- Switzerland

- /

- Building

- /

- SWX:ARBN

Top Growth Companies With High Insider Ownership On SIX Swiss Exchange August 2024

Reviewed by Simply Wall St

The Switzerland market ended on a dismal note on Friday with stocks falling lower and lower as the session progressed amid fears the U.S. could fall into a recession. Investors digested Swiss consumer price inflation data, and a slew of quarterly earnings updates, leading to significant losses in major indices. In such uncertain times, identifying growth companies with high insider ownership can offer some reassurance to investors. Companies where insiders hold substantial shares often indicate confidence in the firm's prospects, making them worth considering even amidst broader market volatility.

Top 10 Growth Companies With High Insider Ownership In Switzerland

| Name | Insider Ownership | Earnings Growth |

| Stadler Rail (SWX:SRAIL) | 14.5% | 22.2% |

| VAT Group (SWX:VACN) | 10.2% | 22.9% |

| Straumann Holding (SWX:STMN) | 32.7% | 20.8% |

| LEM Holding (SWX:LEHN) | 29.9% | 18.5% |

| Swissquote Group Holding (SWX:SQN) | 11.4% | 13.8% |

| Temenos (SWX:TEMN) | 17.4% | 14.2% |

| INFICON Holding (SWX:IFCN) | 10.3% | 10.5% |

| SHL Telemedicine (SWX:SHLTN) | 17.9% | 96.2% |

| Sensirion Holding (SWX:SENS) | 20.7% | 80% |

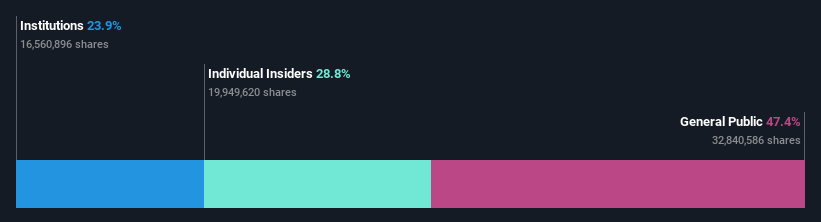

| Arbonia (SWX:ARBN) | 28.8% | 100.1% |

Let's explore several standout options from the results in the screener.

Arbonia (SWX:ARBN)

Simply Wall St Growth Rating: ★★★★☆☆

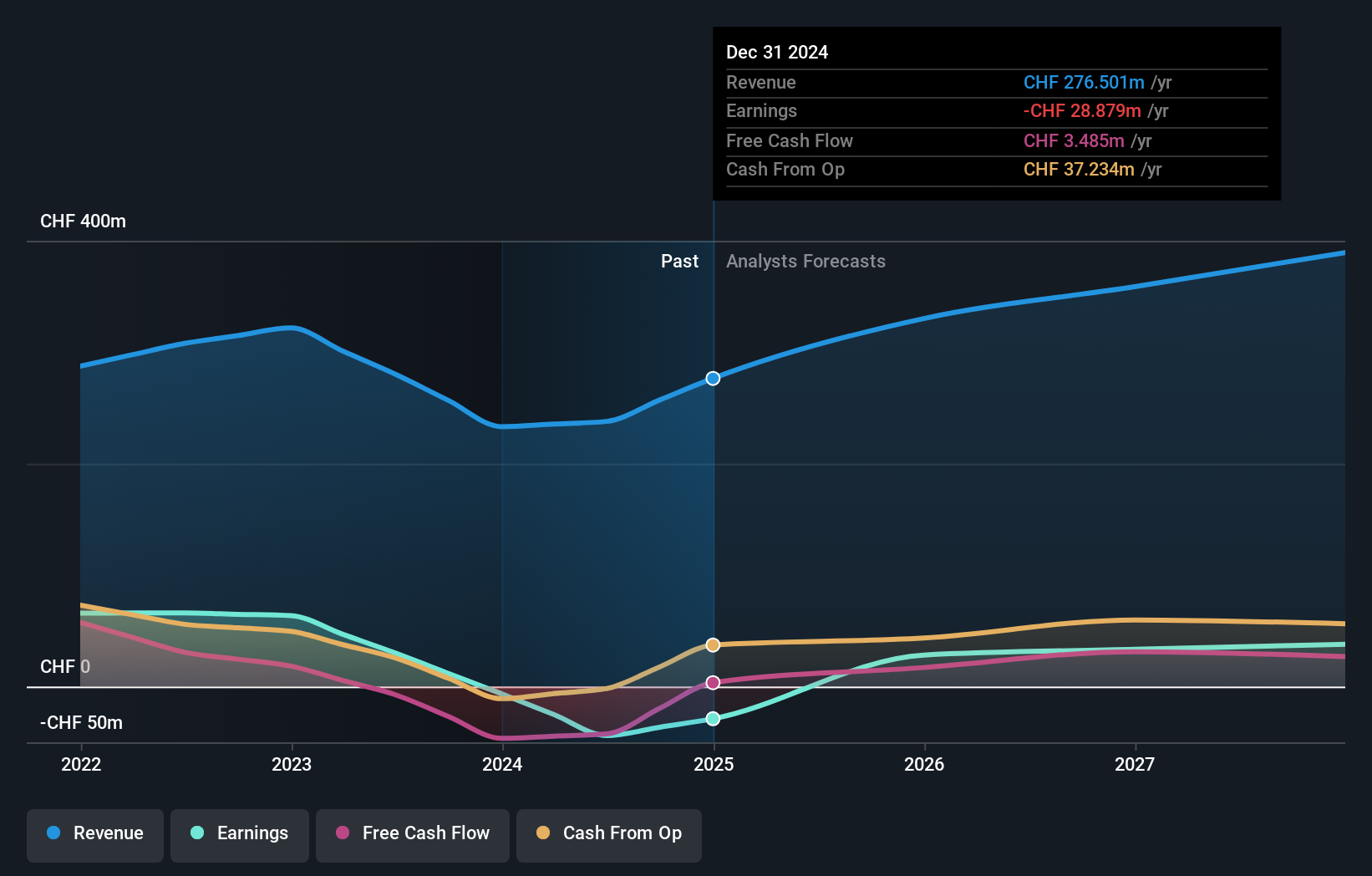

Overview: Arbonia AG, with a market cap of CHF850.24 million, supplies building components in Switzerland, Germany, and internationally.

Operations: The company's revenue segments include CHF501.56 million from Doors (Including Sanitary Equipment) and CHF3.07 million from Corporate Services.

Insider Ownership: 28.8%

Earnings Growth Forecast: 100.1% p.a.

Arbonia is forecast to become profitable over the next three years, with earnings expected to grow 100.06% per year, outpacing the Swiss market's average growth. Although its revenue growth of 9% per year is slower than 20%, it still surpasses the Swiss market's 4.8%. However, Arbonia's Return on Equity is projected to be low at 3.8% in three years, which might concern some investors despite its strong insider ownership and positive profit outlook.

- Click here to discover the nuances of Arbonia with our detailed analytical future growth report.

- The analysis detailed in our Arbonia valuation report hints at an inflated share price compared to its estimated value.

Leonteq (SWX:LEON)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Leonteq AG offers structured investment products and long-term savings and retirement solutions across Switzerland, Europe, and Asia including the Middle East, with a market cap of CHF451.01 million.

Operations: Leonteq AG generates revenue primarily from its brokerage segment, amounting to CHF256.88 million.

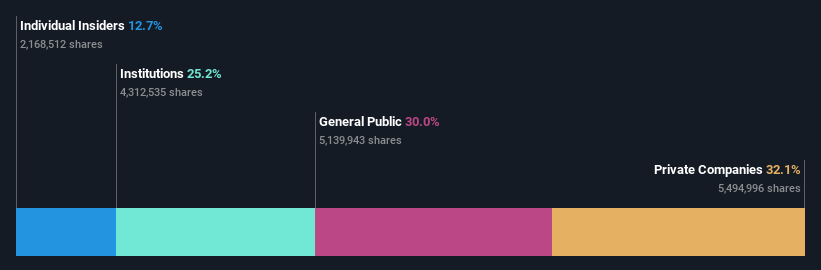

Insider Ownership: 12.7%

Earnings Growth Forecast: 50.5% p.a.

Leonteq is trading at 79.3% below its estimated fair value, indicating potential undervaluation. Despite a significant drop in profit margins from 34.2% to 8%, the company's earnings are forecast to grow substantially at 50.5% per year, outpacing the Swiss market's growth rate of 9.1%. However, its Return on Equity is projected to be low at 11.2% in three years, and dividends are not well covered by free cash flows, raising sustainability concerns.

- Navigate through the intricacies of Leonteq with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Leonteq shares in the market.

Sensirion Holding (SWX:SENS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sensirion Holding AG, with a market cap of CHF1.27 billion, develops, produces, sells, and services sensor systems, modules, and components globally through its subsidiaries.

Operations: The company's revenue primarily comes from sensor systems, modules, and components, amounting to CHF233.17 million.

Insider Ownership: 20.7%

Earnings Growth Forecast: 80% p.a.

Sensirion Holding, with substantial insider ownership, is forecast to grow earnings by 79.98% annually and become profitable within three years, outpacing the Swiss market's growth rate of 4.8%. Despite trading at a discount of 12.7% below its estimated fair value and having no recent insider trading activity, its revenue growth projection of 13.3% per year is slower than the desired 20%. The company's Return on Equity is expected to be low at 10.7%, and its share price has been highly volatile over the past three months.

- Delve into the full analysis future growth report here for a deeper understanding of Sensirion Holding.

- Our valuation report here indicates Sensirion Holding may be overvalued.

Make It Happen

- Click this link to deep-dive into the 13 companies within our Fast Growing SIX Swiss Exchange Companies With High Insider Ownership screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:ARBN

Arbonia

Engages in the supply of building components in Switzerland, Germany, and internationally.

Reasonable growth potential with adequate balance sheet.