- Switzerland

- /

- Electrical

- /

- SWX:HUBN

Here's Why Shareholders May Want To Be Cautious With Increasing Huber+Suhner AG's (VTX:HUBN) CEO Pay Packet

Under the guidance of CEO Urs Ryffel, Huber+Suhner AG (VTX:HUBN) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 31 March 2021. However, some shareholders will still be cautious of paying the CEO excessively.

Check out our latest analysis for Huber+Suhner

How Does Total Compensation For Urs Ryffel Compare With Other Companies In The Industry?

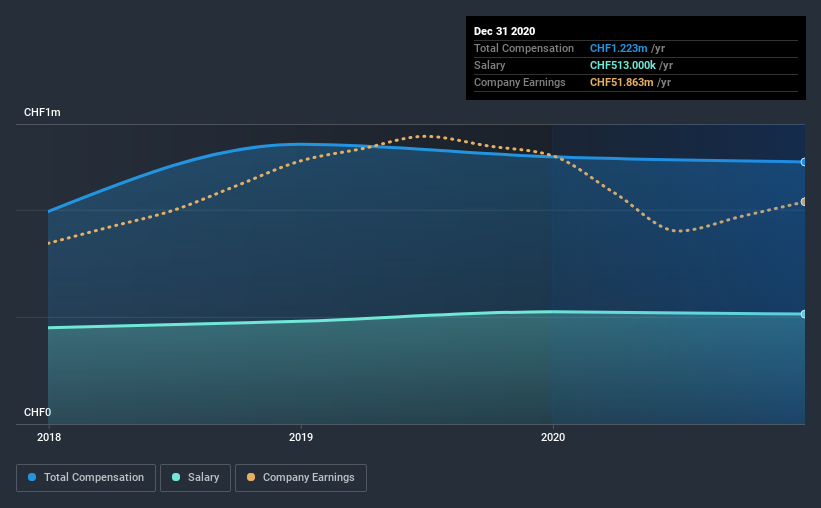

Our data indicates that Huber+Suhner AG has a market capitalization of CHF1.4b, and total annual CEO compensation was reported as CHF1.2m for the year to December 2020. That's mostly flat as compared to the prior year's compensation. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at CHF513k.

In comparison with other companies in the industry with market capitalizations ranging from CHF935m to CHF3.0b, the reported median CEO total compensation was CHF509k. This suggests that Urs Ryffel is paid more than the median for the industry. What's more, Urs Ryffel holds CHF2.1m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CHF513k | CHF524k | 42% |

| Other | CHF710k | CHF723k | 58% |

| Total Compensation | CHF1.2m | CHF1.2m | 100% |

Talking in terms of the industry, salary represented approximately 58% of total compensation out of all the companies we analyzed, while other remuneration made up 42% of the pie. Huber+Suhner sets aside a smaller share of compensation for salary, in comparison to the overall industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Huber+Suhner AG's Growth Numbers

Huber+Suhner AG's earnings per share (EPS) grew 7.2% per year over the last three years. Its revenue is down 11% over the previous year.

We would argue that the lack of revenue growth in the last year is less than ideal, but the modest improvement in EPS is good. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Huber+Suhner AG Been A Good Investment?

Most shareholders would probably be pleased with Huber+Suhner AG for providing a total return of 49% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. That's why we did some digging and identified 1 warning sign for Huber+Suhner that investors should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you decide to trade Huber+Suhner, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Huber+Suhner might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SWX:HUBN

Huber+Suhner

Engages in the provision of electrical and optical connectivity components and system solutions.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives