- Switzerland

- /

- Medical Equipment

- /

- SWX:YPSN

Is Now The Time To Put Ypsomed Holding (VTX:YPSN) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Ypsomed Holding (VTX:YPSN), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Ypsomed Holding with the means to add long-term value to shareholders.

View our latest analysis for Ypsomed Holding

How Quickly Is Ypsomed Holding Increasing Earnings Per Share?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. It certainly is nice to see that Ypsomed Holding has managed to grow EPS by 36% per year over three years. So it's not surprising to see the company trades on a very high multiple of (past) earnings.

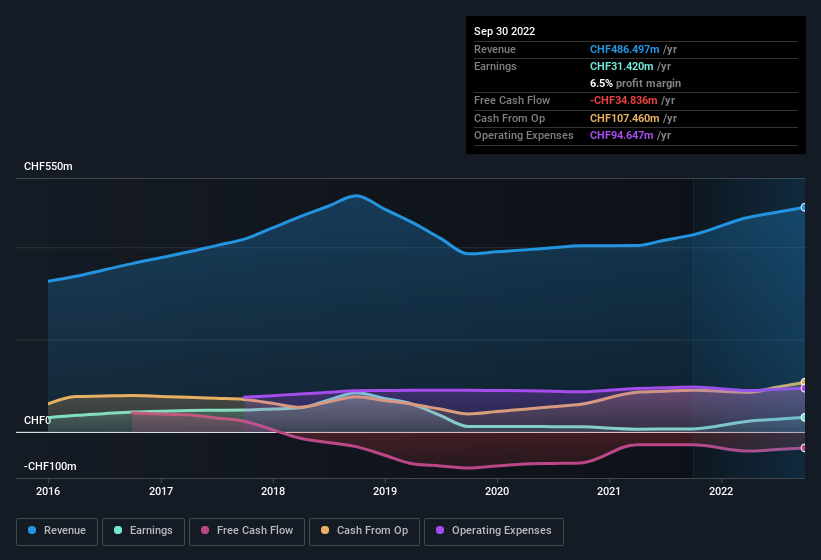

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The good news is that Ypsomed Holding is growing revenues, and EBIT margins improved by 5.1 percentage points to 7.7%, over the last year. Both of which are great metrics to check off for potential growth.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Ypsomed Holding's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Ypsomed Holding Insiders Aligned With All Shareholders?

Many consider high insider ownership to be a strong sign of alignment between the leaders of a company and the ordinary shareholders. So we're pleased to report that Ypsomed Holding insiders own a meaningful share of the business. In fact, they own 68% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. This insider holding amounts to That level of investment from insiders is nothing to sneeze at.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations between CHF1.9b and CHF6.0b, like Ypsomed Holding, the median CEO pay is around CHF1.3m.

Ypsomed Holding's CEO took home a total compensation package worth CHF1.0m in the year leading up to March 2022. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Does Ypsomed Holding Deserve A Spot On Your Watchlist?

If you believe that share price follows earnings per share you should definitely be delving further into Ypsomed Holding's strong EPS growth. If you need more convincing beyond that EPS growth rate, don't forget about the reasonable remuneration and the high insider ownership. The overarching message here is that Ypsomed Holding has underlying strengths that make it worth a look at. It is worth noting though that we have found 2 warning signs for Ypsomed Holding that you need to take into consideration.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:YPSN

Ypsomed Holding

Develops, manufactures, and sells injection and infusion systems for pharmaceutical and biotechnology companies.

High growth potential with solid track record.