- Canada

- /

- Communications

- /

- TSXV:TTZ

Most Shareholders Will Probably Find That The Compensation For Total Telcom Inc.'s (CVE:TTZ) CEO Is Reasonable

Performance at Total Telcom Inc. (CVE:TTZ) has been rather uninspiring recently and shareholders may be wondering how CEO Neil Magrath plans to fix this. They will get a chance to exercise their voting power to influence the future direction of the company in the next AGM on 30 June 2021. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. In our opinion, CEO compensation does not look excessive and we discuss why.

View our latest analysis for Total Telcom

How Does Total Compensation For Neil Magrath Compare With Other Companies In The Industry?

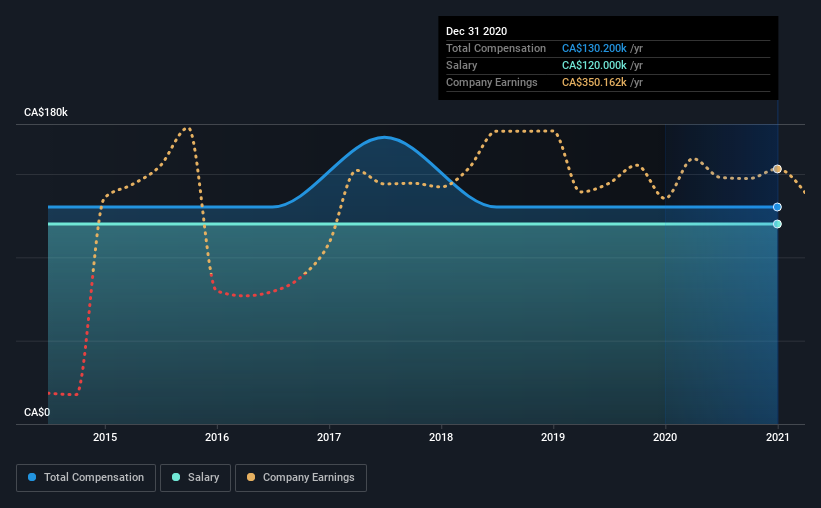

Our data indicates that Total Telcom Inc. has a market capitalization of CA$4.3m, and total annual CEO compensation was reported as CA$130k for the year to December 2020. This was the same as last year. We note that the salary portion, which stands at CA$120.0k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the industry with market capitalizations below CA$248m, reported a median total CEO compensation of CA$196k. In other words, Total Telcom pays its CEO lower than the industry median. Furthermore, Neil Magrath directly owns CA$388k worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | CA$120k | CA$120k | 92% |

| Other | CA$10k | CA$10k | 8% |

| Total Compensation | CA$130k | CA$130k | 100% |

On an industry level, roughly 56% of total compensation represents salary and 44% is other remuneration. According to our research, Total Telcom has allocated a higher percentage of pay to salary in comparison to the wider industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Total Telcom Inc.'s Growth

Total Telcom Inc. has reduced its earnings per share by 8.5% a year over the last three years. In the last year, its revenue is up 12%.

Overall this is not a very positive result for shareholders. And while it's good to see some good revenue growth recently, the growth isn't really fast enough for us to put aside my concerns around EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Total Telcom Inc. Been A Good Investment?

With a total shareholder return of 13% over three years, Total Telcom Inc. shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about the stock keeping up its current momentum. These are are some concerns that shareholders may want to address the board when they revisit their investment thesis.

CEO pay is simply one of the many factors that need to be considered while examining business performance. We identified 4 warning signs for Total Telcom (2 don't sit too well with us!) that you should be aware of before investing here.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Total Telcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSXV:TTZ

Total Telcom

Through its subsidiary, ROM Communications Inc., develops and provides remote asset monitoring and tracking products and services in the United States and Canada.

Flawless balance sheet with acceptable track record.

Market Insights

Community Narratives