- Switzerland

- /

- Food

- /

- SWX:NESN

Assessing Nestlé’s (SWX:NESN) Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Nestlé (SWX:NESN) shares have been attracting renewed interest lately, due to a steady uptick over the past month. Investors are weighing these recent gains against the company’s longer-term performance and business fundamentals.

See our latest analysis for Nestlé.

This recent rally builds on a positive trend for Nestlé, as the stock has posted a 4.6% one-month share price return and is up 5.9% year-to-date. Despite this momentum, the one-year total shareholder return remains modest at 3.7%, and longer-term returns have been in the red. This is something longer-term investors may be weighing against the company’s growth prospects.

If you’re curious about what other established consumer brands are doing in today’s market, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

Given Nestlé's recent upswing, is the current share price still undervalued compared to its future prospects, or has the market already factored in the company’s potential growth and left little room for further upside?

Most Popular Narrative: 9.4% Undervalued

Nestlé's most widely followed narrative places its fair value above the last closing price, suggesting that the stock still has untapped upside. This perspective draws from a combination of structural growth drivers and operational improvements shaping the company's outlook.

Efficiency gains through digitalization and portfolio optimization enable higher marketing intensity and margin improvement. PetCare and science-led nutrition are driving structural expansion.

Curious about what lies behind the numbers? The calculation behind this fair value hinges on ambitious growth expectations and a future earnings multiple that may surprise you. Find out the bold quantitative move analysts expect to unlock Nestlé’s premium valuation by diving into the rest of the narrative.

Result: Fair Value of $87.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin pressure from higher commodity costs and persistently weak consumer demand, especially in China, could challenge the case for further upside.

Find out about the key risks to this Nestlé narrative.

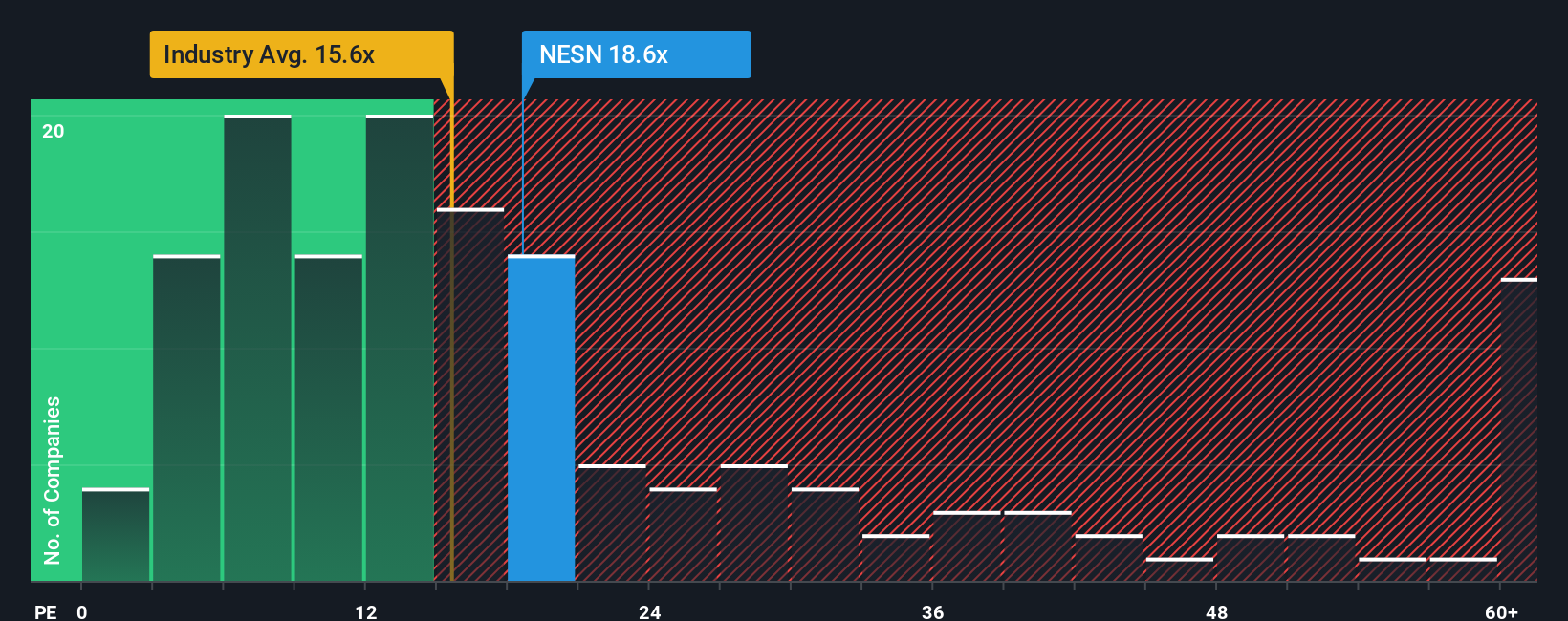

Another View: Multiples Tell a Different Story

Looking through the lens of price-to-earnings ratios, Nestlé’s shares trade at 19.8 times earnings. This is higher than the European food industry's average of 15.6 times earnings but lower than its typical peer that trades at 27.4 times. In addition, the market’s own fair ratio for the business is estimated at 27.2 times earnings. With this gap, does the stock offer value or risk at these levels?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nestlé Narrative

If you want to challenge the consensus or would rather develop your own perspective, our platform makes it easy to assemble a personalized Nestlé narrative in under three minutes, so you can Do it your way.

A great starting point for your Nestlé research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for Smart Investment Moves?

Don’t limit yourself to just one stock when new opportunities are waiting. Make the most of powerful stock filters and catch tomorrow’s biggest ideas before the crowd.

- Unlock the income potential of companies offering attractive payouts with these 16 dividend stocks with yields > 3%, which yield over 3% annually.

- Seize breakthroughs in artificial intelligence with these 25 AI penny stocks, leading advances in automation, data analytics, and next-generation computing.

- Tap into undervalued opportunities by scanning these 882 undervalued stocks based on cash flows, showing strong cash flow and compelling price points.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nestlé might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:NESN

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives