Will TELUS' (TSX:T) Dividend Hike Signal Lasting Balance Between Payouts and Future Growth?

Reviewed by Sasha Jovanovic

- On November 7, 2025, TELUS Corporation’s Board declared a quarterly dividend of CA$0.4184 per share, payable January 2, 2026, to shareholders of record on December 11, 2025, and confirmed its upcoming Q3 2025 earnings call.

- This dividend increase signals board confidence in TELUS’s capacity to sustain and return cash to shareholders amid an evolving Canadian telecom market.

- We’ll examine how the board’s dividend increase announcement aligns with TELUS’s broader plan to balance shareholder returns and future growth.

Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

TELUS Investment Narrative Recap

To be a TELUS shareholder today, you need to believe in the company’s ability to balance stable cash returns with long-term investments in digital infrastructure and growth beyond core telecom services. The just-announced dividend increase may bolster confidence in the sustainability of payouts, but it does not materially affect the near-term focus on cash flow resilience against heavy capex and competitive wireless pricing pressures, which remain the most important catalyst and risk for TELUS.

Among recent announcements, TELUS outlined a new CAD 2 billion commitment to enhance broadband services in Ontario and Quebec over five years. This expansion directly relates to the company’s ability to grow broadband revenues and supports the thesis that network investments are critical for strengthening cash flow and maintaining dividend stability, even as capital requirements weigh on debt metrics.

By contrast, investors should also be alert to how growing debt and elevated capital expenditures could pose ongoing pressure on...

Read the full narrative on TELUS (it's free!)

TELUS' outlook forecasts CA$22.7 billion in revenue and CA$1.5 billion in earnings by 2028. This is based on a projected annual revenue growth rate of 3.6% and an earnings increase of about CA$534 million from current earnings of CA$966 million.

Uncover how TELUS' forecasts yield a CA$23.38 fair value, a 13% upside to its current price.

Exploring Other Perspectives

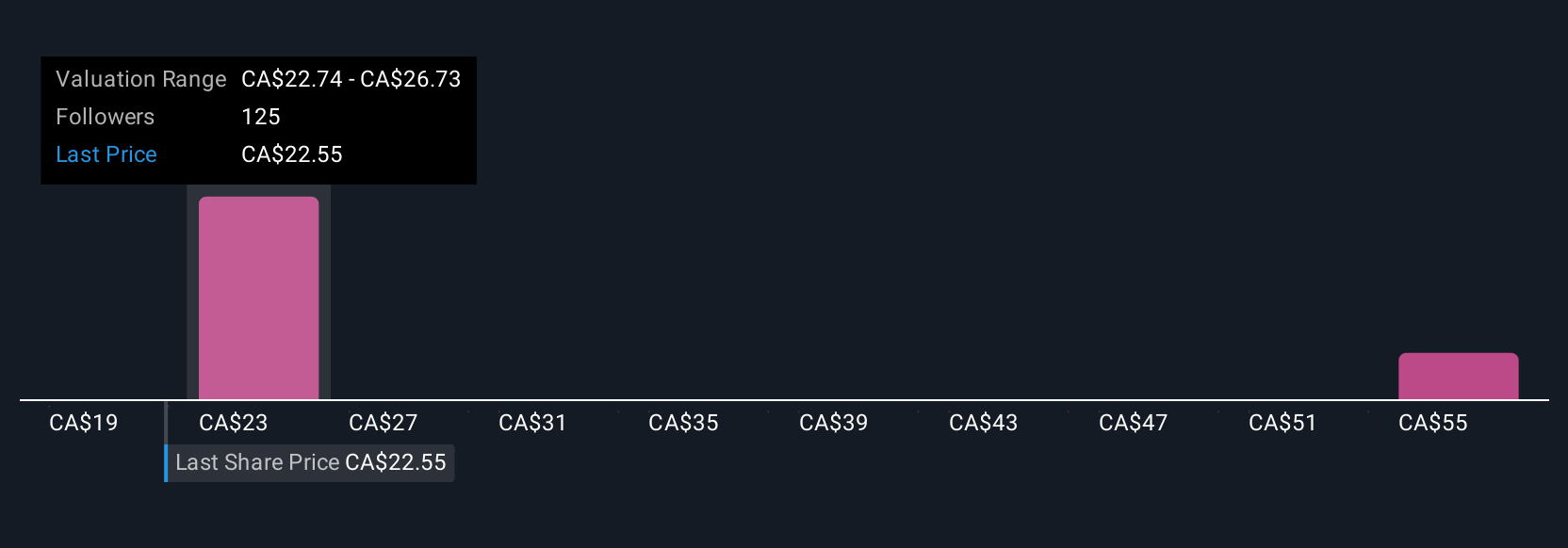

Nine members of the Simply Wall St Community estimate TELUS’s fair value anywhere from CA$17.70 to CA$44.23 per share. With capex and debt levels set against this wide valuation spread, you can explore how actual risks and future investments could differently impact the company’s outlook.

Explore 9 other fair value estimates on TELUS - why the stock might be worth over 2x more than the current price!

Build Your Own TELUS Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TELUS research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free TELUS research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TELUS' overall financial health at a glance.

No Opportunity In TELUS?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives