- Switzerland

- /

- Basic Materials

- /

- SWX:AMRZ

Will Amrize's (SWX:AMRZ) Bold M&A Flexibility Redefine Its Growth Trajectory?

Reviewed by Sasha Jovanovic

- Amrize AG recently raised its annual revenue guidance for 2025, now expecting US$11.7 billion to US$12.0 billion, alongside new details of ongoing merger and acquisition interests shared during its third quarter earnings call.

- The company’s willingness to temporarily increase leverage for the right M&A opportunity highlights a flexible approach to growth even as profit growth remains subdued.

- We’ll explore how Amrize AG’s improved revenue outlook underscores its investment narrative amidst muted recent earnings growth.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Amrize's Investment Narrative?

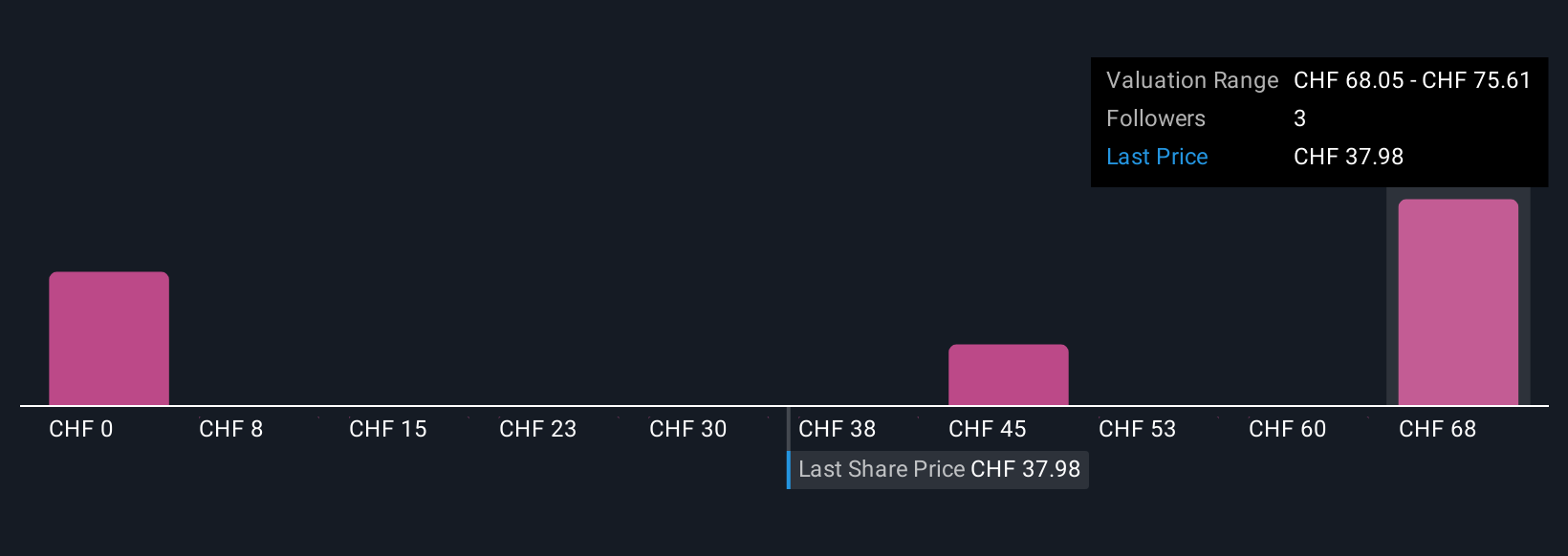

To own a piece of Amrize AG right now, I’d need to have confidence in its ability to execute a dual growth strategy: balancing steady, ongoing gains in its North American building materials business while also seizing compelling acquisitions. The recent jump in full-year revenue guidance hints that management sees momentum and a healthy pipeline, even as net income growth remains tepid. What’s changed with the latest announcements is Amrize’s openness to temporarily higher leverage for acquisitions, which could accelerate scale or market entry but also introduces new risks if deal execution or integration falls short. Short-term catalysts now include any M&A news and the pace at which revenue growth turns into stronger profit margins, while the rapid turnover in leadership and board experience may magnify integration risk. The share price is sitting well below consensus fair value, but these new signals add a different mix to the risk-reward tradeoff for today’s investors.

However, that willingness to increase leverage isn’t without potential downside, especially with a less-experienced board.

Exploring Other Perspectives

Explore 5 other fair value estimates on Amrize - why the stock might be worth less than half the current price!

Build Your Own Amrize Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Amrize research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Amrize research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Amrize's overall financial health at a glance.

Looking For Alternative Opportunities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:AMRZ

Proven track record with adequate balance sheet.

Market Insights

Community Narratives