- Switzerland

- /

- Construction

- /

- SWX:BRKN

Uncovering Switzerland's Hidden Stock Gems In October 2024

Reviewed by Simply Wall St

The Swiss market recently faced a modest downturn, influenced by rising U.S. consumer price inflation and an increase in initial jobless claims, with the SMI index closing down 0.37%. Amidst this cautious sentiment, investors may find opportunities in lesser-known stocks that demonstrate resilience and potential for growth despite broader economic challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Switzerland

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| IVF Hartmann Holding | NA | 0.24% | 0.63% | ★★★★★★ |

| naturenergie holding | NA | 17.32% | 34.71% | ★★★★★★ |

| TX Group | 0.93% | -1.67% | 7.21% | ★★★★★★ |

| Datacolor | NA | 3.59% | 30.14% | ★★★★★★ |

| Elma Electronic | 36.60% | 3.13% | 3.10% | ★★★★★★ |

| Compagnie Financière Tradition | 47.15% | 1.91% | 11.44% | ★★★★★☆ |

| Vaudoise Assurances Holding | NA | 1.52% | 1.85% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| lastminute.com | 42.65% | 4.93% | 3.11% | ★★★★☆☆ |

| Bergbahnen Engelberg-Trübsee-Titlis | 3.00% | -10.81% | -16.31% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Burkhalter Holding (SWX:BRKN)

Simply Wall St Value Rating: ★★★★☆☆

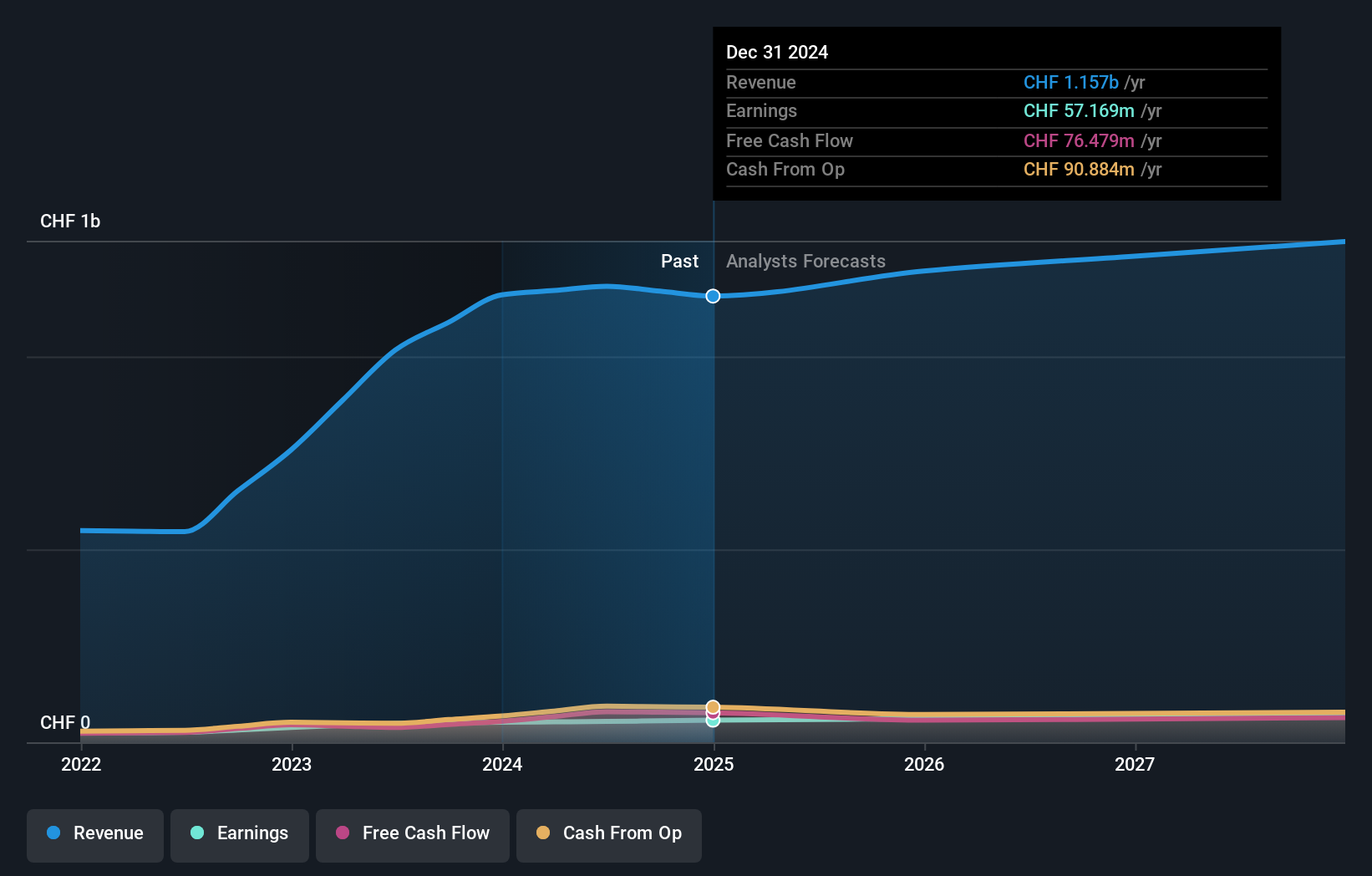

Overview: Burkhalter Holding AG, with a market cap of CHF964.89 million, operates through its subsidiaries to deliver electrical engineering services to the construction sector in Switzerland.

Operations: With revenue of CHF1.18 billion, Burkhalter's primary income is derived from electrical engineering services.

Burkhalter Holding, a Swiss construction company, has demonstrated robust earnings growth of 10.3% over the past year, outpacing the industry average of 8.7%. Despite its high debt level with a net debt to equity ratio at 52.9%, the company's interest payments are well covered by EBIT at 46.1 times coverage. Recent earnings show revenue climbing to CHF 570 million and net income reaching CHF 23 million for H1 2024, reflecting solid operational performance amidst financial challenges.

- Click here and access our complete health analysis report to understand the dynamics of Burkhalter Holding.

Evaluate Burkhalter Holding's historical performance by accessing our past performance report.

Compagnie Financière Tradition (SWX:CFT)

Simply Wall St Value Rating: ★★★★★☆

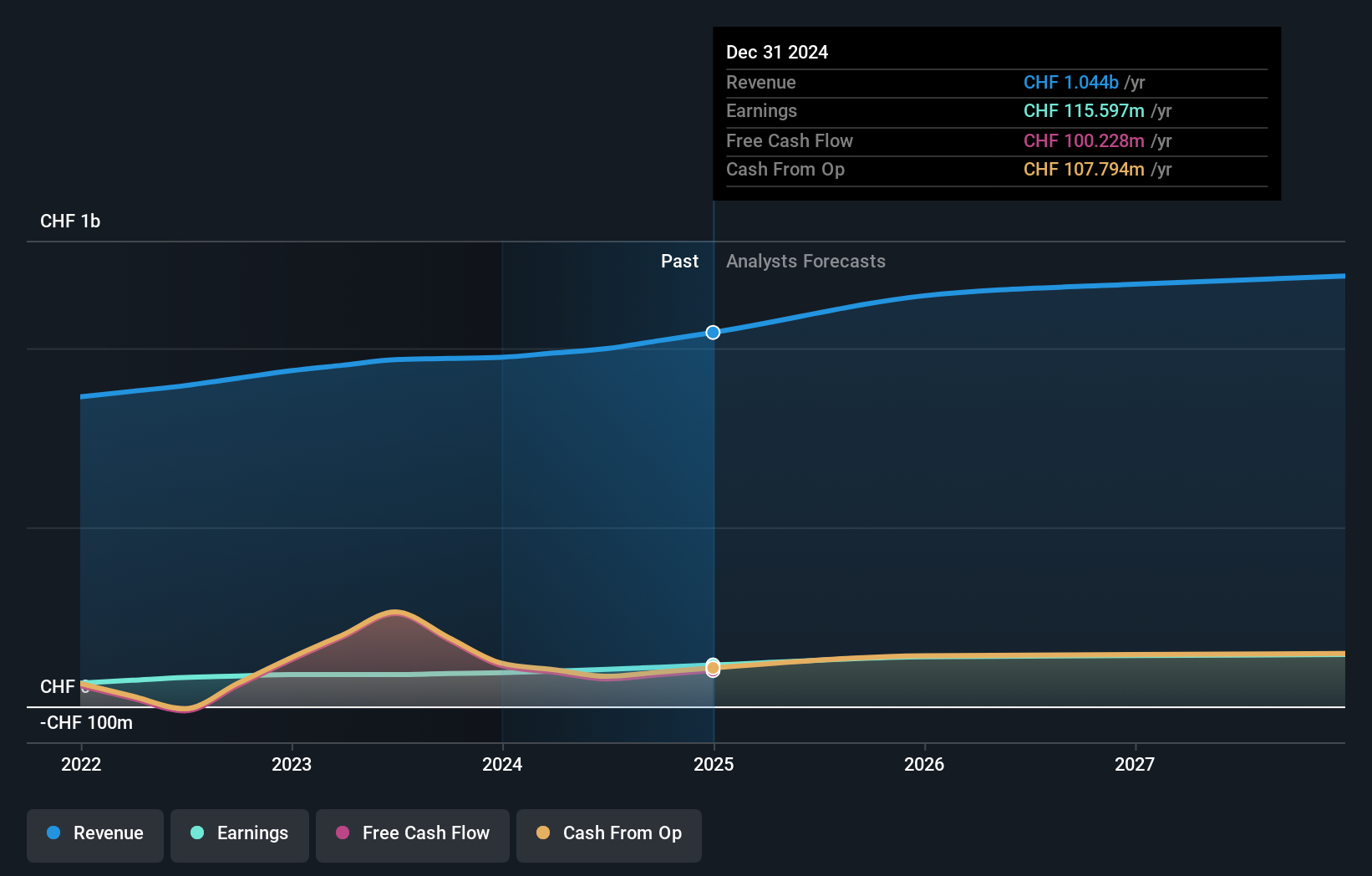

Overview: Compagnie Financière Tradition SA is a global interdealer broker specializing in financial and non-financial products, with a market capitalization of CHF 1.24 billion.

Operations: The company generates revenue primarily from three regions: Europe, Middle East and Africa (CHF 452.85 million), Americas (CHF 352.67 million), and Asia-Pacific (CHF 273.16 million).

Compagnie Financière Tradition, a Swiss financial entity, has shown robust earnings growth of 16.1% over the past year, outpacing the Capital Markets industry which saw a -3.3% change. Their net income for the half-year ending June 2024 was CHF 59.99 million, up from CHF 51.02 million previously, with basic earnings per share rising to CHF 7.98 from CHF 6.86 last year. The company’s debt-to-equity ratio improved significantly from 75.7% to 47.1% over five years and it trades at nearly 30% below estimated fair value, indicating potential undervaluation despite recent shareholder dilution concerns.

- Click to explore a detailed breakdown of our findings in Compagnie Financière Tradition's health report.

Learn about Compagnie Financière Tradition's historical performance.

TX Group (SWX:TXGN)

Simply Wall St Value Rating: ★★★★★★

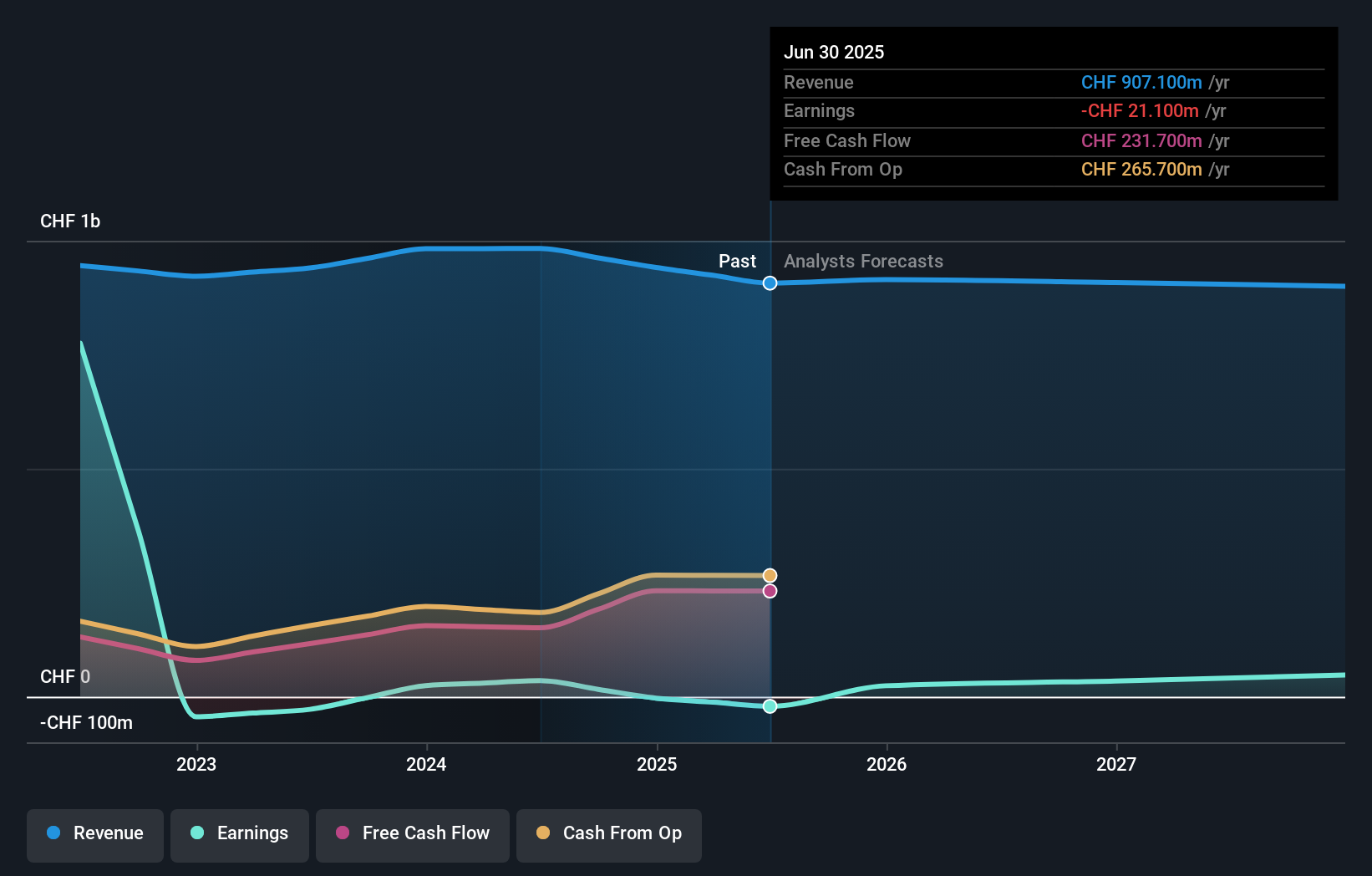

Overview: TX Group AG operates a network of platforms and participations offering information, orientation, entertainment, and support services in Switzerland, with a market cap of CHF1.53 billion.

Operations: TX Group AG generates revenue primarily from its segments: Tamedia (CHF 427 million), Goldbach (CHF 299.10 million), 20 Minutes (CHF 115.60 million), TX Markets (CHF 126.40 million), and Groups & Ventures (CHF 159.40 million). The company incurs eliminations and reconciliation adjustments amounting to CHF -144.60 million according to IAS 19 standards, impacting its financial results.

TX Group, a smaller player in the Swiss market, recently made strides by turning profitable this year, with net income reaching CHF 9.6 million compared to a loss of CHF 1.4 million last year. The company trades at an attractive valuation, approximately 64% below estimated fair value. Its financial health is underscored by a debt-to-equity ratio that has improved from 4.4 to 0.9 over five years and more cash than total debt, positioning it well for future growth prospects as earnings are forecasted to grow annually by over 32%.

- Get an in-depth perspective on TX Group's performance by reading our health report here.

Examine TX Group's past performance report to understand how it has performed in the past.

Make It Happen

- Click here to access our complete index of 18 SIX Swiss Exchange Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Burkhalter Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BRKN

Burkhalter Holding

Through its subsidiaries, provides electrical engineering services to the construction sector in Switzerland.

Established dividend payer with proven track record.