- Switzerland

- /

- Medical Equipment

- /

- SWX:MED

Top 3 Stocks On SIX Swiss Exchange That May Offer Hidden Value In July 2024

Reviewed by Simply Wall St

The Switzerland stock market recently experienced a downturn, reflecting broader concerns about global economic growth and influenced by disappointing earnings reports from major companies in the U.S. and Europe. In such a climate, identifying stocks that may offer hidden value becomes particularly crucial, as they can present opportunities for investors to capitalize on potential recoveries or undervalued assets amidst prevailing market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Switzerland

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LEM Holding (SWX:LEHN) | CHF1186.00 | CHF1751.83 | 32.3% |

| COLTENE Holding (SWX:CLTN) | CHF45.00 | CHF74.52 | 39.6% |

| Burckhardt Compression Holding (SWX:BCHN) | CHF610.00 | CHF853.54 | 28.5% |

| Julius Bär Gruppe (SWX:BAER) | CHF47.45 | CHF91.49 | 48.1% |

| Georg Fischer (SWX:GF) | CHF64.10 | CHF99.54 | 35.6% |

| Swissquote Group Holding (SWX:SQN) | CHF279.80 | CHF361.06 | 22.5% |

| SGS (SWX:SGSN) | CHF94.50 | CHF129.25 | 26.9% |

| Comet Holding (SWX:COTN) | CHF343.50 | CHF588.96 | 41.7% |

| Medartis Holding (SWX:MED) | CHF73.80 | CHF132.79 | 44.4% |

| Sika (SWX:SIKA) | CHF262.00 | CHF341.93 | 23.4% |

Let's explore several standout options from the results in the screener.

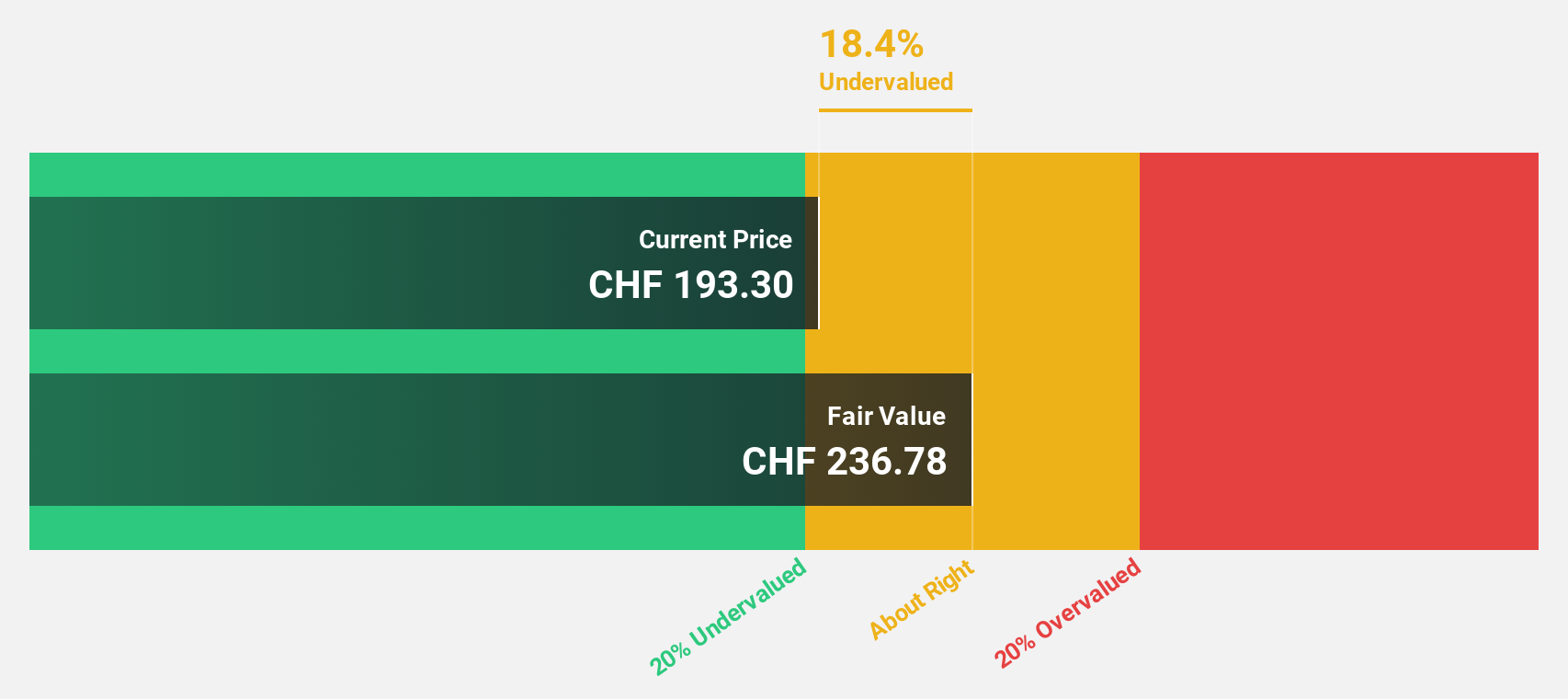

Helvetia Holding (SWX:HELN)

Overview: Helvetia Holding AG operates in life and non-life insurance, as well as reinsurance sectors across Switzerland, Germany, Austria, Spain, Italy, France and other international markets with a market capitalization of CHF 6.90 billion.

Operations: Helvetia Holding AG generates CHF 1.81 billion from its life insurance segment and CHF 7.09 billion from non-life insurance operations.

Estimated Discount To Fair Value: 12.7%

Helvetia Holding, priced at CHF130.6, trades below its fair value of CHF149.38, indicating a 12.6% undervaluation based on discounted cash flows. Despite this potential for appreciation, the company's dividend sustainability is questionable as it is poorly covered by earnings. Earnings are expected to grow by 22.66% annually over the next three years, outpacing the Swiss market's growth rate of 8.6%. However, Helvetia's profit margins have declined from last year’s 5.1% to 3%.

- Our earnings growth report unveils the potential for significant increases in Helvetia Holding's future results.

- Click to explore a detailed breakdown of our findings in Helvetia Holding's balance sheet health report.

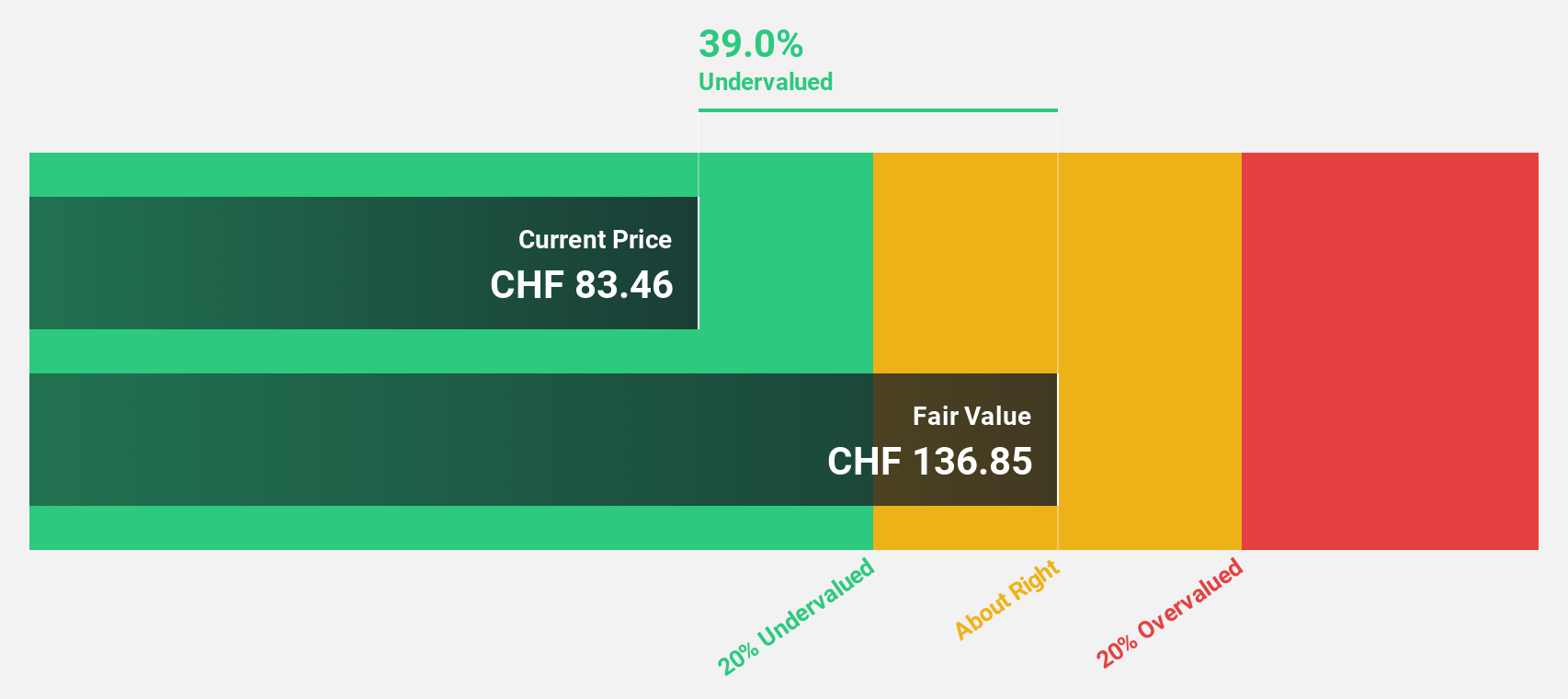

Medartis Holding (SWX:MED)

Overview: Medartis Holding AG is a global medical device company that specializes in developing, manufacturing, and selling implant solutions, with a market capitalization of approximately CHF 1.00 billion.

Operations: The company generates CHF 212.01 million in revenue from its medical products segment.

Estimated Discount To Fair Value: 44.4%

Medartis Holding, valued at CHF73.8, is considered undervalued with a fair value estimate of CHF132.79, reflecting a significant discount. The company's revenue and earnings are expected to outperform the Swiss market with annual growth rates of 13.3% and 60.4%, respectively. Despite recent shareholder dilution and low forecasted Return on Equity at 7%, Medartis's financial metrics suggest robust future earnings growth, although impacted by substantial one-off items this year.

- The growth report we've compiled suggests that Medartis Holding's future prospects could be on the up.

- Dive into the specifics of Medartis Holding here with our thorough financial health report.

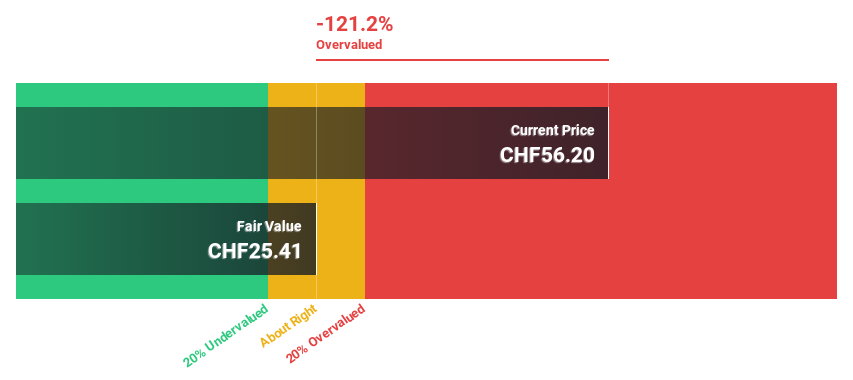

SGS (SWX:SGSN)

Overview: SGS SA operates globally, offering inspection, testing, and verification services across various regions including Europe, Africa, the Middle East, the Americas, and Asia Pacific, with a market capitalization of CHF 17.88 billion.

Operations: The company generates CHF 0.76 billion in revenue from its Business Assurance segment.

Estimated Discount To Fair Value: 26.9%

SGS SA, trading at CHF94.5 against a fair value of CHF129.25, appears undervalued by over 20%. Despite a slight dip in net income and EPS as per the latest half-year results, SGS's revenue growth is expected to surpass the Swiss market average at 5.5% annually. However, its dividend coverage is weak and shareholder dilution occurred over the past year. The company's earnings are projected to grow by 11.9% annually, outpacing the market forecast of 8.6%.

- In light of our recent growth report, it seems possible that SGS' financial performance will exceed current levels.

- Take a closer look at SGS' balance sheet health here in our report.

Summing It All Up

- Click through to start exploring the rest of the 11 Undervalued SIX Swiss Exchange Stocks Based On Cash Flows now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:MED

Medartis Holding

A medical device company, develops, manufactures, and sells implant solutions worldwide.

Excellent balance sheet with reasonable growth potential.