- Switzerland

- /

- Pharma

- /

- SWX:DESN

Is Dottikon Es Holding AG's (VTX:DESN) Stock's Recent Performance Being Led By Its Attractive Financial Prospects?

Most readers would already be aware that Dottikon Es Holding's (VTX:DESN) stock increased significantly by 66% over the past three months. Given the company's impressive performance, we decided to study its financial indicators more closely as a company's financial health over the long-term usually dictates market outcomes. In this article, we decided to focus on Dottikon Es Holding's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. Put another way, it reveals the company's success at turning shareholder investments into profits.

See our latest analysis for Dottikon Es Holding

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Dottikon Es Holding is:

9.2% = CHF39m ÷ CHF424m (Based on the trailing twelve months to September 2020).

The 'return' is the yearly profit. Another way to think of that is that for every CHF1 worth of equity, the company was able to earn CHF0.09 in profit.

What Has ROE Got To Do With Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

A Side By Side comparison of Dottikon Es Holding's Earnings Growth And 9.2% ROE

To begin with, Dottikon Es Holding seems to have a respectable ROE. Be that as it may, the company's ROE is still quite lower than the industry average of 24%. However, the moderate 18% net income growth seen by Dottikon Es Holding over the past five years is definitely a positive. Therefore, the growth in earnings could probably have been caused by other variables. For instance, the company has a low payout ratio or is being managed efficiently. However, not to forget, the company does have a decent ROE to begin with, just that it is lower than the industry average. So this also does lend some color to the fairly high earnings growth seen by the company.

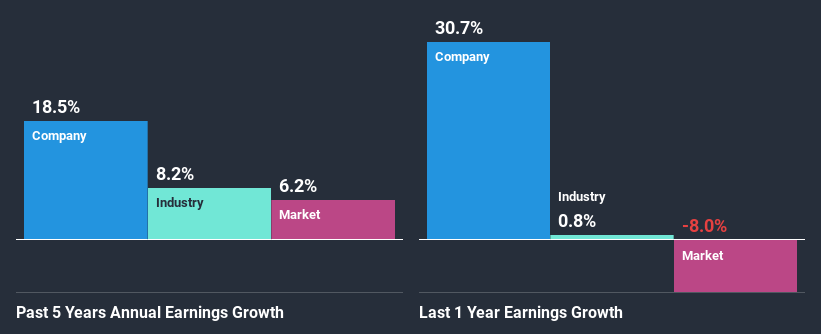

As a next step, we compared Dottikon Es Holding's net income growth with the industry, and pleasingly, we found that the growth seen by the company is higher than the average industry growth of 8.2%.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. Is Dottikon Es Holding fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Dottikon Es Holding Using Its Retained Earnings Effectively?

Given that Dottikon Es Holding doesn't pay any dividend to its shareholders, we infer that the company has been reinvesting all of its profits to grow its business.

Summary

Overall, we are quite pleased with Dottikon Es Holding's performance. Specifically, we like that it has been reinvesting a high portion of its profits at a moderate rate of return, resulting in earnings expansion. If the company continues to grow its earnings the way it has, that could have a positive impact on its share price given how earnings per share influence long-term share prices. Not to forget, share price outcomes are also dependent on the potential risks a company may face. So it is important for investors to be aware of the risks involved in the business. Our risks dashboard will have the 1 risk we have identified for Dottikon Es Holding.

If you’re looking to trade Dottikon Es Holding, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:DESN

Dottikon ES Holding

Manufactures and sells performance chemicals, intermediates, and active pharmaceutical ingredients for the chemical, biotech, and pharmaceutical maceutic industries in Europe, Switzerland, the United States, and Asia.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives