- Canada

- /

- Telecom Services and Carriers

- /

- TSX:TGO

A Piece Of The Puzzle Missing From TeraGo Inc.'s (TSE:TGO) Share Price

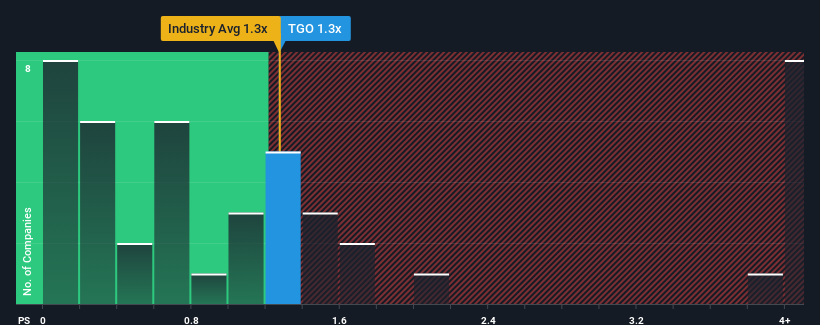

With a median price-to-sales (or "P/S") ratio of close to 1.1x in the Telecom industry in Canada, you could be forgiven for feeling indifferent about TeraGo Inc.'s (TSE:TGO) P/S ratio of 1.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for TeraGo

What Does TeraGo's P/S Mean For Shareholders?

There hasn't been much to differentiate TeraGo's and the industry's revenue growth lately. Perhaps the market is expecting future revenue performance to show no drastic signs of changing, justifying the P/S being at current levels. If this is the case, then at least existing shareholders won't be losing sleep over the current share price.

Keen to find out how analysts think TeraGo's future stacks up against the industry? In that case, our free report is a great place to start.How Is TeraGo's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like TeraGo's is when the company's growth is tracking the industry closely.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 41% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 6.2% during the coming year according to the sole analyst following the company. That's shaping up to be materially higher than the 1.4% growth forecast for the broader industry.

With this in consideration, we find it intriguing that TeraGo's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From TeraGo's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at TeraGo's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

You should always think about risks. Case in point, we've spotted 2 warning signs for TeraGo you should be aware of, and 1 of them is a bit unpleasant.

If these risks are making you reconsider your opinion on TeraGo, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if TeraGo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:TGO

Slight risk and fair value.

Similar Companies

Market Insights

Community Narratives