- China

- /

- Electrical

- /

- SHSE:688032

3 High-Growth Insider-Owned Companies With Earnings Up To 37%

Reviewed by Simply Wall St

Global markets have been grappling with concerns over an economic slowdown, as evidenced by the S&P 500 Index experiencing its worst weekly drop in 18 months. Amidst this backdrop, investors are increasingly looking for companies that not only show high growth potential but also have significant insider ownership, which can be a strong indicator of confidence in the company's future prospects. In turbulent times like these, stocks with robust earnings and high insider ownership often stand out as they suggest alignment between company leadership and shareholder interests. Here are three such high-growth companies where insiders own substantial shares and earnings have surged up to 37%.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 20.6% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

| Kirloskar Pneumatic (BSE:505283) | 30.4% | 30.1% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 29.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.5% | 52.1% |

| KebNi (OM:KEBNI B) | 37.8% | 86.1% |

| Adocia (ENXTPA:ADOC) | 11.9% | 63% |

| Adveritas (ASX:AV1) | 21.1% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| HANA Micron (KOSDAQ:A067310) | 21.3% | 106.2% |

Let's uncover some gems from our specialized screener.

Ningbo Deye Technology Group (SHSE:605117)

Simply Wall St Growth Rating: ★★★★★★

Overview: Ningbo Deye Technology Group Co., Ltd. produces and sells heat exchangers, inverters, and dehumidifiers across China, the UK, the US, Germany, India, and other international markets with a market cap of CN¥54.80 billion.

Operations: The company generates revenue from the production and sales of heat exchangers, inverters, and dehumidifiers across China, the UK, the US, Germany, India, and other international markets.

Insider Ownership: 23.4%

Earnings Growth Forecast: 31.1% p.a.

Ningbo Deye Technology Group, with significant insider ownership, is experiencing rapid growth. Analysts forecast its earnings to grow 31.05% annually and revenue by 32%, outpacing the broader Chinese market. However, recent earnings showed a slight decline in sales and net income compared to last year. The company's shares are trading at 33.2% below estimated fair value despite high volatility and past shareholder dilution due to private placements totaling CNY 1.99 billion (US$273 million).

- Click here and access our complete growth analysis report to understand the dynamics of Ningbo Deye Technology Group.

- Our comprehensive valuation report raises the possibility that Ningbo Deye Technology Group is priced lower than what may be justified by its financials.

Hoymiles Power Electronics (SHSE:688032)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hoymiles Power Electronics Inc. manufactures and sells module level power electronics (MLPE) solutions both in China and internationally, with a market cap of CN¥15.38 billion.

Operations: Hoymiles Power Electronics Inc. generates revenue from the manufacture and sale of module level power electronics (MLPE) solutions both domestically and internationally.

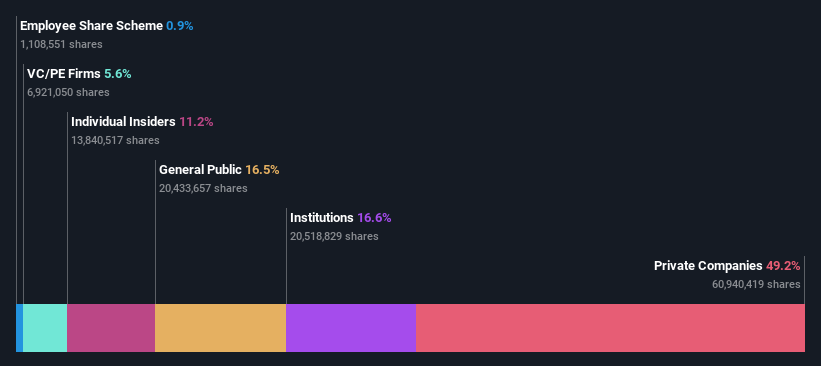

Insider Ownership: 11.2%

Earnings Growth Forecast: 37.7% p.a.

Hoymiles Power Electronics, with substantial insider ownership, is projected to see significant growth in both revenue (37.4% annually) and earnings (37.7% annually), outpacing the broader Chinese market. Despite a recent dip in sales and net income for H1 2024, the company announced a CNY 200 million share repurchase program to enhance shareholder value. However, profit margins have decreased from last year, and the stock has shown high volatility recently.

- Click here to discover the nuances of Hoymiles Power Electronics with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that Hoymiles Power Electronics is trading beyond its estimated value.

LEM Holding (SWX:LEHN)

Simply Wall St Growth Rating: ★★★★☆☆

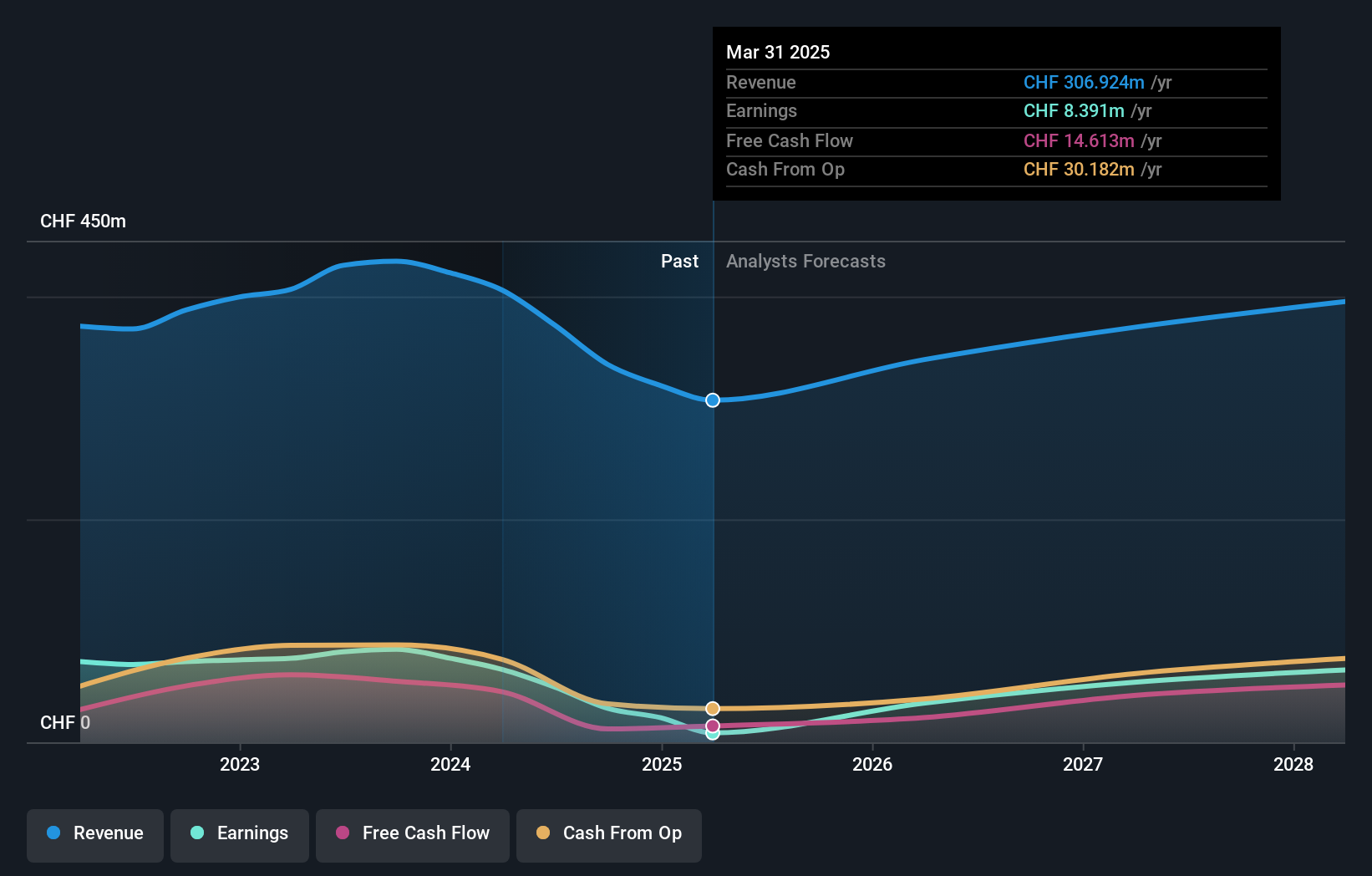

Overview: LEM Holding SA, with a market cap of CHF1.44 billion, provides solutions for measuring electrical parameters across various regions including China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Operations: Revenue Segments: LEM Holding SA generates revenue by providing solutions for measuring electrical parameters in regions such as China, Japan, South Korea, India, Southeast Asia, Europe, the Middle East, Africa, NAFTA and Latin America.

Insider Ownership: 29.9%

Earnings Growth Forecast: 17.1% p.a.

LEM Holding, with high insider ownership, faces mixed growth prospects. Despite a forecasted earnings growth of 17.07% annually, its revenue is expected to grow at 9% per year—faster than the Swiss market but not exceptionally high. Recent earnings show a decline in sales (CHF 80.96 million) and net income (CHF 4.78 million) compared to last year. The stock is trading at 31.4% below fair value estimates, yet it remains highly volatile and has lower profit margins than the previous year.

- Take a closer look at LEM Holding's potential here in our earnings growth report.

- The valuation report we've compiled suggests that LEM Holding's current price could be quite moderate.

Where To Now?

- Investigate our full lineup of 1514 Fast Growing Companies With High Insider Ownership right here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Hoymiles Power Electronics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688032

Hoymiles Power Electronics

Engages in the manufacture and sale of module level power electronics (MLPE) solutions in China and internationally.

Flawless balance sheet with high growth potential.