- Switzerland

- /

- Pharma

- /

- SWX:GALD

Galderma (SWX:GALD) Valuation in Focus Following FDA Nod for Expanded Restylane Lyft Use

Reviewed by Simply Wall St

Galderma Group (SWX:GALD) received FDA approval for Restylane Lyft with Lidocaine, now cleared for chin augmentation in adults. Backed by pivotal trial data, this move further broadens Restylane Lyft’s indications in the US market.

See our latest analysis for Galderma Group.

Galderma Group’s FDA win added fresh momentum to its already impressive run this year. Recent gains have kept investor attention squarely on the company’s growth story. The stock’s 47.6% year-to-date share price return stands out, and the real highlight is a 77.9% total shareholder return over the past year. This underscores enthusiasm for both earnings progress and new product milestones.

If Galderma’s progress has you on the lookout for more healthcare standouts, it’s a perfect time to explore See the full list for free.

With shares hitting record highs, the question now is whether Galderma’s strong growth and product momentum are already reflected in the price or if this approval signals a new buying opportunity for investors.

Most Popular Narrative: Fairly Valued

Galderma Group’s fair value estimate from the most widely followed narrative is just a fraction above where shares last closed. Analysts see current prices as closely aligned with forecasts, with fresh upgrades reflecting recent performance strength.

"Bullish analysts have significantly raised their price targets for Galderma, reflecting stronger confidence in the company’s growth trajectory. Upward revisions are tied to improved margin forecasts. This suggests the firm is expected to drive higher profitability in coming quarters."

Wondering what assumptions drive analysts to lift those margin forecasts and price targets? There is a playbook for revenue, profits, and future multiples that could surprise even the most bullish investors. Which future numbers do they expect Galderma to hit? Find out what’s really powering this near-fair-value call.

Result: Fair Value of $149.91 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pricing pressure in injectables and an overreliance on a few blockbuster products may create challenges for Galderma's ability to sustain its recent growth pace.

Find out about the key risks to this Galderma Group narrative.

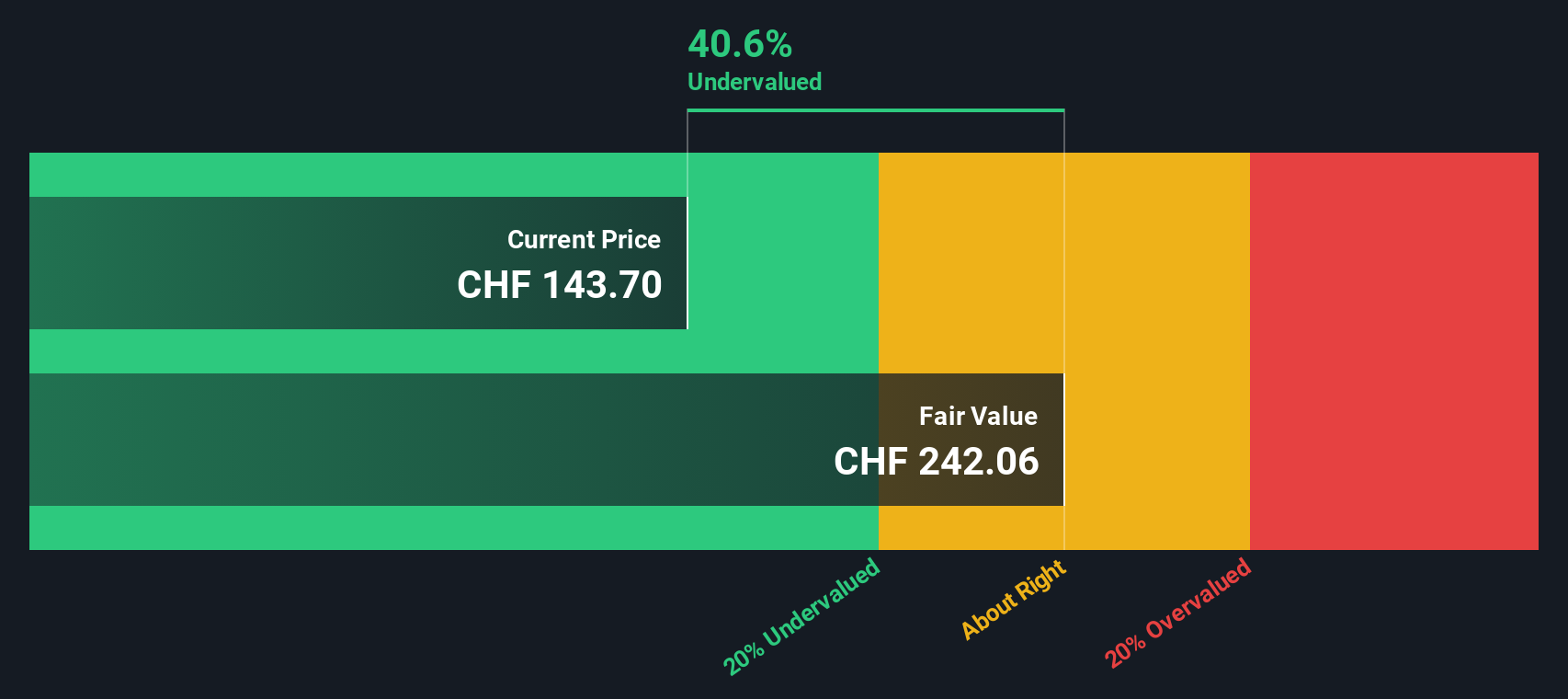

Another View: Discounted Cash Flow Signals Opportunity

While analysts see Galderma Group as fairly valued based on consensus estimates, the SWS DCF model points to a much lower fair value. This suggests the stock could actually be trading at a significant discount. This raises the question: are investors missing out on a hidden opportunity, or are the risks reflected in the price for good reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Galderma Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Galderma Group Narrative

If you want to challenge the current outlook or dig into Galderma Group’s data for yourself, it only takes a few minutes to shape your own perspective. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Galderma Group.

Ready for More Winning Ideas?

Seize your next opportunity by checking out stocks other investors are talking about. Why wait when new trends and top picks are right at your fingertips?

- Accelerate your returns and tap into potential market leaders with these 874 undervalued stocks based on cash flows, which focuses on companies trading below their true worth.

- Supplement your income and grow wealth over time by reviewing these 16 dividend stocks with yields > 3%, featuring candidates with attractive yields above 3%.

- Ride the innovation wave and catch the momentum with these 24 AI penny stocks to discover bold companies at the cutting edge of artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:GALD

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives