- Switzerland

- /

- Packaging

- /

- SWX:SIGN

The SIG Combibloc Group (VTX:SIGN) Share Price Has Gained 28% And Shareholders Are Hoping For More

If you want to compound wealth in the stock market, you can do so by buying an index fund. But if you pick the right individual stocks, you could make more than that. For example, the SIG Combibloc Group AG (VTX:SIGN) share price is up 28% in the last year, clearly besting the market decline of around 3.5% (not including dividends). So that should have shareholders smiling. Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for SIG Combibloc Group

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

SIG Combibloc Group went from making a loss to reporting a profit, in the last year.

When a company has just transitioned to profitability, earnings per share growth is not always the best way to look at the share price action.

We are skeptical of the suggestion that the 1.9% dividend yield would entice buyers to the stock. We think that the revenue growth of 7.4% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

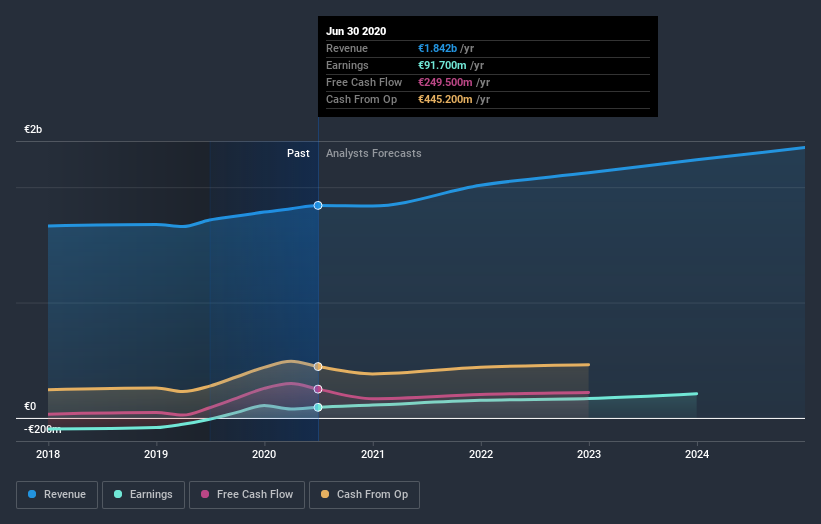

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

SIG Combibloc Group is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think SIG Combibloc Group will earn in the future (free analyst consensus estimates)

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. We note that for SIG Combibloc Group the TSR over the last year was 32%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

SIG Combibloc Group boasts a total shareholder return of 32% for the last year (that includes the dividends) . And the share price momentum remains respectable, with a gain of 8.8% in the last three months. Demand for the stock from multiple parties is pushing the price higher; it could be that word is getting out about its virtues as a business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for SIG Combibloc Group that you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CH exchanges.

When trading SIG Combibloc Group or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SWX:SIGN

SIG Group

Provides aseptic carton packaging systems and solutions for beverage and liquid food products.

Proven track record and fair value.