- Canada

- /

- Other Utilities

- /

- TSX:AQN

Why Algonquin Power & Utilities (TSX:AQN) Is Up 11.4% After Earnings Beat and New CFO Appointment

Reviewed by Sasha Jovanovic

- Algonquin Power & Utilities Corp. recently reported third-quarter results, showing quarterly sales of US$566.7 million and a return to net profitability, while also announcing the appointment of Robert J. Stefani as Chief Financial Officer effective January 2026.

- The company’s turnaround from a very large net loss a year ago, along with the incoming CFO’s strong background in financial restructuring and capital management, may signal operational and financial improvement ahead.

- To understand the implications of this earnings improvement, we’ll explore how the CFO appointment could affect Algonquin’s investment outlook.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Algonquin Power & Utilities Investment Narrative Recap

To be a shareholder in Algonquin Power & Utilities, you need to believe in the company's ongoing transformation into a pure regulated utility and its ability to resolve operational challenges, particularly those related to regulatory lag and customer service systems. The recent earnings turnaround signals improvement, but the biggest near-term catalyst remains progress on regulatory cases, while the main risk stems from ongoing integration and execution issues. The new CFO appointment is constructive but may not have an immediate, material impact on these short-term priorities.

Among the recent announcements, the affirmation of the quarterly dividend at US$0.065 per common share provides insight into management’s outlook for operational stability during a period marked by executive changes and strategic shifts. Continued dividend payments, despite past earnings volatility, may interest income-oriented investors, but should be weighed carefully against unresolved operational and regulatory risks that are top of mind for the future.

However, the ongoing uncertainty around resolving SAP-related billing and customer service issues remains a concern that investors should watch closely, as...

Read the full narrative on Algonquin Power & Utilities (it's free!)

Algonquin Power & Utilities is projected to reach $2.6 billion in revenue and $447.9 million in earnings by 2028. This scenario is based on an assumed annual revenue growth rate of 3.4% and a substantial increase in earnings, up $377 million from the current $70.9 million.

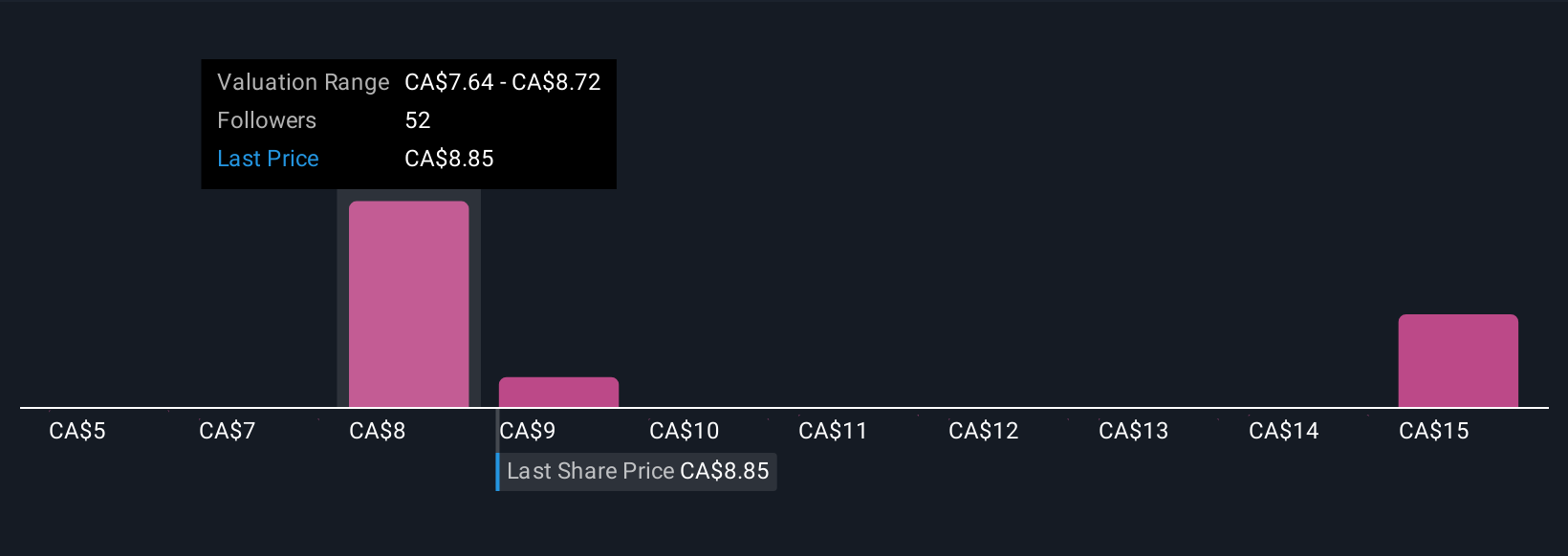

Uncover how Algonquin Power & Utilities' forecasts yield a CA$7.71 fair value, a 12% downside to its current price.

Exploring Other Perspectives

Fair value estimates from eight individual members of the Simply Wall St Community range from US$5.48 up to US$15.22 per share. While many are focused on the company’s leadership transition and operational turnaround, opinions differ widely, so take time to consider these varied viewpoints before making any investment decisions.

Explore 8 other fair value estimates on Algonquin Power & Utilities - why the stock might be worth as much as 75% more than the current price!

Build Your Own Algonquin Power & Utilities Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Algonquin Power & Utilities research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Algonquin Power & Utilities research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Algonquin Power & Utilities' overall financial health at a glance.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AQN

Algonquin Power & Utilities

Operates in the power and utility industries.

Slight risk with moderate growth potential.

Similar Companies

Market Insights

Community Narratives