- Switzerland

- /

- Consumer Durables

- /

- SWX:VZUG

Discovering APG|SGA And Two Other Swiss Small Caps with Promising Potential

Reviewed by Simply Wall St

The Swiss market has recently experienced fluctuations, with the benchmark SMI ending on a negative note amid global economic growth concerns and uncertainty about U.S. interest rate cuts. Despite these challenges, small-cap stocks can offer unique opportunities for investors seeking growth potential in a volatile environment. In this article, we explore three promising Swiss small-cap stocks: APG|SGA and two others that stand out as undiscovered gems in the current market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 1.26% | -4.29% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| APG|SGA | NA | 1.12% | -16.11% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

APG|SGA (SWX:APGN)

Simply Wall St Value Rating: ★★★★★★

Overview: APG|SGA SA operates in the advertising sector, offering services mainly in Switzerland and Serbia, with a market cap of CHF584.05 million.

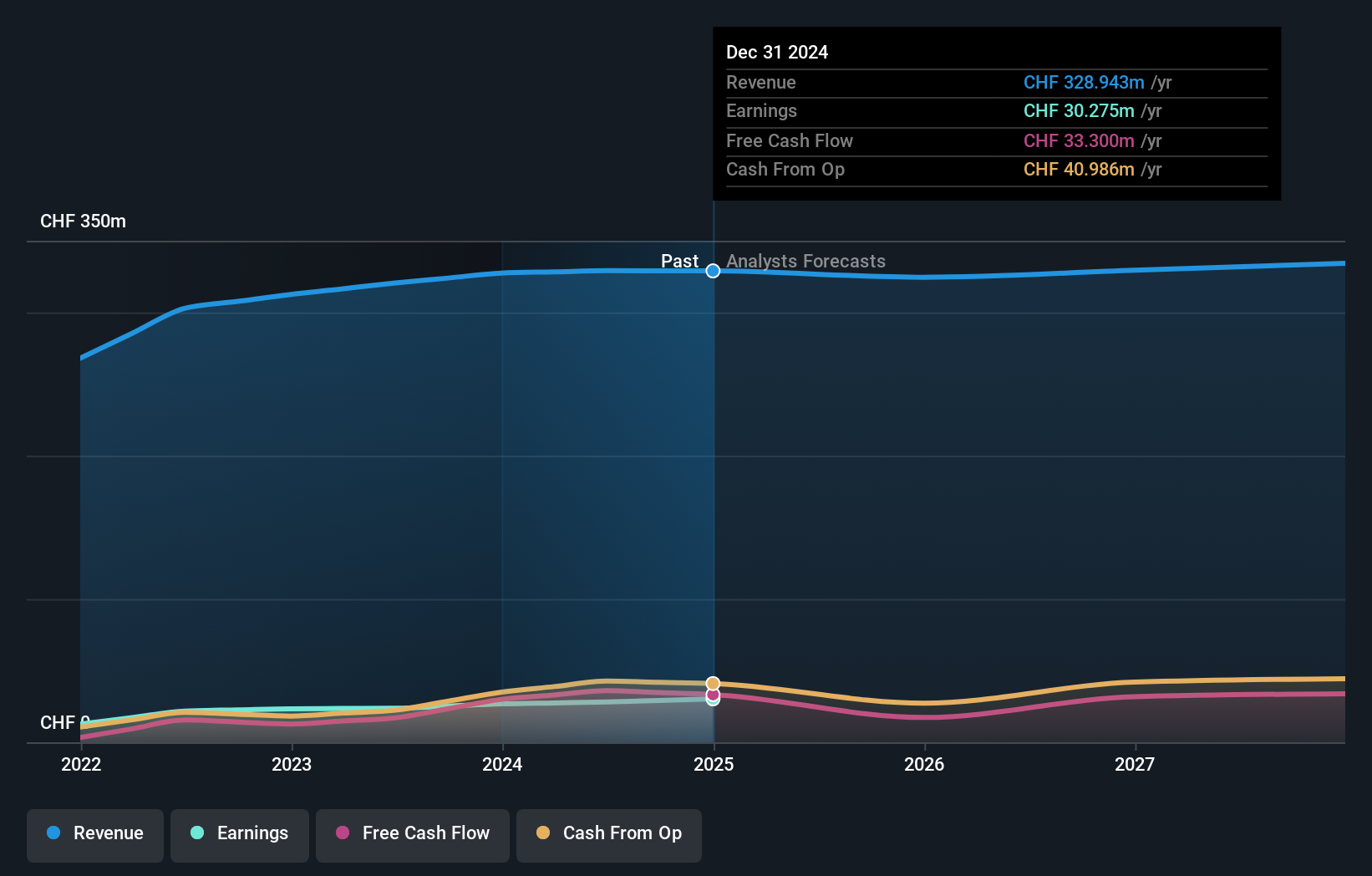

Operations: APG|SGA generates CHF327.46 million from acquiring, selling, and managing advertising spaces primarily in Switzerland and Serbia.

APG|SGA, a Swiss advertising company, offers an intriguing investment opportunity. Despite earnings declining by 16.1% annually over the past five years, it has shown resilience with a 14.6% growth in the last year, although slightly trailing the Media industry's 16.3%. The firm is debt-free and has been for five years, highlighting financial prudence. Trading at 59.3% below its estimated fair value suggests potential upside for investors seeking undervalued stocks in Switzerland's market landscape.

- Take a closer look at APG|SGA's potential here in our health report.

Gain insights into APG|SGA's past trends and performance with our Past report.

IVF Hartmann Holding (SWX:VBSN)

Simply Wall St Value Rating: ★★★★★★

Overview: IVF Hartmann Holding AG supplies medical consumer goods both in Switzerland and internationally, with a market cap of CHF326.28 million.

Operations: IVF Hartmann Holding AG generates revenue through four primary segments: Wound Care (CHF40.21 million), Infection Management (CHF54.18 million), Other Group Activities (CHF21.45 million), and Incontinence Management (CHF32.11 million).

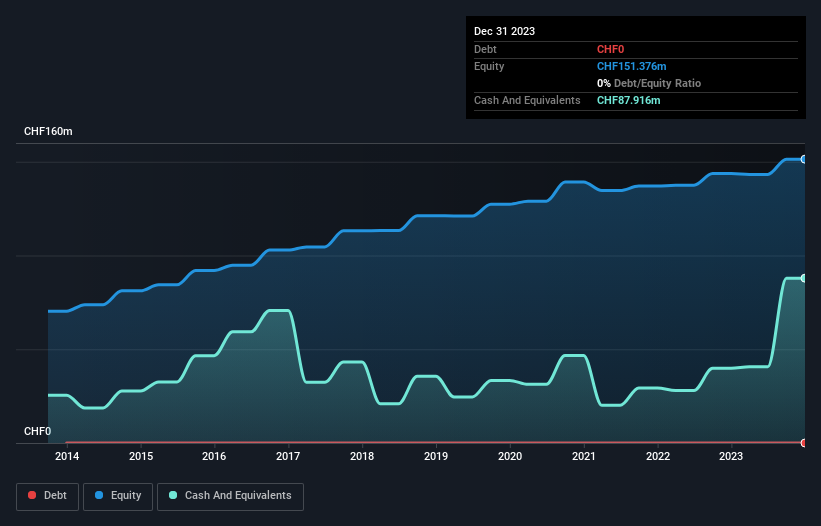

IVF Hartmann Holding, a small cap in the Swiss medical equipment sector, has shown impressive earnings growth of 34.9% over the past year, outpacing the industry average of -2.4%. The company repurchased shares in 2024, reflecting confidence in its valuation. Trading at 88.4% below estimated fair value suggests potential upside. Despite no debt for five years and high-quality earnings, latest financial reports are more than six months old which could affect investor sentiment.

- Get an in-depth perspective on IVF Hartmann Holding's performance by reading our health report here.

Explore historical data to track IVF Hartmann Holding's performance over time in our Past section.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

Overview: V-ZUG Holding AG develops, manufactures, markets, sells, and services kitchen and laundry appliances for private households in Switzerland and internationally with a market cap of CHF354.86 million.

Operations: V-ZUG Holding AG generates revenue primarily from its Household Appliances segment, which reported CHF571.35 million in sales.

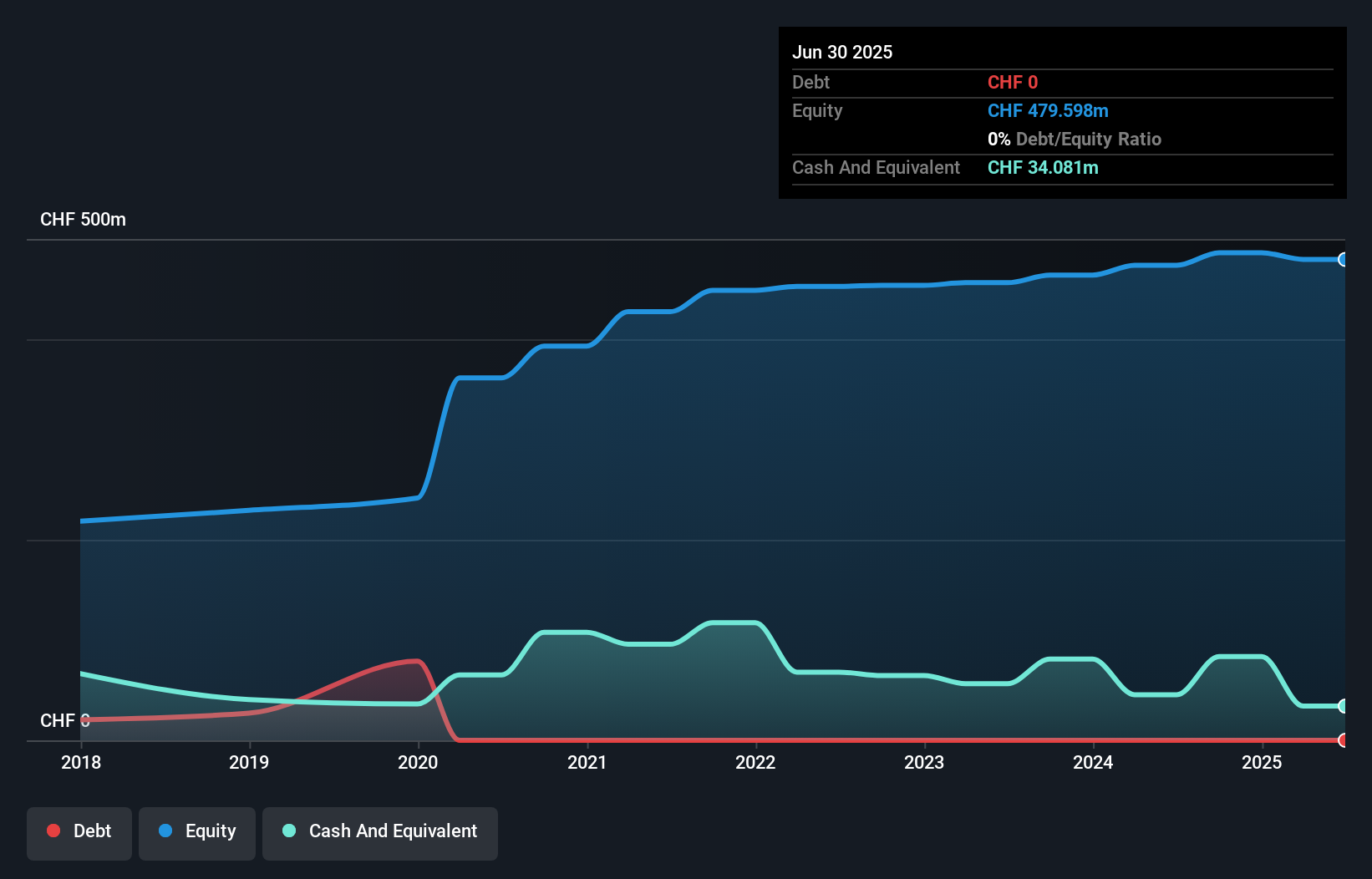

With no debt and high-quality earnings, V-ZUG Holding stands out in the Swiss market. Over the past year, earnings surged by 89.2%, far outpacing the Consumer Durables industry’s 0.2% growth rate. Trading at 82% below its estimated fair value, it offers potential upside for investors. Recent half-year results showed sales of CHF 284 million and net income of CHF 8.73 million, with basic EPS from continuing operations at CHF 1.36 compared to CHF 0.67 last year.

- Click to explore a detailed breakdown of our findings in V-ZUG Holding's health report.

Examine V-ZUG Holding's past performance report to understand how it has performed in the past.

Key Takeaways

- Gain an insight into the universe of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:VZUG

V-ZUG Holding

Engages in development, manufacture, marketing, sale, and services of kitchen and laundry appliances for private households in Switzerland and internationally.

Flawless balance sheet and good value.