- Canada

- /

- Other Utilities

- /

- TSX:ACO.X

Will Rob Peabody’s Board Appointment Steer ATCO's (TSX:ACO.X) Long-Term Growth Strategy?

Reviewed by Sasha Jovanovic

- ATCO Ltd. recently reported third quarter results, with sales rising to C$1.18 billion and net income of C$85 million, compared to C$1.12 billion and C$93 million in the same period last year; for the first nine months of 2025, net income held steady at C$293 million year-over-year.

- Alongside these earnings, ATCO announced the appointment of Rob Peabody, former CEO of Husky Energy, to its Board of Directors, bringing decades of industry leadership to the company.

- We’ll explore how Rob Peabody’s board appointment may influence ATCO’s growth strategy and the broader investment thesis.

We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

ATCO Investment Narrative Recap

ATCO appeals to investors who are focused on stable essential services and infrastructure growth, with the company’s long-term thesis resting on regulated utility earnings, steady dividends, and global expansion. The recent appointment of Rob Peabody to the Board brings valuable industry expertise, but does not materially change the key near-term catalyst, the anticipated demand for modular and affordable housing, nor does it immediately address the most significant risk: ongoing capital requirements and debt management. Among recent announcements, the ongoing dividend payment of CA$0.5045 per share continues to reinforce ATCO’s commitment to shareholder returns, coinciding with its cautious approach to share buybacks. This consistency is especially relevant to investors watching how the company balances cash distributions with a growing need for capital to fund expansion and service outstanding debt. In contrast, investors should also be aware that as capital requirements and debt levels increase, the pressure on ATCO’s balance sheet could become...

Read the full narrative on ATCO (it's free!)

ATCO's outlook anticipates CA$6.1 billion in revenue and CA$553.3 million in earnings by 2028. This is based on a projected 6.2% annual revenue growth rate and a CA$114.3 million increase in earnings from the current level of CA$439.0 million.

Uncover how ATCO's forecasts yield a CA$55.71 fair value, in line with its current price.

Exploring Other Perspectives

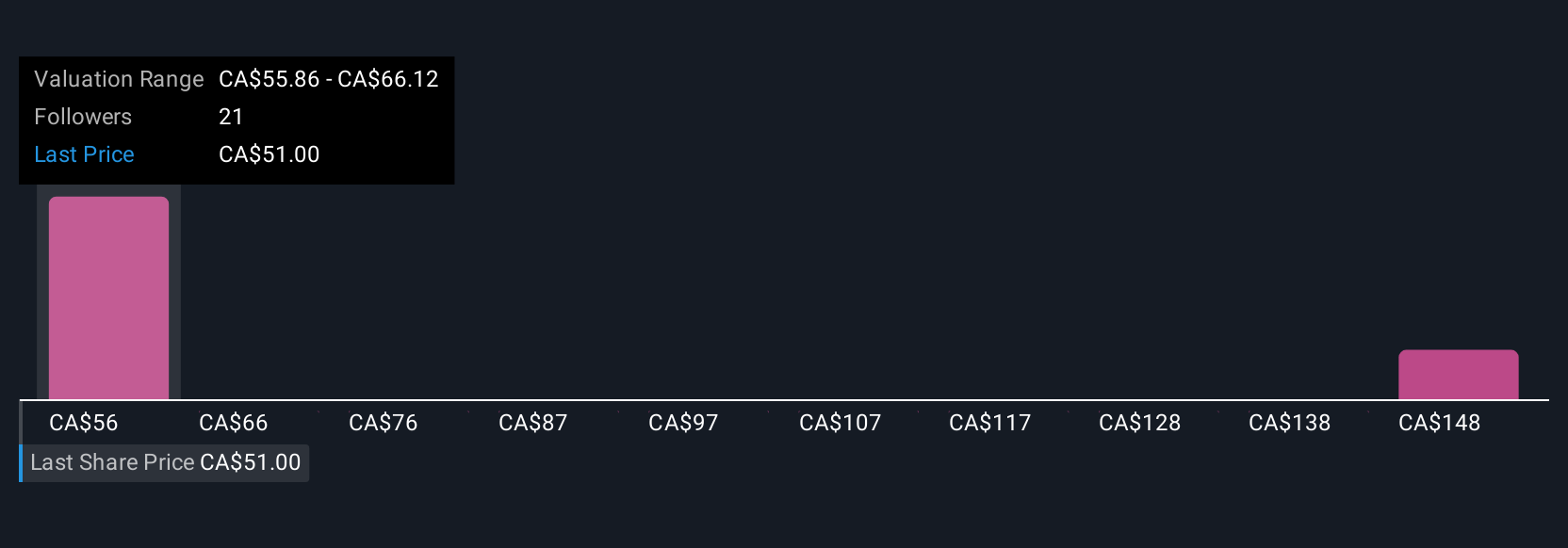

Simply Wall St Community members shared just 2 fair value estimates for ATCO, from CA$55.71 up to CA$135.14 per share. With rising capital requirements still cited as a key concern, it’s clear that opinions on the company’s future financial strength and valuation can vary widely.

Explore 2 other fair value estimates on ATCO - why the stock might be worth over 2x more than the current price!

Build Your Own ATCO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ATCO research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ATCO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ATCO's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ACO.X

ATCO

Engages in the energy, logistics and transportation, shelter, and real estate services in Canada, Australia, and internationally.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives