- Switzerland

- /

- Semiconductors

- /

- SWX:MBTN

Meyer Burger Technology (VTX:MBTN investor five-year losses grow to 56% as the stock sheds CHF187m this past week

Statistically speaking, long term investing is a profitable endeavour. But no-one is immune from buying too high. Zooming in on an example, the Meyer Burger Technology AG (VTX:MBTN) share price dropped 70% in the last half decade. That's an unpleasant experience for long term holders. And some of the more recent buyers are probably worried, too, with the stock falling 66% in the last year. Shareholders have had an even rougher run lately, with the share price down 52% in the last 90 days.

If the past week is anything to go by, investor sentiment for Meyer Burger Technology isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Meyer Burger Technology

Because Meyer Burger Technology made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over half a decade Meyer Burger Technology reduced its trailing twelve month revenue by 35% for each year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 11% per year in that period. This kind of price performance makes us very wary, especially when combined with falling revenue. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

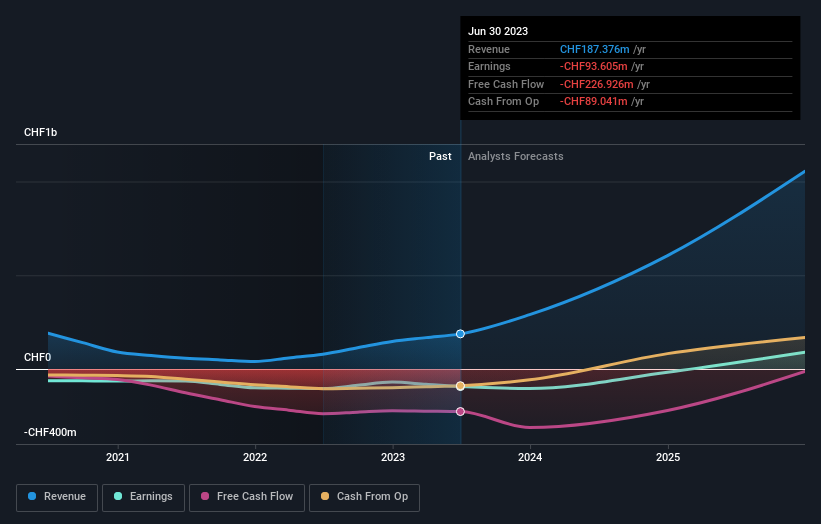

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Meyer Burger Technology is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Meyer Burger Technology's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that Meyer Burger Technology's TSR, at -56% is higher than its share price return of -70%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

While the broader market gained around 2.5% in the last year, Meyer Burger Technology shareholders lost 66%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 1 warning sign for Meyer Burger Technology that you should be aware of before investing here.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:MBTN

Meyer Burger Technology

A technology company, produces and sells solar cells and modules.

Exceptional growth potential slight.