- Canada

- /

- Communications

- /

- TSXV:CMI

It Might Not Be A Great Idea To Buy C-Com Satellite Systems Inc. (CVE:CMI) For Its Next Dividend

It looks like C-Com Satellite Systems Inc. (CVE:CMI) is about to go ex-dividend in the next three days. The ex-dividend date is one business day before the record date, which is the cut-off date for shareholders to be present on the company's books to be eligible for a dividend payment. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. In other words, investors can purchase C-Com Satellite Systems' shares before the 29th of July in order to be eligible for the dividend, which will be paid on the 13th of August.

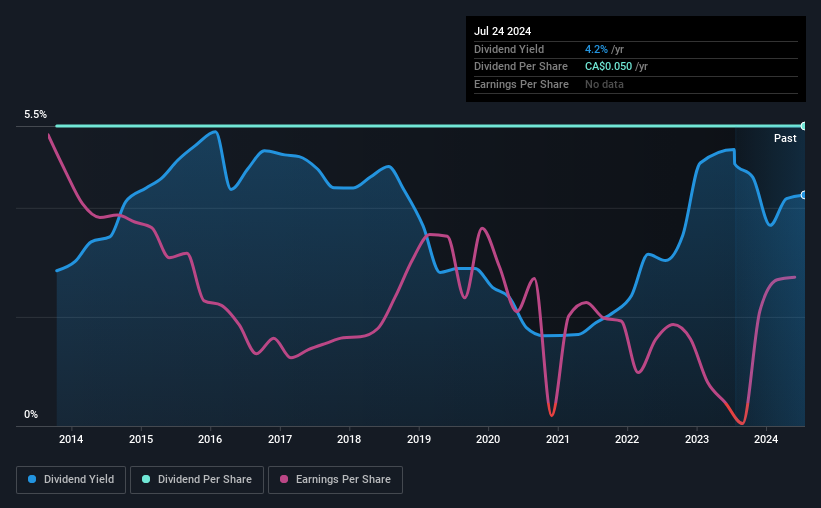

The company's next dividend payment will be CA$0.0125 per share, on the back of last year when the company paid a total of CA$0.05 to shareholders. Calculating the last year's worth of payments shows that C-Com Satellite Systems has a trailing yield of 4.2% on the current share price of CA$1.18. If you buy this business for its dividend, you should have an idea of whether C-Com Satellite Systems's dividend is reliable and sustainable. As a result, readers should always check whether C-Com Satellite Systems has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for C-Com Satellite Systems

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Last year C-Com Satellite Systems paid out 92% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings. A useful secondary check can be to evaluate whether C-Com Satellite Systems generated enough free cash flow to afford its dividend. Over the past year it paid out 127% of its free cash flow as dividends, which is uncomfortably high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

C-Com Satellite Systems does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

As C-Com Satellite Systems's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

Click here to see how much of its profit C-Com Satellite Systems paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. That's why it's not ideal to see C-Com Satellite Systems's earnings per share have been shrinking at 2.7% a year over the previous five years.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. It looks like the C-Com Satellite Systems dividends are largely the same as they were 10 years ago. If a company's dividend stays flat while earnings are in decline, this is typically a sign that it is paying out a larger percentage of its earnings. This can become unsustainable if earnings fall far enough.

The Bottom Line

From a dividend perspective, should investors buy or avoid C-Com Satellite Systems? It's looking like an unattractive opportunity, with its earnings per share declining, while, paying out an uncomfortably high percentage of both its profits (92%) and cash flow as dividends. This is a starkly negative combination that often suggests a dividend cut could be in the company's near future. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

So if you're still interested in C-Com Satellite Systems despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Be aware that C-Com Satellite Systems is showing 3 warning signs in our investment analysis, and 2 of those can't be ignored...

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CMI

C-Com Satellite Systems

Develops and deploys commercial grade mobile auto-deploying satellite-based technology for the delivery of two-way high-speed Internet, VoIP, and video services into vehicles in Canada, Europe, the United States, Asia, the Kingdom of Saudi Arabia, Kazakhstan, and internationally.

Flawless balance sheet with proven track record.