- Canada

- /

- Telecom Services and Carriers

- /

- TSX:QBR.A

Quebecor (TSX:QBR.A): Examining the Valuation After Recent Share Price Gains

Reviewed by Simply Wall St

Quebecor (TSX:QBR.A) has drawn the attention of investors recently, as its shares have climbed more than 27% over the past 3 months, continuing a year of solid gains. The move has raised questions about what is driving this steady momentum in the Canadian telecom landscape.

See our latest analysis for Quebecor.

Quebecor’s 46.9% share price return so far this year easily outpaces most of Canada’s major telecoms, reflecting a shift in investor confidence after the company steadily regained ground from previous years. With a 1-year total shareholder return of 51.6% and its latest close at $48.49, momentum appears to be building as the market rewards both resilience and growth potential.

If recent telecom moves piqued your interest, now is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with such robust gains, investors are left asking an important question: does Quebecor remain undervalued, or is its rapid rise a sign that the market is already factoring in the company’s future growth potential?

Price-to-Earnings of 13.5x: Is it justified?

Quebecor currently trades at a price-to-earnings (P/E) ratio of 13.5x, which puts it above the average for its direct peers but below broader global telecom standards. With a recent close at $48.49, investors are paying a premium compared to similar companies. However, the stock may still appear attractively valued from a wider industry perspective.

The price-to-earnings ratio is a commonly used benchmark in the telecom sector as it measures how much investors are willing to pay for each dollar of current earnings. It is especially relevant for mature businesses with stable cash flows, such as Quebecor.

While the current P/E ratio is noticeably more expensive than the peer average of 11.9x, it remains well below the global telecom industry average of 16x. This suggests that the market is pricing in Quebecor’s resilience and growth, yet perhaps not fully rewarding it as highly as the largest international players. When compared to what could be considered a “fair” P/E ratio, based on deeper analysis and regression studies, Quebecor’s valuation could have further room to move.

Explore the SWS fair ratio for Quebecor

Result: Price-to-Earnings of 13.5x (ABOUT RIGHT)

However, slower revenue growth and a dip in annual net income could act as hurdles for Quebecor, which may temper its otherwise upbeat investment story.

Find out about the key risks to this Quebecor narrative.

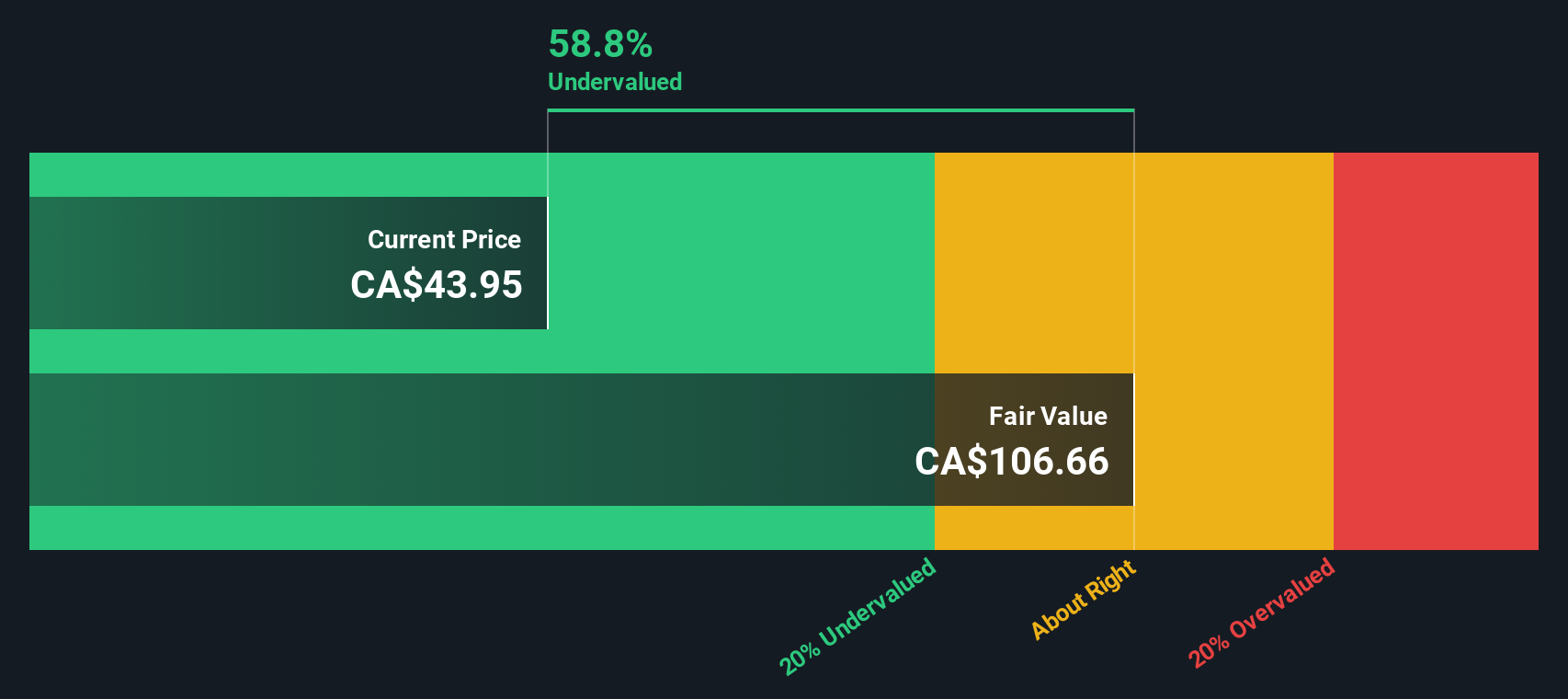

Another View: Discounted Cash Flow Says Shares Could Be Undervalued

While the price-to-earnings ratio signals Quebecor may be trading above the peer average, our DCF model presents a different assessment. According to this approach, the company is trading at a price well below our estimate of fair value. Could this deeper discount be an opportunity, or is the market cautious for a reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Quebecor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Quebecor Narrative

If these insights do not quite match your personal view or you would rather dive into the data yourself, it only takes a few minutes to shape your own perspective. Do it your way

A great starting point for your Quebecor research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t settle for the obvious when standout opportunities are still out there. Use the power of the Simply Wall Street Screener to target smart, forward-looking investments today.

- Tap opportunities for recurring income by screening for generous payouts among these 16 dividend stocks with yields > 3% with yields above 3% and robust financial health.

- Ride the technological revolution by checking out these 25 AI penny stocks, which are transforming industries with artificial intelligence innovation and standout growth momentum.

- Step ahead of the crowd by searching through these 874 undervalued stocks based on cash flows that the market may be missing and unlock potential before everyone else catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Quebecor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:QBR.A

Quebecor

Operates in the telecommunications, media, and sports and entertainment businesses in Canada.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives