Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Dufry AG (VTX:DUFN) makes use of debt. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Dufry

What Is Dufry's Debt?

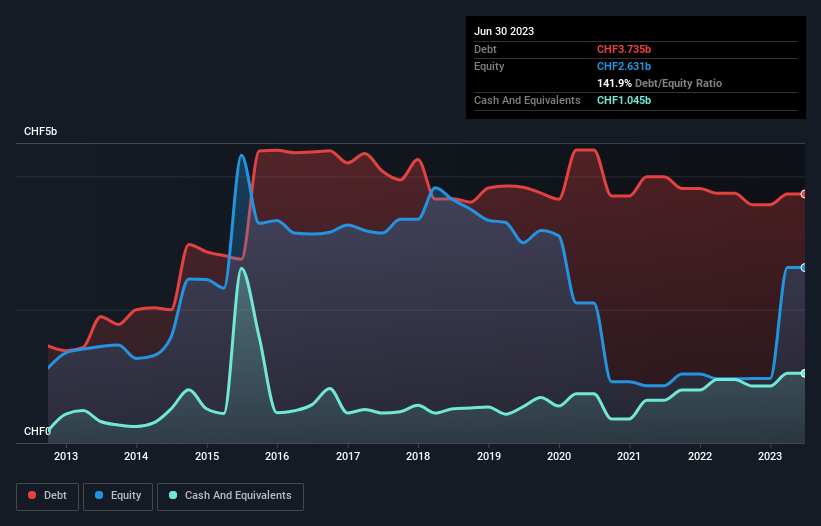

The chart below, which you can click on for greater detail, shows that Dufry had CHF3.73b in debt in June 2023; about the same as the year before. However, it does have CHF1.05b in cash offsetting this, leading to net debt of about CHF2.69b.

How Healthy Is Dufry's Balance Sheet?

We can see from the most recent balance sheet that Dufry had liabilities of CHF3.71b falling due within a year, and liabilities of CHF7.32b due beyond that. Offsetting this, it had CHF1.05b in cash and CHF684.8m in receivables that were due within 12 months. So it has liabilities totalling CHF9.31b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the CHF5.79b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, Dufry would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Dufry's net debt is sitting at a very reasonable 2.4 times its EBITDA, while its EBIT covered its interest expense just 2.5 times last year. While that doesn't worry us too much, it does suggest the interest payments are somewhat of a burden. However, the silver lining was that Dufry achieved a positive EBIT of CHF705m in the last twelve months, an improvement on the prior year's loss. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Dufry's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Happily for any shareholders, Dufry actually produced more free cash flow than EBIT over the last year. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Our View

We'd go so far as to say Dufry's level of total liabilities was disappointing. But at least it's pretty decent at converting EBIT to free cash flow; that's encouraging. Once we consider all the factors above, together, it seems to us that Dufry's debt is making it a bit risky. That's not necessarily a bad thing, but we'd generally feel more comfortable with less leverage. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 3 warning signs for Dufry (of which 2 are potentially serious!) you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:AVOL

Avolta

Operates as a travel retailer. The company’s retail brands include general travel retail shops under the Dufry, World Duty Free, Nuance, Hellenic Duty Free, Zurich Duty-Free or Stockholm Duty-Free, Autogrill, and HMSHost brands; Dufry shopping stores; brand boutiques; convenience stores primarily under the Hudson brand; and specialized shops and theme stores.

Solid track record with reasonable growth potential.