- Switzerland

- /

- Machinery

- /

- SWX:BUCN

Bucher Industries AG's (VTX:BUCN) Earnings Are Not Doing Enough For Some Investors

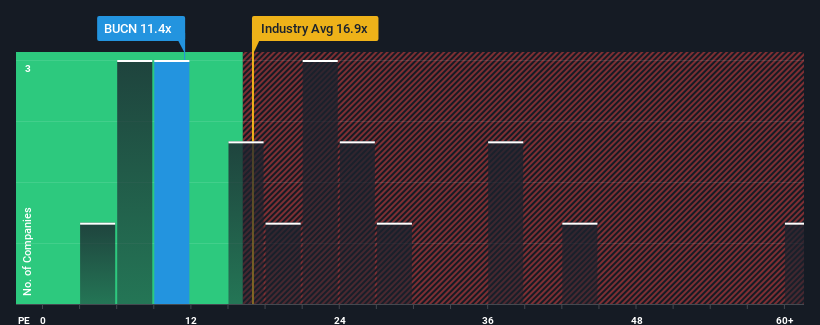

With a price-to-earnings (or "P/E") ratio of 11.4x Bucher Industries AG (VTX:BUCN) may be sending bullish signals at the moment, given that almost half of all companies in Switzerland have P/E ratios greater than 22x and even P/E's higher than 35x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Recent earnings growth for Bucher Industries has been in line with the market. It might be that many expect the mediocre earnings performance to degrade, which has repressed the P/E. If not, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Bucher Industries

What Are Growth Metrics Telling Us About The Low P/E?

Bucher Industries' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

Retrospectively, the last year delivered a decent 6.2% gain to the company's bottom line. Pleasingly, EPS has also lifted 134% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should bring diminished returns, with earnings decreasing 6.4% per annum as estimated by the seven analysts watching the company. That's not great when the rest of the market is expected to grow by 11% per annum.

With this information, we are not surprised that Bucher Industries is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Bucher Industries' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Bucher Industries maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Bucher Industries (1 can't be ignored!) that you need to take into consideration.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Bucher Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SWX:BUCN

Bucher Industries

Engages in the manufacture and sale of machinery, systems, and hydraulic components for harvesting, producing and packaging food products, and keeping roads and public spaces clean and safe in Asia, the United States, Europe, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives