- Switzerland

- /

- Chemicals

- /

- SWX:EMSN

EMS-CHEMIE HOLDING AG's (VTX:EMSN) Business Is Trailing The Market But Its Shares Aren't

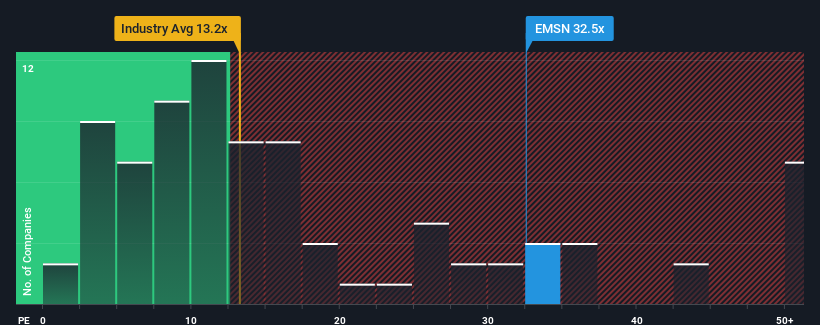

When close to half the companies in Switzerland have price-to-earnings ratios (or "P/E's") below 18x, you may consider EMS-CHEMIE HOLDING AG (VTX:EMSN) as a stock to avoid entirely with its 32.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, EMS-CHEMIE HOLDING's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for EMS-CHEMIE HOLDING

What Are Growth Metrics Telling Us About The High P/E?

EMS-CHEMIE HOLDING's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. That put a dampener on the good run it was having over the longer-term as its three-year EPS growth is still a noteworthy 8.6% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 4.2% each year as estimated by the seven analysts watching the company. With the market predicted to deliver 8.7% growth per annum, the company is positioned for a weaker earnings result.

With this information, we find it concerning that EMS-CHEMIE HOLDING is trading at a P/E higher than the market. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

What We Can Learn From EMS-CHEMIE HOLDING's P/E?

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of EMS-CHEMIE HOLDING's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It is also worth noting that we have found 1 warning sign for EMS-CHEMIE HOLDING that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if EMS-CHEMIE HOLDING might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:EMSN

EMS-CHEMIE HOLDING

Engages in the high performance polymers and specialty chemicals businesses in the United States, Europe, Asia, and internationally.

Excellent balance sheet established dividend payer.