- Switzerland

- /

- Metals and Mining

- /

- SWX:STLN

Further weakness as Swiss Steel Holding (VTX:STLN) drops 11% this week, taking five-year losses to 87%

Long term investing is the way to go, but that doesn't mean you should hold every stock forever. It hits us in the gut when we see fellow investors suffer a loss. Anyone who held Swiss Steel Holding AG (VTX:STLN) for five years would be nursing their metaphorical wounds since the share price dropped 87% in that time. And we doubt long term believers are the only worried holders, since the stock price has declined 68% over the last twelve months. Furthermore, it's down 36% in about a quarter. That's not much fun for holders. We really feel for shareholders in this scenario. It's a good reminder of the importance of diversification, and it's worth keeping in mind there's more to life than money, anyway.

Since Swiss Steel Holding has shed CHF28m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

See our latest analysis for Swiss Steel Holding

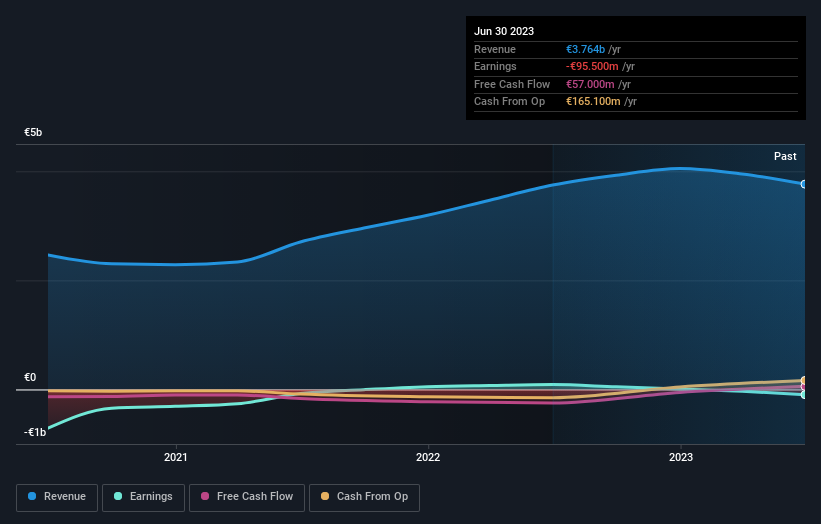

Given that Swiss Steel Holding didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, Swiss Steel Holding saw its revenue increase by 5.0% per year. That's not a very high growth rate considering it doesn't make profits. Nonetheless, it's fair to say the rapidly declining share price (down 13%, compound, over five years) suggests the market is very disappointed with this level of growth. We'd be pretty cautious about this one, although the sell-off may be too severe. A company like this generally needs to produce profits before it can find favour with new investors.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Swiss Steel Holding stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Swiss Steel Holding shareholders are down 68% for the year. Unfortunately, that's worse than the broader market decline of 0.2%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 13% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Swiss Steel Holding .

But note: Swiss Steel Holding may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Swiss exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:STLN

Swiss Steel Holding

Swiss Steel Holding AG produce and sells engineering, stainless, and tool steel products.

Mediocre balance sheet low.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026