HIVE Digital Technologies (TSXV:HIVE) Is Down 13.2% After Announcing Paraguay’s Largest Renewable Data Center Expansion – What's Changed

Reviewed by Sasha Jovanovic

- HIVE Digital Technologies recently announced an agreement to develop a 100 MW hydroelectric-powered data center in Paraguay, increasing its renewable capacity in the country to 400 MW and making it the largest facility of its kind there.

- This expansion supports HIVE's target to achieve 35 EH/s global Bitcoin mining capacity by 2026 and a fivefold boost in high-performance computing and AI operations through its partnership with Bell Canada.

- We'll explore what this acceleration of renewable-powered infrastructure could mean for HIVE's investment narrative and future positioning.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is HIVE Digital Technologies' Investment Narrative?

To be a shareholder in HIVE Digital Technologies, you need to believe in the long-term potential of renewable-powered digital infrastructure and the company's ability to scale both Bitcoin mining and AI operations globally. The recent announcement of expanding Paraguayan operations with an additional 100 MW hydroelectric-powered data center is significant, as it directly supports HIVE’s ambitious targets for hashrate and high-performance computing growth. In the short term, this could reinforce catalysts like faster capacity ramps, broader revenue streams, and continued cost advantages from low-cost renewable energy, especially as mining economics remain volatile. However, risks are evolving: while growth appetite is high, the pace of scaling, capital allocation, and the operational complexity tied to large multi-region expansions may become more prominent watchpoints compared to past quarters. The news may shift market focus to execution risks just as much as the technology or market conditions themselves. Yet, with share price strength seen earlier and robust recent earnings, the company’s narrative seems to be moving to a higher-stakes phase.

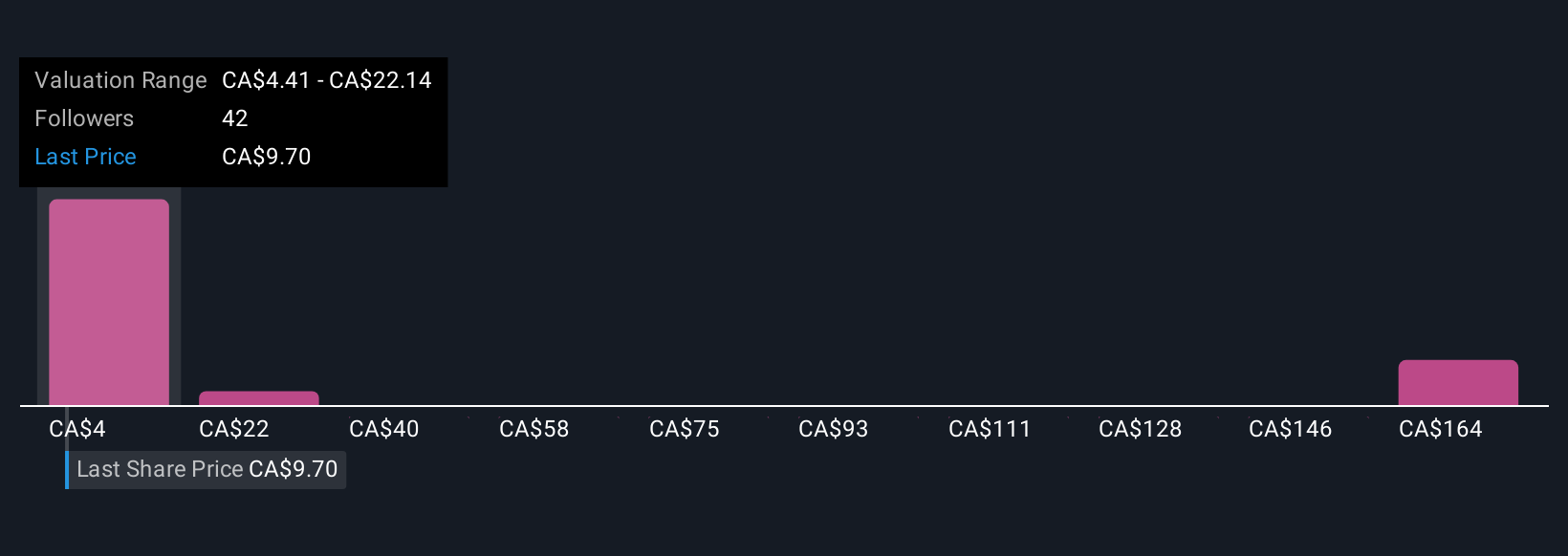

But on the flip side, scaling quickly can introduce its own risks that investors should watch closely. Our comprehensive valuation report raises the possibility that HIVE Digital Technologies is priced lower than what may be justified by its financials.Exploring Other Perspectives

Explore 12 other fair value estimates on HIVE Digital Technologies - why the stock might be worth over 4x more than the current price!

Build Your Own HIVE Digital Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your HIVE Digital Technologies research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free HIVE Digital Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate HIVE Digital Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HIVE Digital Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:HIVE

HIVE Digital Technologies

A technology company, engages in the building and operating data centers powered by green energy in Bermuda.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives