- Switzerland

- /

- Banks

- /

- SWX:BLKB

Basellandschaftliche Kantonalbank (SWX:BLKB): Evaluating Valuation After Recent Subtle Share Price Shift

Reviewed by Simply Wall St

A sharp move in Basellandschaftliche Kantonalbank (SWX:BLKB) shares this week may have left some investors pausing to wonder whether the market is signaling something bigger under the surface. Without a headline-driving news event, this uptick is harder to explain at first glance. However, it does bring fresh attention to BLKB’s underlying valuation and potential growth path. Could this be more than short-term momentum, or just a routine shift as broader market dynamics unfold?

The past year has seen Basellandschaftliche Kantonalbank stack up a total return of almost 12%, with year-to-date performance up around 6%. It’s a decent stretch in which the stock has moved both higher and lower at different points, but the most recent month has brought a 2% gain that hints at renewed optimism after a small stumble in the previous quarter. No single announcement or development appears to be driving this move, which might suggest investors are starting to reconsider the bank’s long-term value or changing their appetite for risk in financial stocks more generally.

With the shares drifting higher and no obvious trigger in the headlines, is Basellandschaftliche Kantonalbank a sleeper opportunity at today’s prices, or is the market already factoring in whatever growth lies ahead?

Price-to-Earnings of 9.8x: Is it justified?

Basellandschaftliche Kantonalbank (BLKB) is currently valued at a price-to-earnings (P/E) ratio of 9.8, which places it below the average of its Swiss bank peers (12.6x) and right in line with the wider European banking industry (9.8x). This ratio indicates how much investors are willing to pay today for a single unit of the bank’s past earnings, making it a fundamental measure for banks and other stable, mature businesses.

A P/E multiple can reflect market expectations for future growth and risk. For BLKB, this lower multiple compared to Swiss peers could suggest that the market is underestimating the bank's growth or profit potential, or is pricing in a higher level of caution due to other company or sector-specific factors. At the same time, being aligned with the industry average shows its valuation is not extreme by continental standards.

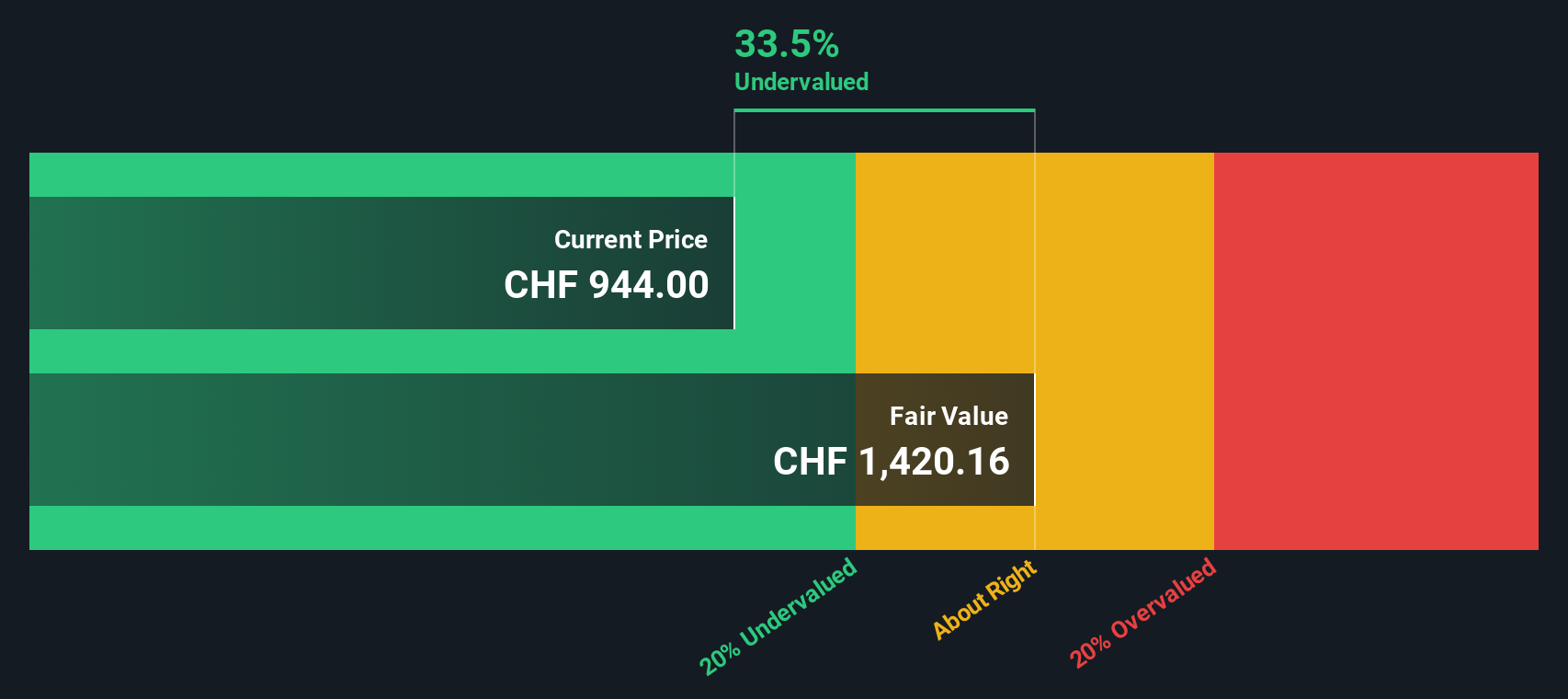

Result: Fair Value of $1,369.97 (UNDERVALUED)

See our latest analysis for Basellandschaftliche Kantonalbank.However, if revenue or net income growth continues to stagnate or if there is a broader shift in sentiment in the banking sector, recent optimism around BLKB shares could be quickly reversed.

Find out about the key risks to this Basellandschaftliche Kantonalbank narrative.Another View: The SWS DCF Model Perspective

Taking a different approach, our DCF model suggests the market may be underestimating BLKB’s true worth. This view supports the idea that shares are trading beneath fair value. However, it is important to consider whether every model can tell the whole story.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Basellandschaftliche Kantonalbank Narrative

If you see things differently or want to dive into the numbers yourself, you can build your own view in just a few minutes. Do it your way

A great starting point for your Basellandschaftliche Kantonalbank research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t just watch from the sidelines while unique opportunities pass by. Use these powerful tools to find stocks that could transform your portfolio:

- Spot companies loaded with untapped potential by tapping into undervalued stocks based on cash flows. See which stocks are trading well below their true worth.

- Fuel your income strategy by uncovering top picks with reliable dividend payouts through dividend stocks with yields > 3%. Target stocks offering robust yields above 3%.

- Get ahead of the next big shift in healthcare by tracking innovative firms using artificial intelligence with healthcare AI stocks. Seize the trends shaping tomorrow's medical breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Basellandschaftliche Kantonalbank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:BLKB

Basellandschaftliche Kantonalbank

Provides various banking products and services to the private and corporate customers in Switzerland.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives