- Switzerland

- /

- Capital Markets

- /

- SWX:PGHN

Top Growth Companies With High Insider Ownership On SIX Swiss Exchange August 2024

Reviewed by Simply Wall St

The Switzerland market experienced a mild setback but ultimately ended on a firm note, buoyed by positive GDP growth and steady producer and import prices. In this context, identifying growth companies with high insider ownership can be particularly appealing to investors looking for stability and potential upside.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 21.1% |

| VAT Group (SWX:VACN) | 10.2% | 22.5% |

| Straumann Holding (SWX:STMN) | 32.7% | 21.5% |

| LEM Holding (SWX:LEHN) | 29.9% | 18.4% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 13.3% |

| Temenos (SWX:TEMN) | 17.4% | 14.3% |

| Leonteq (SWX:LEON) | 12.7% | 35.1% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 80% |

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Let's review some notable picks from our screened stocks.

Partners Group Holding (SWX:PGHN)

Simply Wall St Growth Rating: ★★★★☆☆

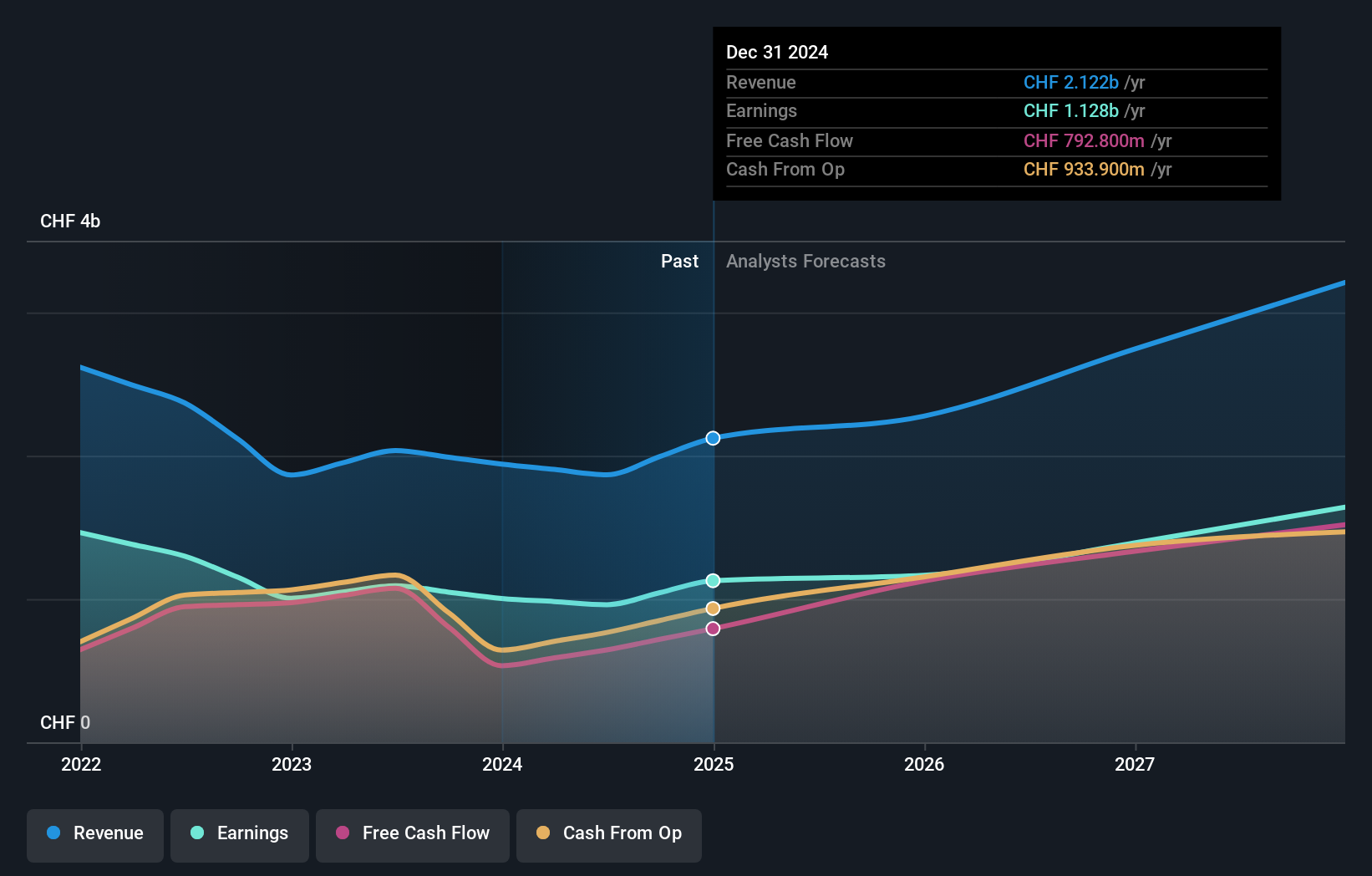

Overview: Partners Group Holding AG is a private equity firm specializing in direct, secondary, and primary investments across private equity, real estate, infrastructure, and debt with a market cap of CHF30.81 billion.

Operations: Revenue segments for Partners Group Holding AG are: Private Equity CHF1.17 billion, Infrastructure CHF379.20 million, Private Credit CHF211.30 million, and Real Estate CHF186.90 million.

Insider Ownership: 17.1%

Partners Group Holding, a Swiss growth company with substantial insider ownership, is poised for significant revenue and earnings growth, forecasted at 14.1% and 13.5% per year respectively, outpacing the broader Swiss market. Recent M&A rumors involving a potential buyout of Lighthouse Learnings highlight its strategic expansion efforts. Despite high debt levels and a dividend not well-covered by earnings or free cash flows, it trades below fair value estimates and boasts a very high return on equity forecast (51.9%).

- Get an in-depth perspective on Partners Group Holding's performance by reading our analyst estimates report here.

- Our valuation report here indicates Partners Group Holding may be overvalued.

Straumann Holding (SWX:STMN)

Simply Wall St Growth Rating: ★★★★★☆

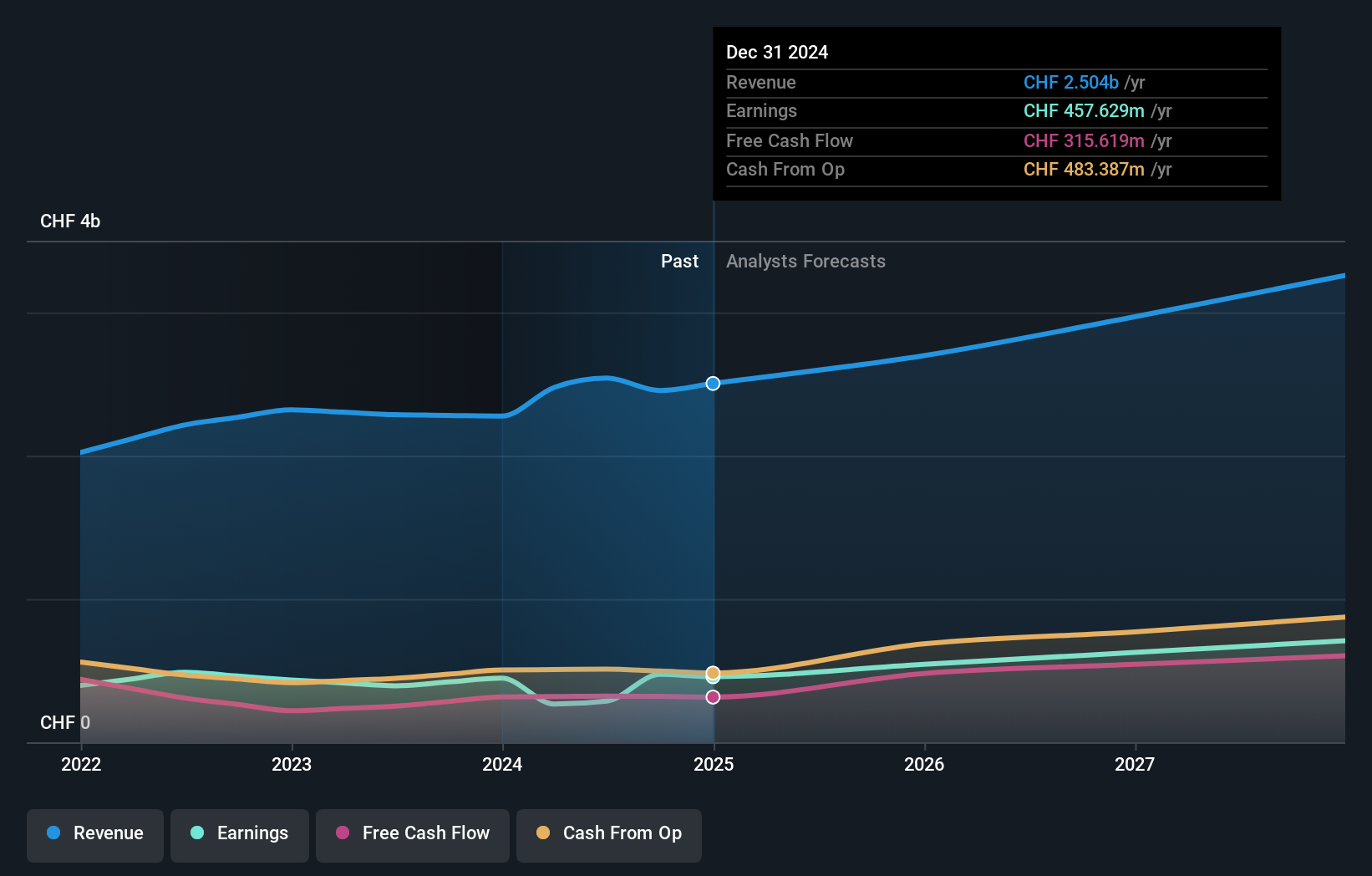

Overview: Straumann Holding AG, with a market cap of CHF20.16 billion, provides tooth replacement and orthodontic solutions worldwide.

Operations: Straumann Holding AG's revenue segments include Operations (CHF1.20 billion), Sales Asia Pacific (CHF451.27 million), Sales North America (CHF793.05 million), Sales Latin America (CHF265.82 million), and Sales Europe, Middle East and Africa (CHF1.17 billion).

Insider Ownership: 32.7%

Straumann Holding, a Swiss growth company with high insider ownership, is forecasted to see earnings grow significantly at 21.53% per year, outpacing the broader Swiss market. Despite lower profit margins this year (10.2%) compared to last (18.7%), its revenue growth of 9.1% per year remains above the market average and it trades at a discount to fair value estimates. However, recent earnings calls indicate no substantial insider trading activity in the past three months and share price volatility remains high.

- Take a closer look at Straumann Holding's potential here in our earnings growth report.

- The analysis detailed in our Straumann Holding valuation report hints at an inflated share price compared to its estimated value.

VAT Group (SWX:VACN)

Simply Wall St Growth Rating: ★★★★★☆

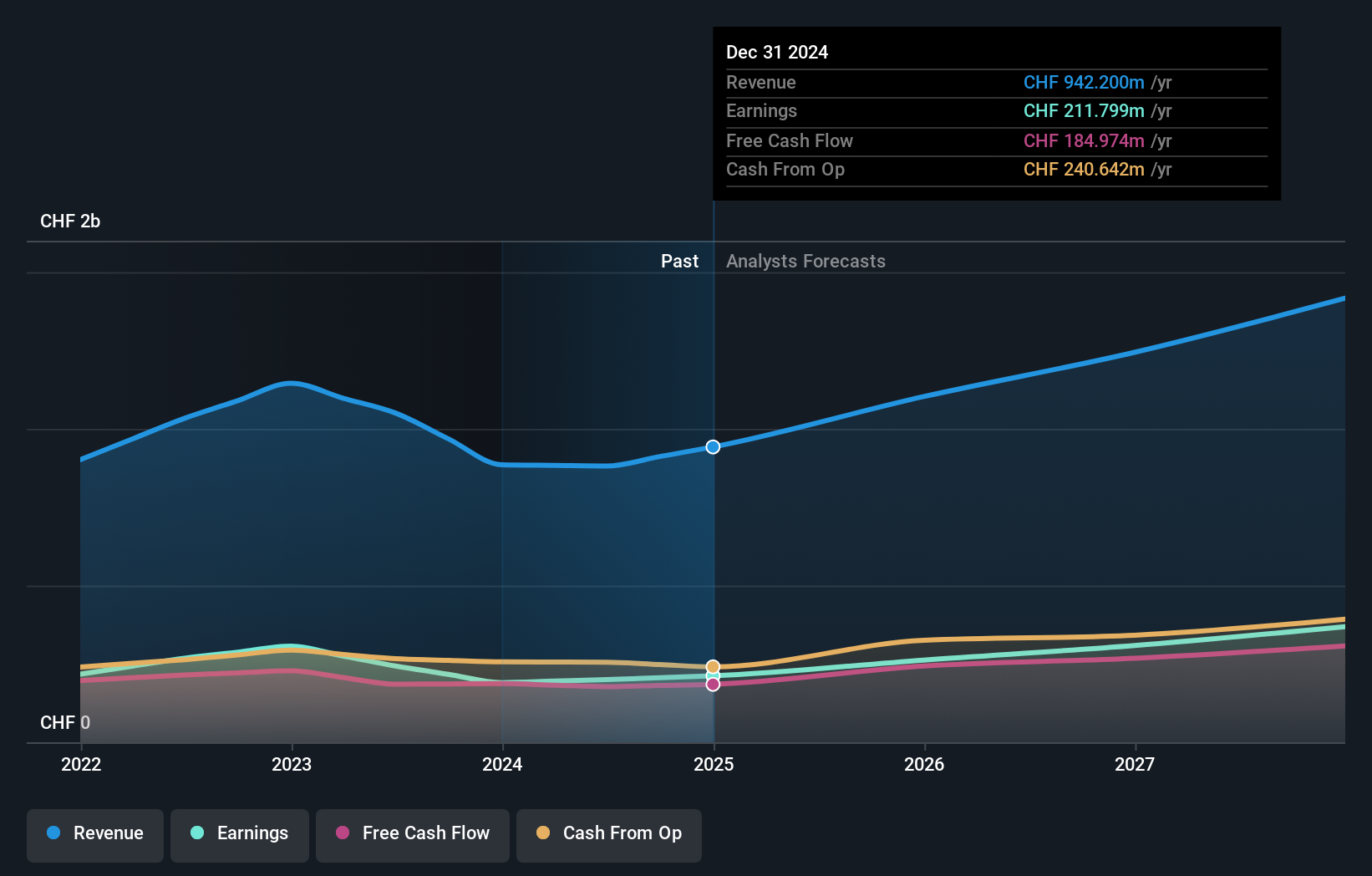

Overview: VAT Group AG develops, manufactures, and supplies vacuum valves, multi-valve units, vacuum modules, and edge-welded metal bellows globally with a market cap of CHF12.99 billion.

Operations: The company's revenue segments consist of CHF783.51 million from Valves and CHF163.83 million from Global Service.

Insider Ownership: 10.2%

VAT Group's earnings are forecast to grow significantly at 22.48% per year, outpacing the Swiss market. Recent earnings results show net income rising to CHF 94 million from CHF 84.2 million a year ago, with diluted EPS increasing to CHF 3.13 from CHF 2.81. The company trades at a discount to fair value estimates and is expected to have high return on equity (41%) in three years, despite recent share price volatility and no substantial insider trading activity in the past three months.

- Unlock comprehensive insights into our analysis of VAT Group stock in this growth report.

- Upon reviewing our latest valuation report, VAT Group's share price might be too optimistic.

Where To Now?

- Access the full spectrum of 13 Fast Growing SIX Swiss Exchange Companies With High Insider Ownership by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PGHN

Partners Group Holding

A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

Reasonable growth potential with adequate balance sheet.