- Switzerland

- /

- Electrical

- /

- SWX:HUBN

Is It Worth Considering Huber+Suhner AG (VTX:HUBN) For Its Upcoming Dividend?

Huber+Suhner AG (VTX:HUBN) is about to trade ex-dividend in the next 4 days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. This means that investors who purchase Huber+Suhner's shares on or after the 31st of March will not receive the dividend, which will be paid on the 4th of April.

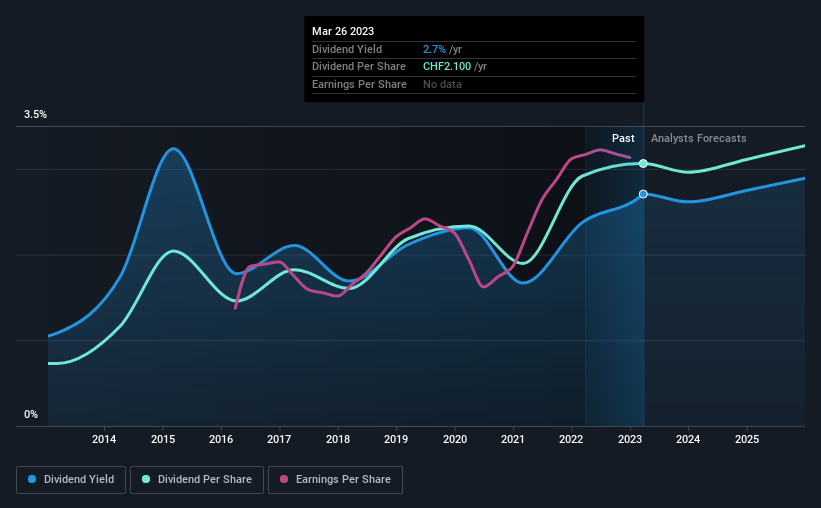

The company's next dividend payment will be CHF2.10 per share, and in the last 12 months, the company paid a total of CHF2.10 per share. Based on the last year's worth of payments, Huber+Suhner has a trailing yield of 2.7% on the current stock price of CHF77.6. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether Huber+Suhner can afford its dividend, and if the dividend could grow.

Check out our latest analysis for Huber+Suhner

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. That's why it's good to see Huber+Suhner paying out a modest 47% of its earnings. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out 92% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Cash flows are usually much more volatile than earnings, so this could be a temporary effect - but we'd generally want to look more closely here.

Huber+Suhner paid out less in dividends than it reported in profits, but unfortunately it didn't generate enough cash to cover the dividend. Cash is king, as they say, and were Huber+Suhner to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. For this reason, we're glad to see Huber+Suhner's earnings per share have risen 16% per annum over the last five years. Earnings have been growing at a decent rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last 10 years, Huber+Suhner has lifted its dividend by approximately 15% a year on average. It's exciting to see that both earnings and dividends per share have grown rapidly over the past few years.

The Bottom Line

Has Huber+Suhner got what it takes to maintain its dividend payments? We're glad to see the company has been improving its earnings per share while also paying out a low percentage of income. However, it's not great to see it paying out what we see as an uncomfortably high percentage of its cash flow. To summarise, Huber+Suhner looks okay on this analysis, although it doesn't appear a stand-out opportunity.

On that note, you'll want to research what risks Huber+Suhner is facing. Every company has risks, and we've spotted 1 warning sign for Huber+Suhner you should know about.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Huber+Suhner might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:HUBN

Huber+Suhner

Engages in the provision of electrical and optical connectivity components and system solutions.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026