Stock Analysis

High Growth Tech Stocks To Watch In Switzerland August 2024

Reviewed by Simply Wall St

The Switzerland market ended marginally down on Tuesday despite trading higher till a couple of hours past noon, as investors digested the latest batch of economic data from the European region and looked ahead to key Fed announcements. In this fluctuating environment, identifying high growth tech stocks can be crucial for investors seeking opportunities amid economic uncertainties.

Top 5 High Growth Tech Companies In Switzerland

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| LEM Holding | 9.25% | 18.37% | ★★★★☆☆ |

| Santhera Pharmaceuticals Holding | 22.30% | 32.48% | ★★★★★★ |

| Temenos | 7.59% | 14.32% | ★★★★☆☆ |

| Comet Holding | 19.03% | 48.25% | ★★★★★☆ |

| Cicor Technologies | 7.10% | 27.73% | ★★★★☆☆ |

| Basilea Pharmaceutica | 9.88% | 36.82% | ★★★★★☆ |

| SoftwareONE Holding | 8.12% | 35.28% | ★★★★★☆ |

| MCH Group | 5.18% | 83.82% | ★★★★☆☆ |

| Sensirion Holding | 13.28% | 79.98% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Basilea Pharmaceutica (SWX:BSLN)

Simply Wall St Growth Rating: ★★★★★☆

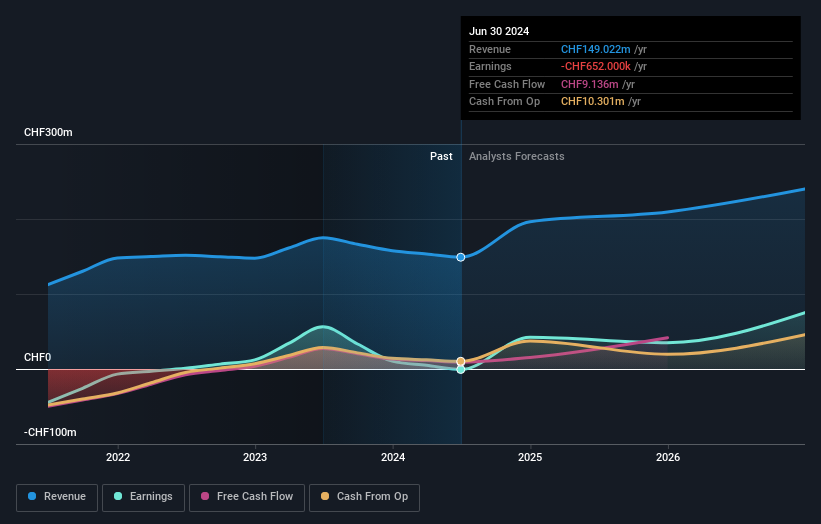

Overview: Basilea Pharmaceutica AG, a commercial-stage biopharmaceutical company with a market cap of CHF538.78 million, focuses on developing products for oncology and anti-infectives.

Operations: The company generates revenue primarily through the discovery, development, and commercialization of innovative pharmaceutical products, amounting to CHF149.02 million. Its business operations are centered around addressing medical needs in oncology and anti-infectives.

Basilea Pharmaceutica, a notable player in the Swiss biotech scene, reported CHF 76.29 million in revenue for H1 2024, down from CHF 84.91 million the previous year. Despite this, its earnings per share from continuing operations fell to CHF 1.72 from CHF 2.66 last year. The company's R&D expenditure is significant and integral to its future growth; with an expected annual profit growth of 36.82%, Basilea's focus on innovative treatments positions it well for long-term success in the competitive biotech industry.

Comet Holding (SWX:COTN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Comet Holding AG, along with its subsidiaries, offers X-ray and radio frequency (RF) power technology solutions across Europe, North America, Asia, and globally, with a market cap of CHF2.69 billion.

Operations: The company generates revenue primarily through its Plasma Control Technologies (CHF180.62 million), X-Ray Systems (CHF115.34 million), and Industrial X-Ray Modules (CHF95.90 million) segments. The business focuses on providing advanced technology solutions in X-ray and RF power across various international markets.

Comet Holding AG, a Swiss tech firm, reported CHF 189.32 million in sales for H1 2024, down from CHF 207.03 million the previous year, yet net income surged to CHF 4.06 million from CHF 1.94 million. With earnings per share doubling to CHF 0.52 and an impressive forecasted annual profit growth of 48.3%, Comet's future looks promising despite recent volatility in its stock price and a lower profit margin of 4.6% compared to last year's 10.8%. The company's dedication to innovation is evident with significant R&D expenses contributing to its long-term strategy; this focus on cutting-edge technology positions it well within the competitive landscape of high-growth tech firms in Switzerland.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

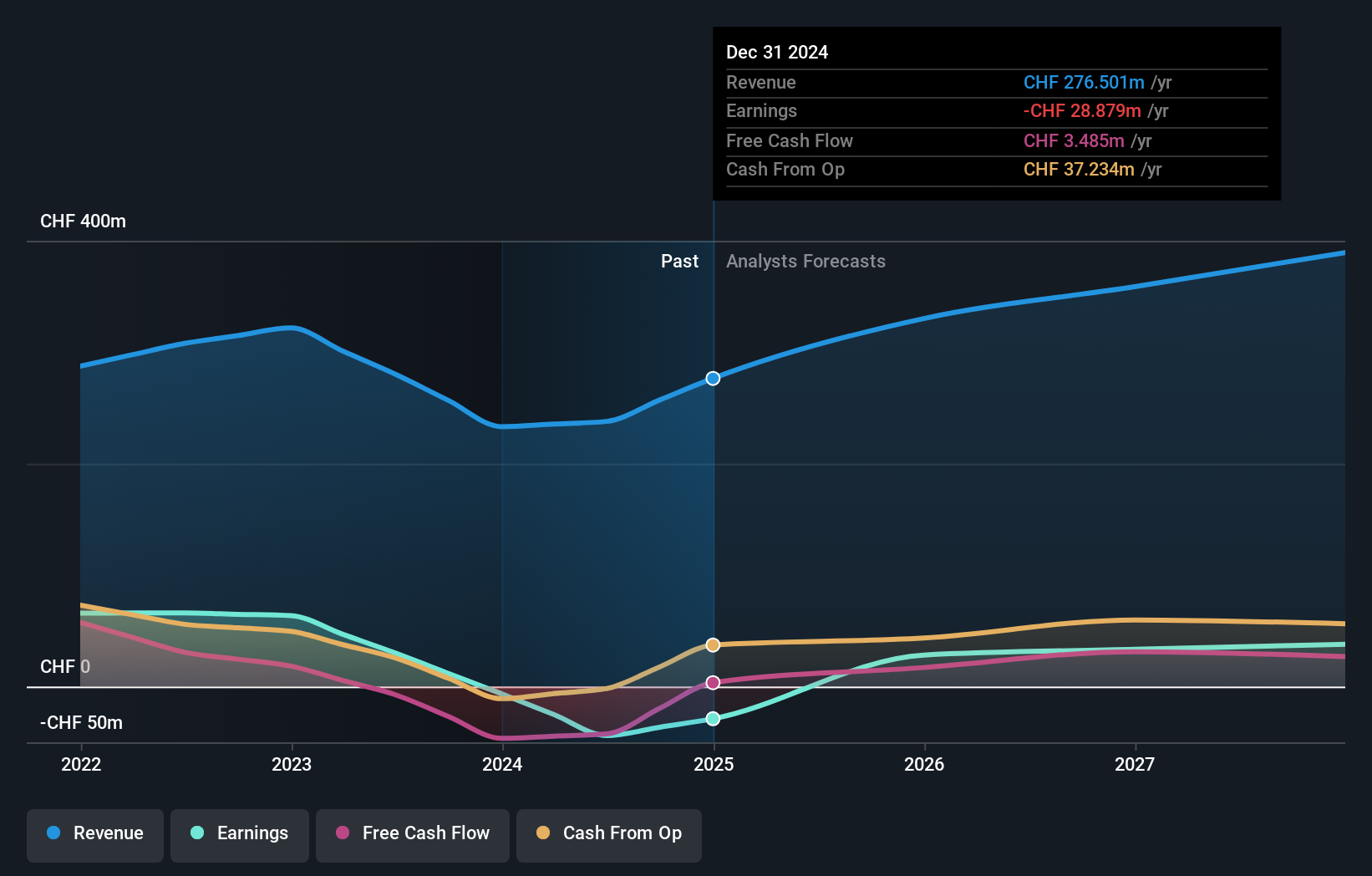

Overview: Sensirion Holding AG, together with its subsidiaries, engages in the development, production, sale, and servicing of sensor systems, modules, and components worldwide and has a market cap of CHF1.10 billion.

Operations: Sensirion generates revenue primarily from its sensor systems, modules, and components, totaling CHF233.17 million. The company focuses on the global market for these products.

Sensirion Holding, a Swiss sensor manufacturer, is expected to see revenue growth of 13.3% annually, outpacing the Swiss market's 4.4%. Despite currently being unprofitable, earnings are forecasted to grow at an impressive 80% per year over the next three years. The company’s significant investment in R&D—CHF 29 million in the latest fiscal year—underscores its commitment to innovation and long-term strategy within high-growth tech sectors.

- Unlock comprehensive insights into our analysis of Sensirion Holding stock in this health report.

Assess Sensirion Holding's past performance with our detailed historical performance reports.

Seize The Opportunity

- Embark on your investment journey to our 9 SIX Swiss Exchange High Growth Tech and AI Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:SENS

Sensirion Holding

Engages in the development, production, sale, and servicing of sensor systems, modules, and components worldwide.