- Switzerland

- /

- Machinery

- /

- SWX:BYS

3 European Stocks Trading At Estimated Discounts For Value Investors

Reviewed by Simply Wall St

The European stock market has recently faced challenges, with the pan-European STOXX Europe 600 Index declining amid concerns over U.S. Federal Reserve independence, tariff uncertainties, and political instability in key regions. Despite these hurdles, value investors might find opportunities in stocks perceived to be trading at discounts due to broader market anxieties rather than company fundamentals. Identifying such stocks requires a keen focus on intrinsic value and potential for growth amidst current economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Trifork Group (CPSE:TRIFOR) | DKK89.00 | DKK175.03 | 49.2% |

| SKAN Group (SWX:SKAN) | CHF60.90 | CHF120.14 | 49.3% |

| SBO (WBAG:SBO) | €27.55 | €54.71 | 49.6% |

| Pluxee (ENXTPA:PLX) | €17.30 | €33.99 | 49.1% |

| Norconsult (OB:NORCO) | NOK46.10 | NOK90.69 | 49.2% |

| E-Globe (BIT:EGB) | €0.67 | €1.31 | 49% |

| Camurus (OM:CAMX) | SEK718.00 | SEK1416.78 | 49.3% |

| Bystronic (SWX:BYS) | CHF375.00 | CHF746.26 | 49.7% |

| Absolent Air Care Group (OM:ABSO) | SEK259.00 | SEK506.79 | 48.9% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €36.50 | €71.33 | 48.8% |

Let's dive into some prime choices out of the screener.

Bystronic (SWX:BYS)

Overview: Bystronic AG, with a market cap of CHF774.50 million, provides sheet metal processing solutions for cutting, bending, and automation globally through its subsidiaries.

Operations: The company's revenue is primarily derived from its sheet metal processing segment, which generated CHF622 million.

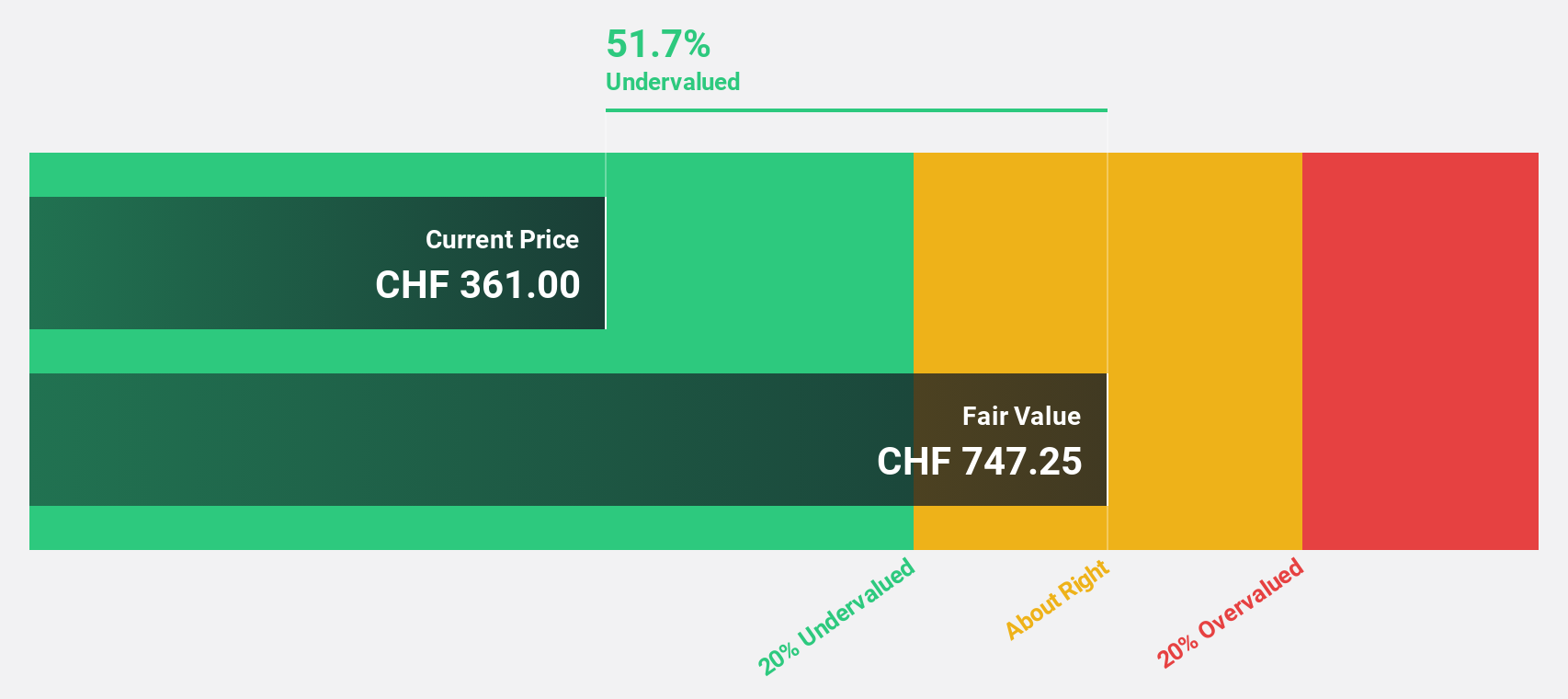

Estimated Discount To Fair Value: 49.7%

Bystronic is trading at CHF375, significantly below its estimated fair value of CHF746.26, suggesting it may be undervalued based on cash flows. Despite a challenging market environment and a slight decline in sales to CHF304.6 million for H1 2025, the company reduced its net loss to CHF12.9 million from the previous year. With anticipated profitability within three years and revenue growth outpacing the Swiss market, Bystronic presents potential long-term value for investors seeking undervalued opportunities in Europe.

- In light of our recent growth report, it seems possible that Bystronic's financial performance will exceed current levels.

- Take a closer look at Bystronic's balance sheet health here in our report.

Kardex Holding (SWX:KARN)

Overview: Kardex Holding AG is a global provider of intralogistics solutions, automated storage solutions, and materials handling systems, with a market cap of CHF2.52 billion.

Operations: The company's revenue is derived from its Automated Products segment, which generated €574.30 million, and its Standardized Systems segment, contributing €263.40 million.

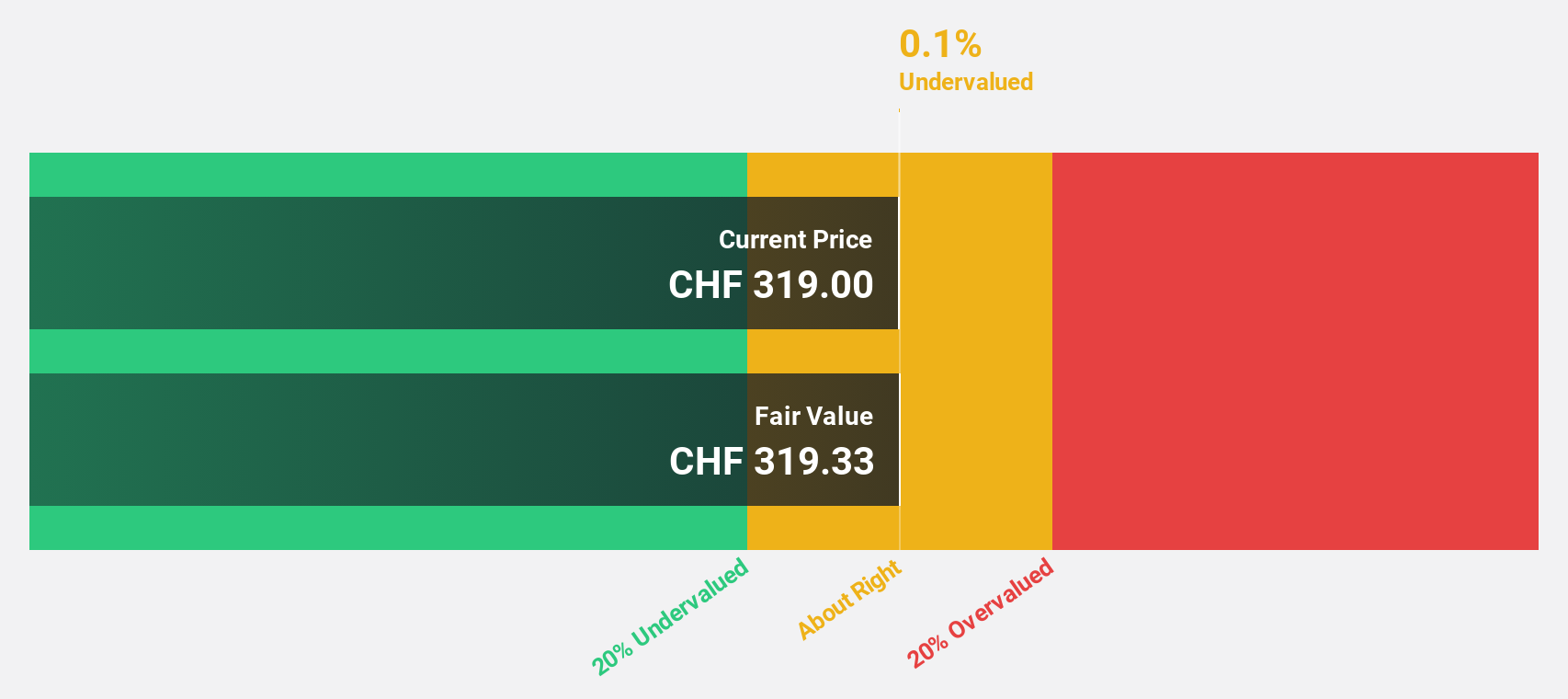

Estimated Discount To Fair Value: 11%

Kardex Holding is trading at CHF326.5, slightly below its fair value estimate of CHF366.78, indicating it might be undervalued by cash flow metrics. The company reported an 8.1% earnings growth last year and forecasts a 12.3% annual earnings increase, outpacing the Swiss market's growth rate of 11%. For 2025, Kardex projects net revenue of €415.7 million and an EBIT of €48.9 million, aligning with consistent profitability expectations amidst moderate revenue expansion.

- Our comprehensive growth report raises the possibility that Kardex Holding is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of Kardex Holding.

Stratec (XTRA:SBS)

Overview: Stratec SE, along with its subsidiaries, offers automation solutions for in-vitro diagnostics and life science companies across Germany, the European Union, and internationally, with a market cap of €320.92 million.

Operations: The company generates revenue of €263.52 million from its automation solutions for highly regulated laboratory environments.

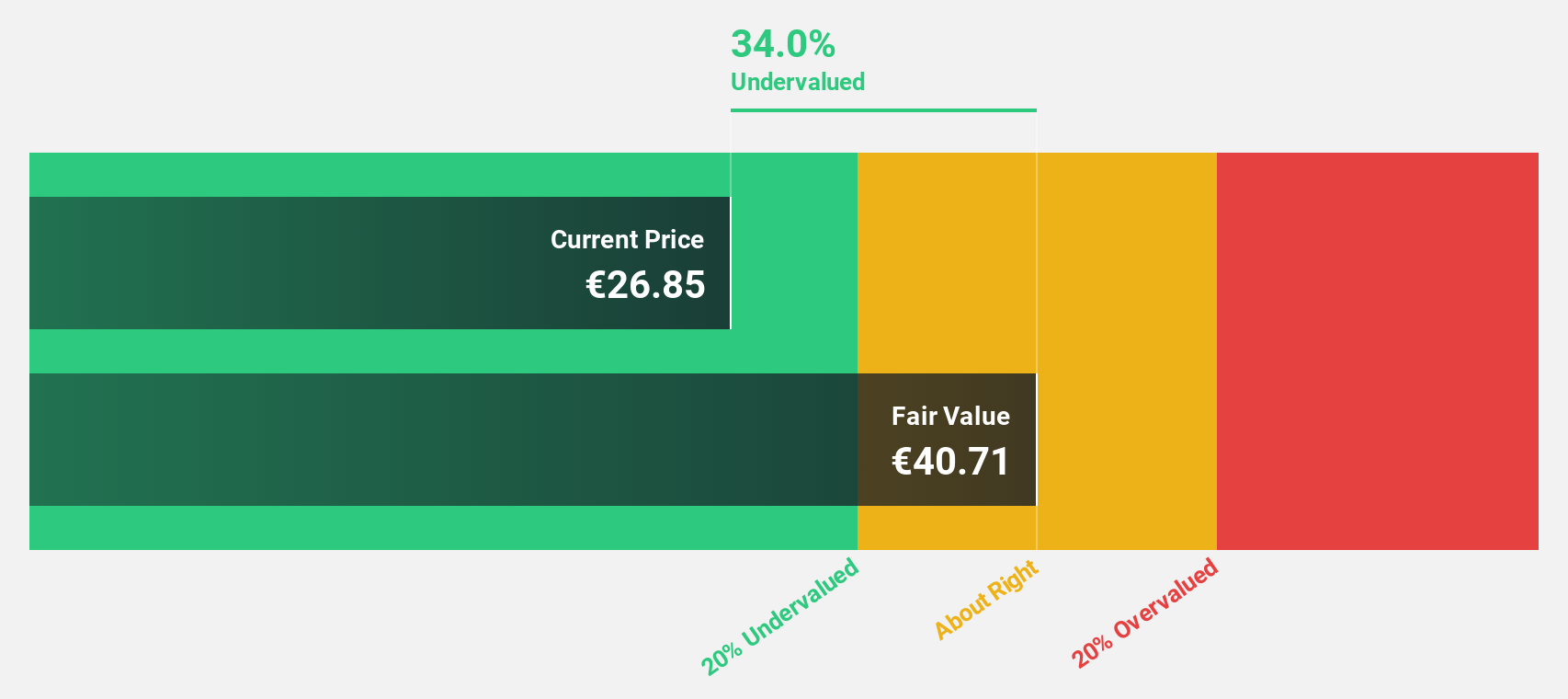

Estimated Discount To Fair Value: 42.8%

Stratec is trading at €26.4, significantly below its fair value estimate of €46.12, suggesting it may be undervalued based on cash flow analysis. Despite a recent dip in net income to €2.6 million for H1 2025 from €4.05 million the previous year, earnings are forecasted to grow substantially at 21.5% annually, surpassing the German market's growth rate of 16.5%. However, dividend coverage by free cash flows remains weak and debt coverage by operating cash flow is inadequate.

- The analysis detailed in our Stratec growth report hints at robust future financial performance.

- Get an in-depth perspective on Stratec's balance sheet by reading our health report here.

Summing It All Up

- Click here to access our complete index of 218 Undervalued European Stocks Based On Cash Flows.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bystronic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BYS

Bystronic

Through its subsidiaries, engages in the provision of sheet metal processing solutions for cutting, bending, and automation worldwide.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives