TELUS (TSX:T): Examining Current Valuation After Recent Modest Share Price Uptick

Reviewed by Simply Wall St

TELUS (TSX:T) has caught some investor attention recently, especially as its share price has edged up about 0.5% in the past day and just over 1% this week. The stock’s performance over the past month remains down, which has prompted many to keep an eye on upcoming developments that could shift sentiment.

See our latest analysis for TELUS.

While TELUS’ share price has edged up in the past week, momentum has generally been mixed, with the stock seeing a 1-year total shareholder return of 2.44% and a stronger 5-year total return of 11.12%. Recent price action suggests that investor sentiment is still forming, with near-term movements reflecting a cautious but steady view on its growth prospects.

If you’re curious about what else savvy investors are discovering, now might be the perfect time to widen your scope and check out fast growing stocks with high insider ownership

With TELUS trading about 12% below analyst price targets and a price suggesting a notable discount to intrinsic value, the big question is whether the current shares represent an attractive entry point or if future upside is already priced in.

Most Popular Narrative: 11% Undervalued

TELUS closed at CA$20.77, while the most popular narrative pins fair value at CA$23.38, a sizable gap. This sets the expectation that the company’s long-term prospects may warrant a stronger share price, if analyst forecasts hold true.

TELUS Health and related digital health and virtual care businesses are demonstrating rapid revenue and EBITDA growth (16% and 29% YoY, respectively), underpinned by ongoing product innovation, global expansion, and synergies from recent acquisitions. This strategic push into high-margin, non-commoditized digital wellness segments aligns with Canada’s demographic trends and will diversify and increase TELUS’s long-term earnings and margin profile.

Want to know what makes this valuation tick? One daring forecast lies at the heart of the story, powered by ambitious earnings projections and margin expansion far above today’s levels. Are analysts eyeing a profit paradigm shift? Uncover what this consensus is truly betting on in the full narrative.

Result: Fair Value of $23.38 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing competitive pressures on wireless ARPU and TELUS’s high capital investment needs could quickly challenge the optimism beneath current valuations.

Find out about the key risks to this TELUS narrative.

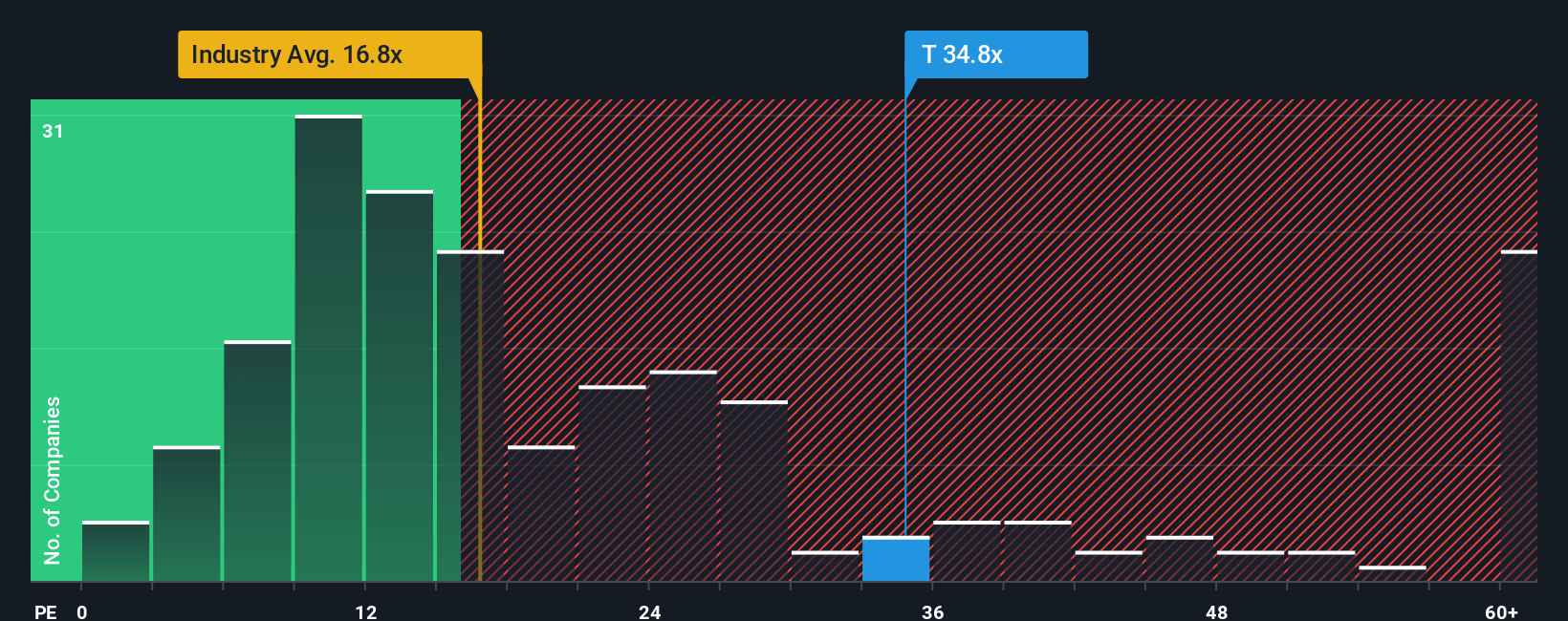

Another View: Market Multiples Tell a Different Story

Looking at TELUS through the lens of its price-to-earnings ratio, the shares trade at 27.3x earnings. This is much higher than both the Canadian peer average of 8.4x and the global telecom average of 16x. Even compared to the fair ratio of 16.7x, TELUS stands out as expensive. Such a premium could mean heightened expectations or increased downside risk if those expectations fall short. Is the market right to price TELUS this far above its peers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own TELUS Narrative

If you see things differently or want to shape your own view, you can dive into the numbers and craft a custom narrative in just a few minutes, and Do it your way.

A great starting point for your TELUS research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Now’s your chance to step ahead and power up your watchlist with fresh opportunities. Don’t let a great stock idea pass you by; your next winner could be within reach.

- Unearth value by scanning these 874 undervalued stocks based on cash flows, where companies trading below their true potential are primed for savvy investors to capitalize on growth.

- Capture steady income streams and shield against volatility as you browse these 16 dividend stocks with yields > 3%, yielding reliable payouts above 3%.

- Ride the AI wave with these 25 AI penny stocks, which are pushing boundaries in machine learning, automation, and digital intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TELUS might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:T

TELUS

Provides a range of telecommunications and information technology products and services in Canada.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Community Narratives