- Canada

- /

- Renewable Energy

- /

- TSX:BLX

Should Apuiat Wind Farm's Launch and Innu Partnership Drive New Growth for Boralex (TSX:BLX) Investors?

Reviewed by Sasha Jovanovic

- Apuiat Wind Farm L.P., a partnership between the Innu communities and Boralex, recently announced that the 200 MW Apuiat Wind Farm achieved commercial operation on Québec's Côte-Nord, marking the region's first large-scale wind energy project since 2018 and the introduction of Quebec's most powerful wind turbines.

- This venture not only advances Québec’s provincial energy objectives but also stands out as the first national energy project led by Innu communities, underscoring a landmark collaboration between Indigenous partners and the renewables sector.

- We'll examine how the successful launch of Apuiat Wind Farm with a long-term power purchase agreement shapes Boralex’s growth outlook.

The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

Boralex Investment Narrative Recap

To believe in Boralex as an investment, you need confidence in its ability to grow through new renewables projects and secure long-term power purchase agreements, especially in North America. The Apuiat Wind Farm’s launch with a 30-year contract adds visibility to future revenues, which may help offset exposure to short-term price volatility and market risks driven by legacy contract roll-offs, though these challenges in other regions remain material near-term issues for the business.

Among recent announcements, the Limekiln Wind Farm in Scotland reaching operations highlights Boralex’s ongoing project execution outside Québec, reinforcing its growth strategy through geographic and technological diversification. Large-scale launches like Apuiat and Limekiln signal continued momentum in meeting clean energy demand, supporting expansion even as Boralex manages earnings swings linked to contract pricing and market exposure.

However, despite these growth achievements, it's important to contrast this with continuing risks to near-term earnings from rolling legacy contracts, especially in France, that investors should be aware of…

Read the full narrative on Boralex (it's free!)

Boralex's narrative projects CA$1.1 billion revenue and CA$162.7 million earnings by 2028. This requires 10.7% yearly revenue growth and a CA$172.7 million increase in earnings from the current level of CA$-10.0 million.

Uncover how Boralex's forecasts yield a CA$38.10 fair value, a 36% upside to its current price.

Exploring Other Perspectives

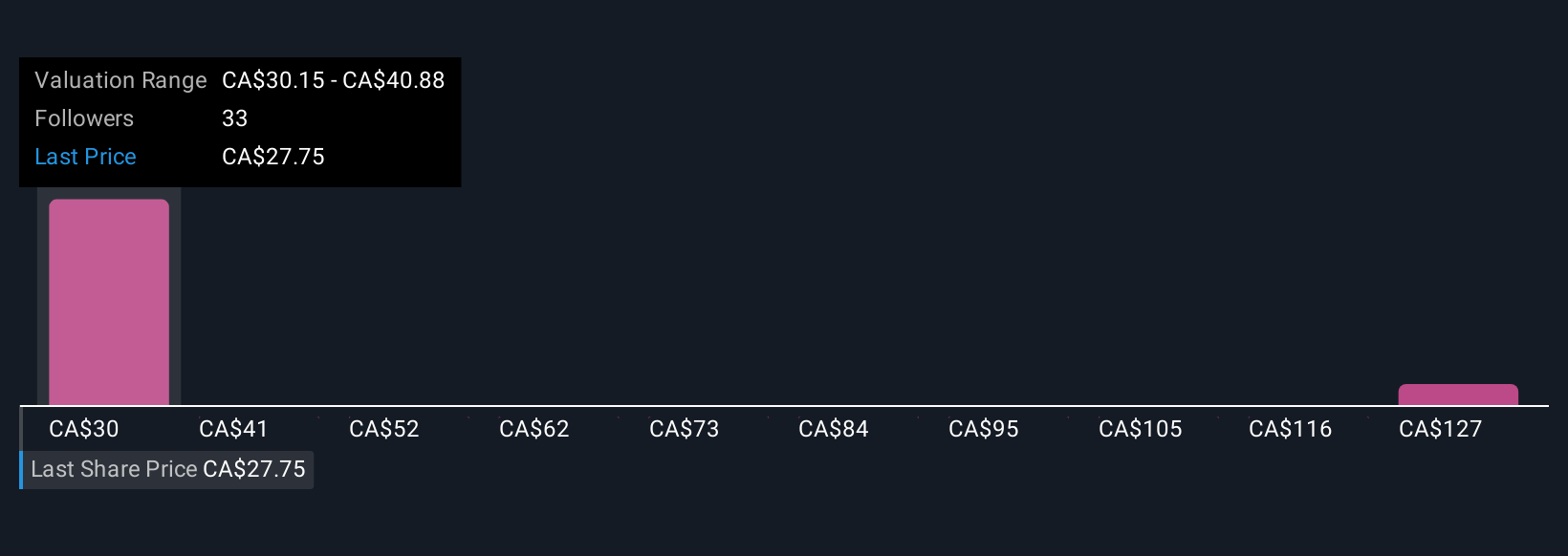

Three individual fair value estimates from the Simply Wall St Community span from CA$30.15 to CA$134.51, highlighting a wide range of investor views. With contract price volatility still a concern for revenue predictability, consider how diverse market perspectives can inform your opinion on Boralex’s next steps.

Explore 3 other fair value estimates on Boralex - why the stock might be worth over 4x more than the current price!

Build Your Own Boralex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Boralex research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Boralex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Boralex's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Boralex might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BLX

Boralex

Engages in the developing, building, and operating power generating and storage facilities in Canada, France, and the United States.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives