- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

Top Growth Companies With High Insider Ownership On SIX Swiss Exchange October 2024

Reviewed by Simply Wall St

The Swiss market recently experienced a downturn, influenced by geopolitical tensions and weaker-than-expected euro area economic data, with the benchmark SMI slipping into negative territory. In such a challenging environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business, suggesting resilience and potential for long-term success.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 24.1% |

| VAT Group (SWX:VACN) | 10.2% | 22.5% |

| Addex Therapeutics (SWX:ADXN) | 19% | 33.3% |

| Straumann Holding (SWX:STMN) | 32.7% | 21.7% |

| LEM Holding (SWX:LEHN) | 29.9% | 18.4% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 12.6% |

| Temenos (SWX:TEMN) | 21.8% | 14.4% |

| Partners Group Holding (SWX:PGHN) | 17% | 14.5% |

| HOCHDORF Holding (SWX:HOCN) | 15.7% | 122.2% |

| Sensirion Holding (SWX:SENS) | 19.9% | 102.7% |

We're going to check out a few of the best picks from our screener tool.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

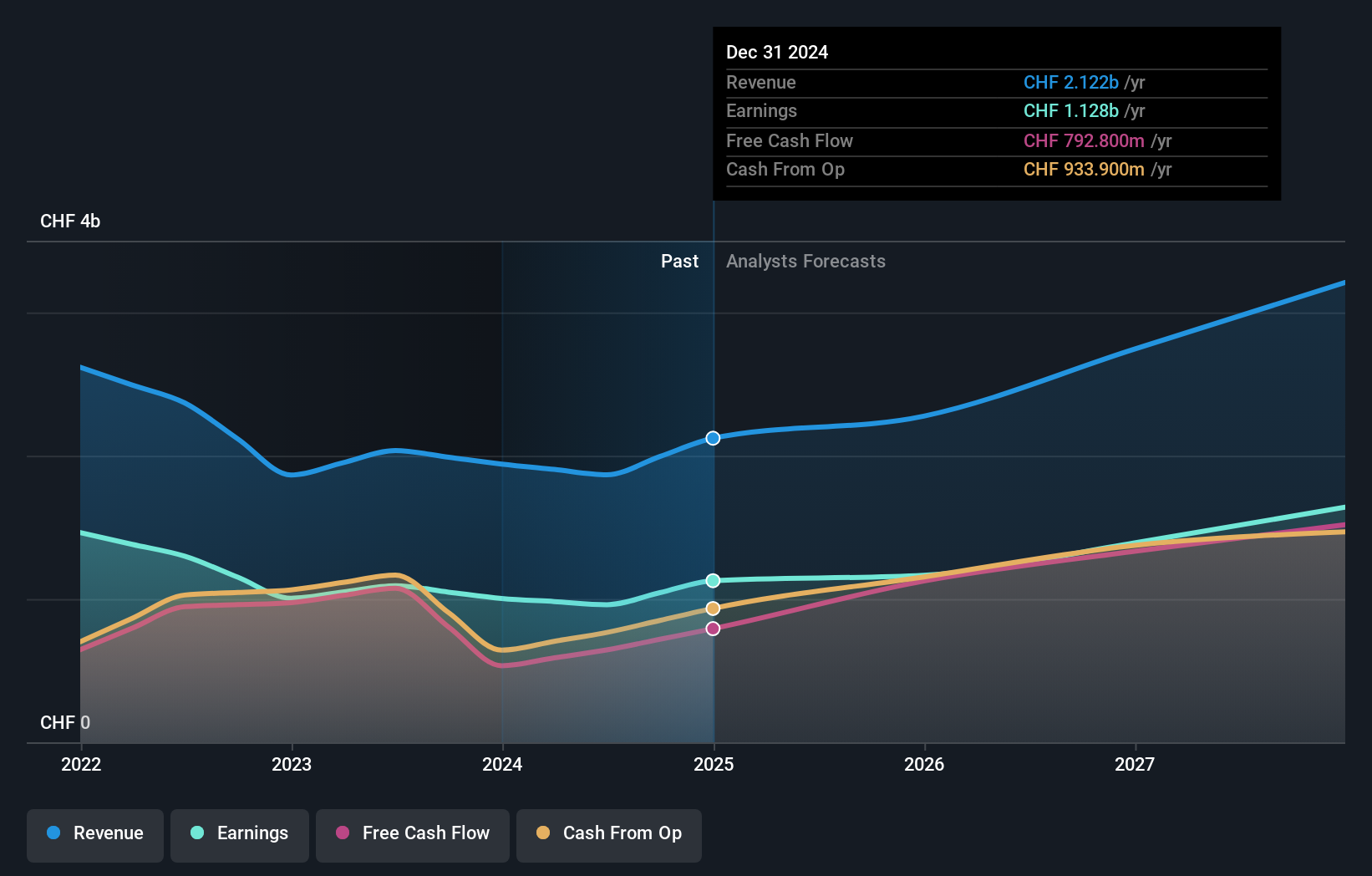

Overview: Partners Group Holding AG is a private equity firm that focuses on direct, secondary, and primary investments in private equity, real estate, infrastructure, and debt with a market cap of CHF33.16 billion.

Operations: The company's revenue segments include CHF1.19 billion from Private Equity, CHF254.90 million from Infrastructure, CHF218.90 million from Private Credit, and CHF190.90 million from Real Estate.

Insider Ownership: 17%

Partners Group Holding demonstrates strong growth potential with forecasted revenue and earnings growth rates of 15.5% and 14.5% per year, respectively, both outpacing the Swiss market averages. Despite a recent dip in net income to CHF 508 million for H1 2024, the company remains active in strategic M&A activities, such as its involvement in the potential buyout of Lighthouse Learnings. However, its dividend sustainability is challenged by limited coverage from earnings and cash flows.

- Click here and access our complete growth analysis report to understand the dynamics of Partners Group Holding.

- The analysis detailed in our Partners Group Holding valuation report hints at an inflated share price compared to its estimated value.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

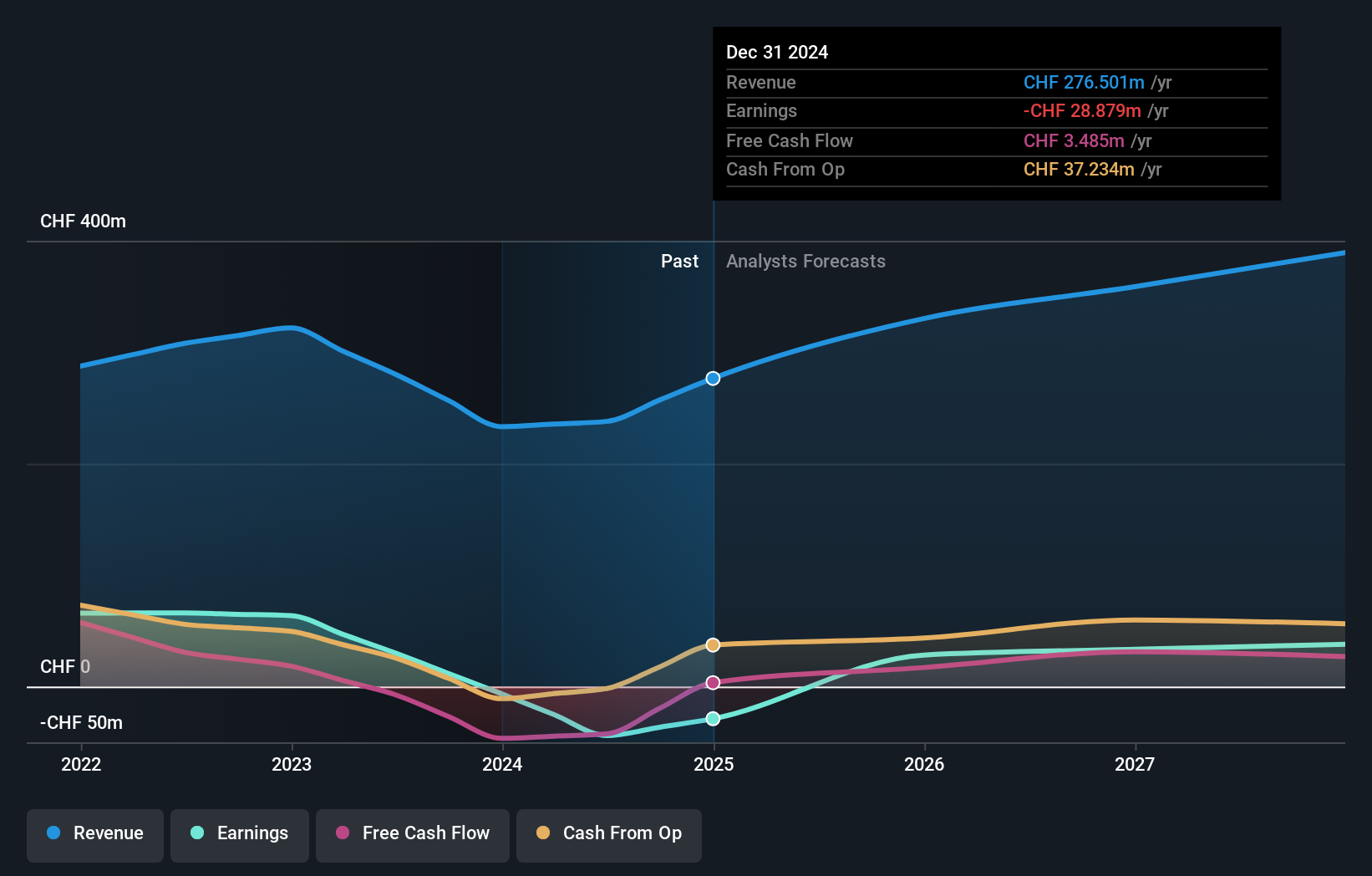

Overview: Sensirion Holding AG, along with its subsidiaries, is involved in the development, production, sale, and servicing of sensor systems, modules, and components globally with a market cap of CHF1.12 billion.

Operations: The company's revenue is primarily derived from its sensor systems, modules, and components segment, which generated CHF237.91 million.

Insider Ownership: 19.9%

Sensirion Holding is positioned for strong growth with expected annual revenue and earnings increases of 13.9% and 102.68%, respectively, surpassing Swiss market averages. Despite trading at 39.1% below its estimated fair value, recent results show a net loss of CHF 36.01 million for H1 2024, contrasting with the previous year's profit. The company faces high share price volatility and low future return on equity forecasts but anticipates profitability within three years.

- Dive into the specifics of Sensirion Holding here with our thorough growth forecast report.

- According our valuation report, there's an indication that Sensirion Holding's share price might be on the expensive side.

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★★☆

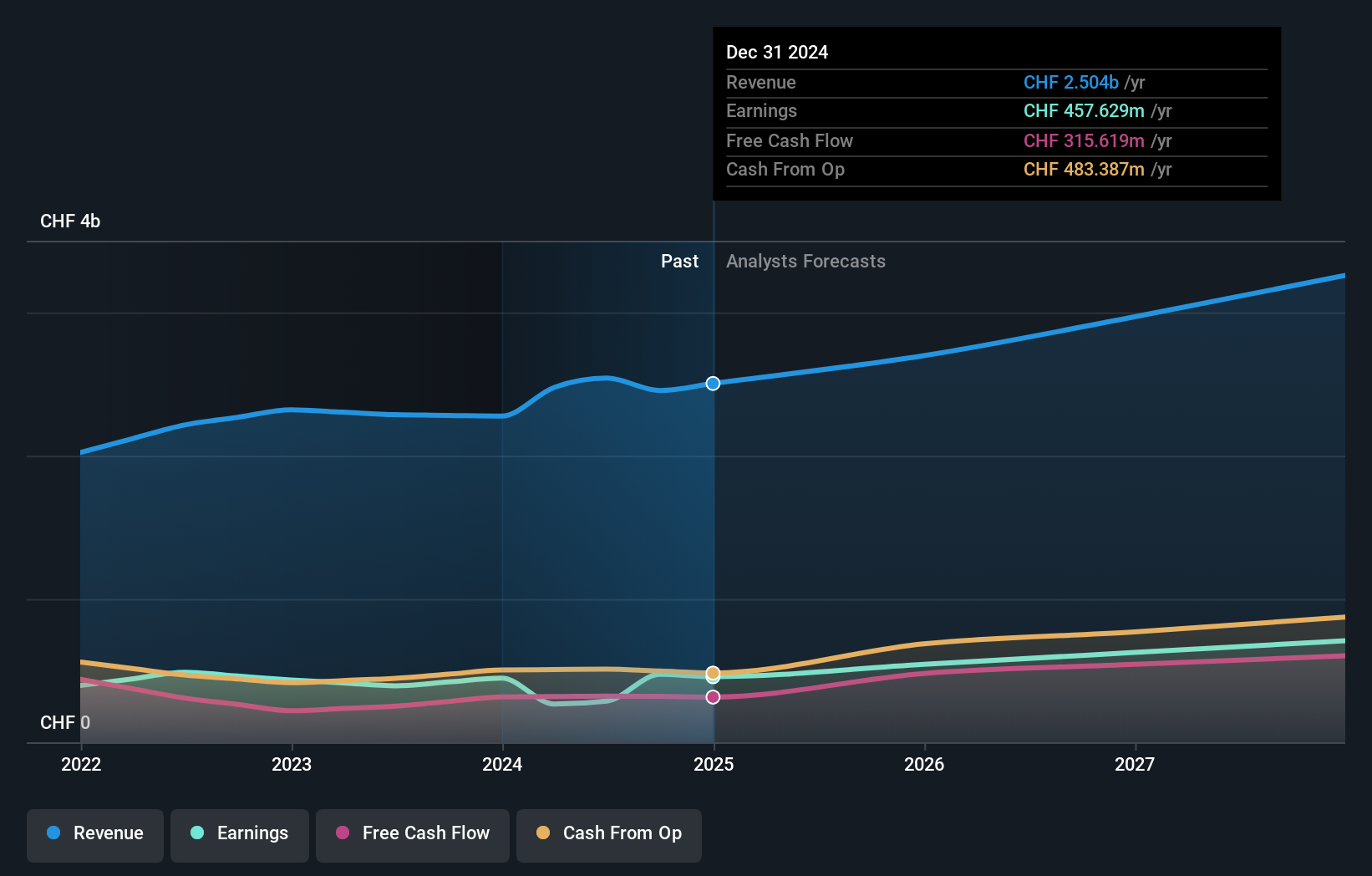

Overview: Straumann Holding AG offers tooth replacement and orthodontic solutions globally, with a market cap of CHF21.70 billion.

Operations: The company's revenue segments include Sales NAM at CHF800.14 million, Operations at CHF1.26 billion, Sales APAC at CHF540.74 million, Sales EMEA at CHF1.20 billion, and Sales LATAM at CHF282.34 million.

Insider Ownership: 32.7%

Straumann Holding demonstrates strong growth potential, with earnings expected to increase significantly at 21.67% annually, outpacing the Swiss market's average. Recent H1 2024 results show sales of CHF 1.27 billion and net income of CHF 230.37 million, reflecting solid performance despite lower profit margins compared to last year. The company forecasts low double-digit revenue growth for 2024 and maintains high insider ownership, which aligns management interests with shareholders amidst recent executive changes enhancing leadership capabilities.

- Unlock comprehensive insights into our analysis of Straumann Holding stock in this growth report.

- Our valuation report here indicates Straumann Holding may be overvalued.

Key Takeaways

- Embark on your investment journey to our 12 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Reasonable growth potential with adequate balance sheet.