- Canada

- /

- Telecom Services and Carriers

- /

- TSX:BCE

Will BCE's (TSX:BCE) Dramatic Profit Turnaround Redefine Long-Term Earnings Resilience?

Reviewed by Sasha Jovanovic

- BCE Inc. reported third-quarter 2025 results, posting CAD 6.05 billion in sales and a net profit of CAD 4.54 billion, compared to a net loss of CAD 1.19 billion a year earlier.

- This impressive turnaround from loss to profit highlights a year of significant financial recovery and strong operational performance for the company.

- We'll now examine how BCE's sharp profit rebound could influence analyst assumptions about its long-term earnings resilience and growth prospects.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

BCE Investment Narrative Recap

To be a BCE shareholder, you need to believe in the stability of Canada’s telecom infrastructure growth and the company’s ability to generate resilient earnings in a highly regulated industry. While BCE’s dramatic profit turnaround signals improved year-on-year execution, the largest short-term catalyst, its fiber network expansion, remains largely unchanged, as much of this profit rise was driven by a one-off gain rather than a fundamental shift in core operations or regulatory clarity. The biggest risk continues to be regulatory headwinds, particularly those slowing BCE’s fiber rollout.

Among recent announcements, the leadership transition plan for the Board stands out. With Gordon Nixon set to step down as Chair and Louis Vachon nominated as his successor, this governance renewal is unlikely to shift the near-term business outlook. However, it highlights ongoing efforts to ensure board continuity and oversight during a period where stability in execution is critical for catalyzing BCE’s core network and digital transformation initiatives.

However, with regulatory uncertainty still weighing on BCE’s fiber build-out and margin outlook, investors should be aware that…

Read the full narrative on BCE (it's free!)

BCE's outlook projects CA$26.0 billion in revenue and CA$2.8 billion in earnings by 2028. This requires 2.2% annual revenue growth and a CA$2.4 billion increase in earnings from current levels of CA$433.0 million.

Uncover how BCE's forecasts yield a CA$36.15 fair value, a 11% upside to its current price.

Exploring Other Perspectives

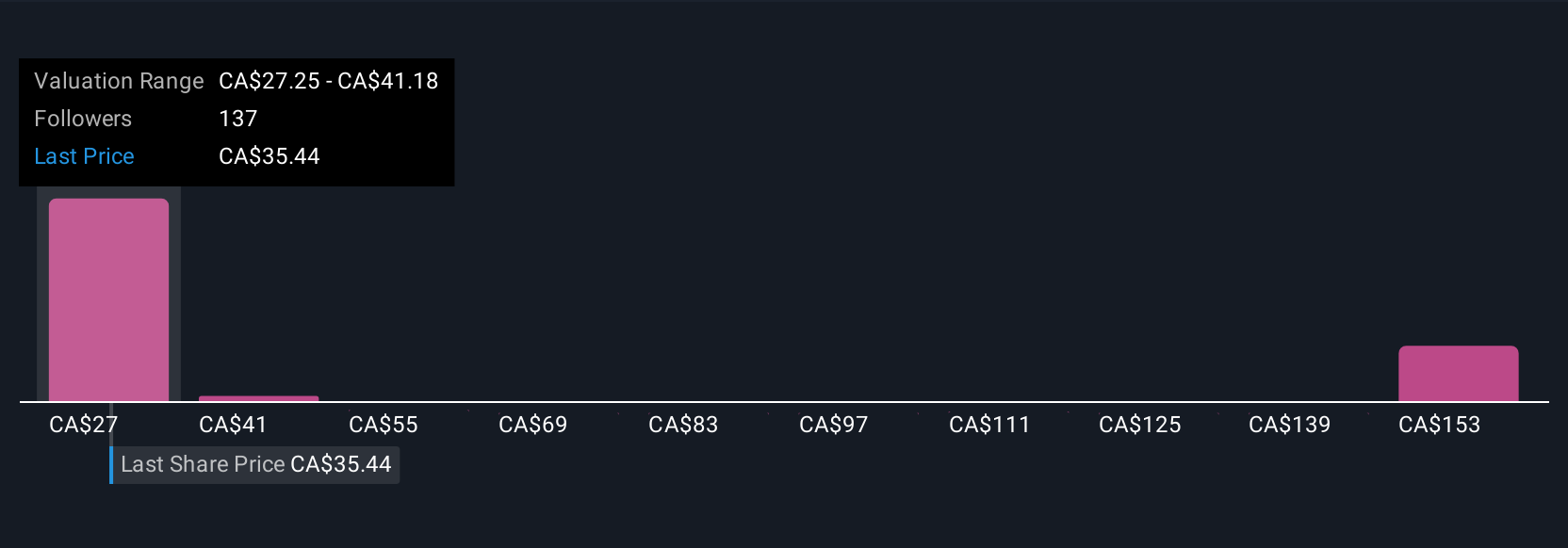

Simply Wall St Community members provided 12 fair value estimates for BCE, ranging widely from CA$27.77 to CA$86.32. While some see substantial upside, regulatory changes curbing fiber expansion may limit the company’s ability to drive margin growth, so explore these diverse perspectives before making decisions.

Explore 12 other fair value estimates on BCE - why the stock might be worth 15% less than the current price!

Build Your Own BCE Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your BCE research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free BCE research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate BCE's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BCE might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BCE

BCE

A communications company, provides wireless, wireline, internet, streaming services, and television (TV) services to residential, business, and wholesale customers in Canada.

Undervalued with slight risk.

Similar Companies

Market Insights

Community Narratives