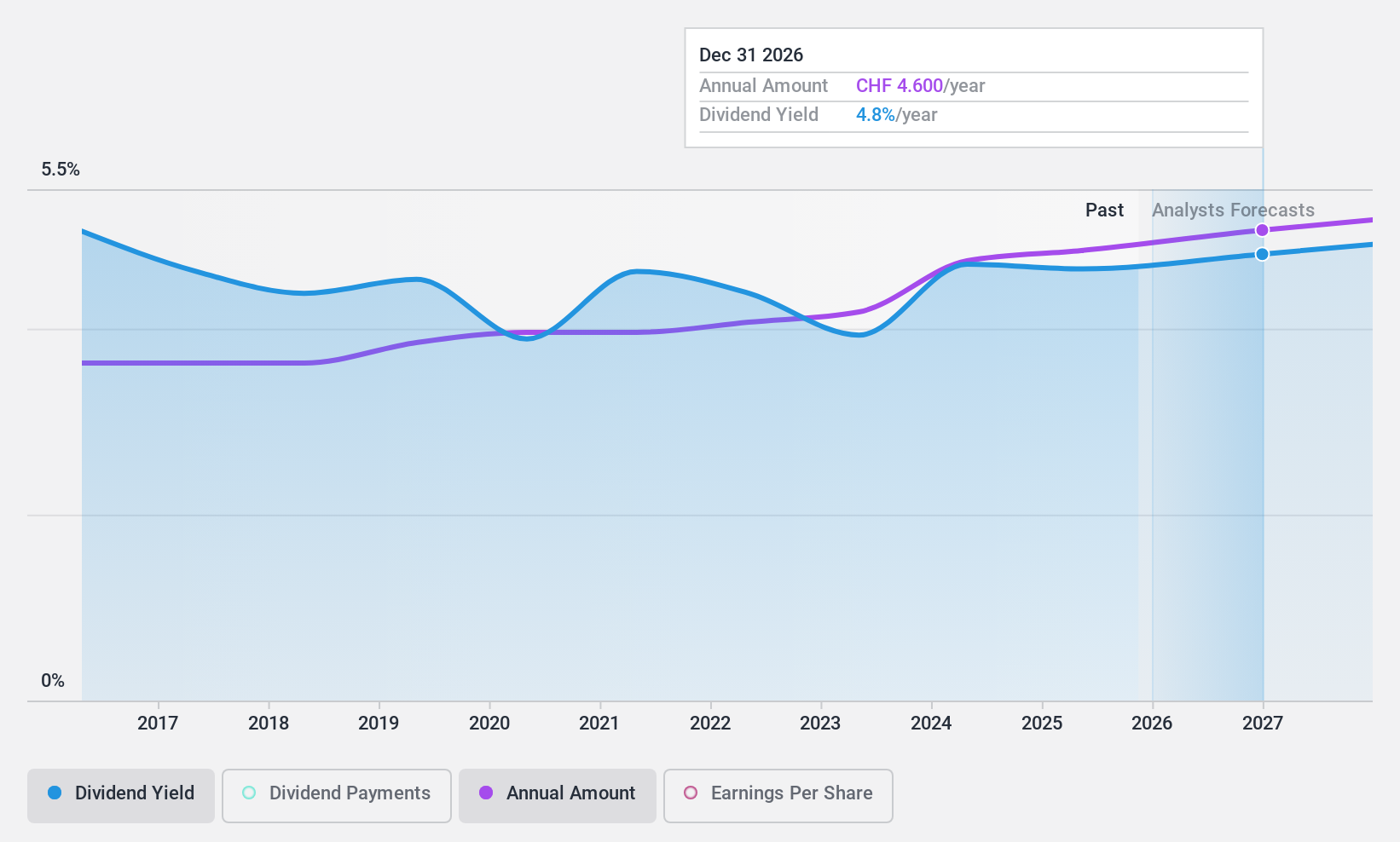

Dividend Yield: 4.5%

Banque Cantonale Vaudoise offers a compelling case for dividend-focused investors, with a stable dividend yield of 4.46%, ranking in the top 25% in the Swiss market. The bank maintains a payout ratio of 78.7%, ensuring dividends are well covered by earnings, a trend expected to continue with an anticipated payout ratio of 85.4% in three years. Despite modest forecasted earnings growth of 0.21% annually, BCVN has consistently increased its dividends over the past decade and demonstrated reliability in its payments amidst varying economic conditions.

- Take a closer look at Banque Cantonale Vaudoise's potential here in our dividend report.

- Our valuation report here indicates Banque Cantonale Vaudoise may be overvalued.

LEM Holding (SWX:LEHN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LEM Holding SA operates globally, offering solutions for measuring electrical parameters across various regions including Asia, Europe, the Middle East, Africa, and the Americas, with a market capitalization of approximately CHF 1.61 billion.

Operations: LEM Holding SA generates revenue primarily from two segments: Asia (CHF 201.98 million) and Europe/Americas (CHF 203.80 million).

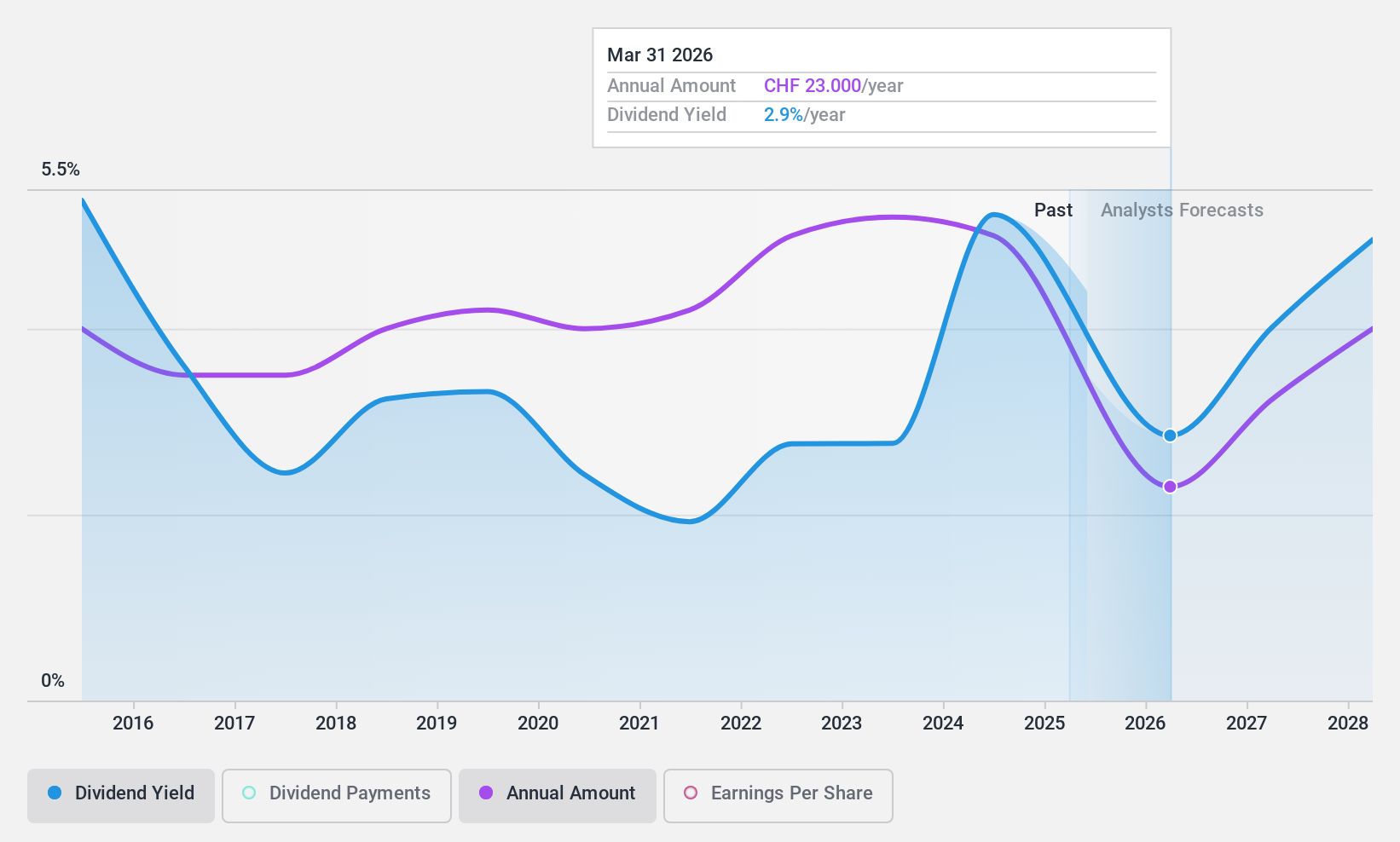

Dividend Yield: 3.5%

LEM Holding SA's dividend yield of 3.55% trails behind the top Swiss dividend payers. Despite a decade of stable and increasing dividends, the current cash payout ratio at 125.8% suggests these are not well supported by cash flow, posing risks to sustainability. Recent earnings show a decline with net income dropping from CHF 75.34 million to CHF 65.33 million year-over-year, further challenging future dividend reliability despite trading below estimated fair value by 15.6%.

- Click here and access our complete dividend analysis report to understand the dynamics of LEM Holding.

- The analysis detailed in our LEM Holding valuation report hints at an deflated share price compared to its estimated value.

Vontobel Holding (SWX:VONN)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Vontobel Holding AG offers a range of financial services to private and institutional clients across multiple countries including Switzerland, Germany, the UK, Italy, North America, and several Asian regions, with a market capitalization of approximately CHF 2.99 billion.

Operations: Vontobel Holding AG generates revenue primarily through three segments: Asset Management (CHF 384.10 million), Digital Investing (CHF 154.30 million), and Wealth Management (CHF 746.90 million).

Dividend Yield: 5.5%

Vontobel Holding offers a robust dividend yield at 5.55%, ranking well among Swiss firms. Over the past decade, its dividends have shown growth and stability, supported by a conservative payout ratio of 77.7%. Looking ahead, dividends are expected to be comfortably covered with a forecasted payout ratio of 58.5% in three years. Despite trading at a significant discount to fair value (44.2% below), investors should note that 63% of Vontobel's liabilities stem from higher-risk funding sources.

- Click here to discover the nuances of Vontobel Holding with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Vontobel Holding's share price might be too pessimistic.

Where To Now?

- Navigate through the entire inventory of 26 Top Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banque Cantonale Vaudoise might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BCVN

Banque Cantonale Vaudoise

Engages in the provision of various financial services in Vaud Canton and rest of Switzerland, the European Union, North America, and internationally.

6 star dividend payer with excellent balance sheet.