- Canada

- /

- Specialty Stores

- /

- TSX:PET

Can Pet Valu (TSX:PET) Balance Dividend Stability With Intensifying Retail Pet Sector Competition?

Reviewed by Sasha Jovanovic

- Earlier this week, Pet Valu Holdings Ltd. reported third-quarter results showing revenue of C$289.46 million and net income of C$24.86 million, while also lowering its full-year sales guidance to between C$1.175 billion and C$1.185 billion due to softer discretionary spending and heavier competition.

- Amid these results, Pet Valu reaffirmed its quarterly dividend payment, underlining its continued focus on shareholder returns despite short-term headwinds in the retail pet sector.

- We'll now examine how Pet Valu's reduced sales guidance, reflecting consumer caution, impacts its overall investment narrative and outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Pet Valu Holdings Investment Narrative Recap

To be a shareholder in Pet Valu Holdings today, you need confidence that Canada’s pet retail space can sustain steady sales and profit growth through premiumization, loyal customer engagement, and network expansion, even as headwinds like consumer caution and increasing competition weigh on near-term results. This quarter’s trimmed sales guidance is a setback for momentum, but the core catalyst of growing store and digital presence remains intact while the most immediate risk now centers on discretionary spending softness.

The reaffirmed quarterly dividend of C$0.12 per share stands out, signaling management’s commitment to reliable shareholder returns despite current volatility, a move that may comfort investors keeping an eye on near-term cash flow and capital allocation as guidance moderates.

In contrast, investors should be aware that high regional concentration in Canada leaves Pet Valu especially sensitive if...

Read the full narrative on Pet Valu Holdings (it's free!)

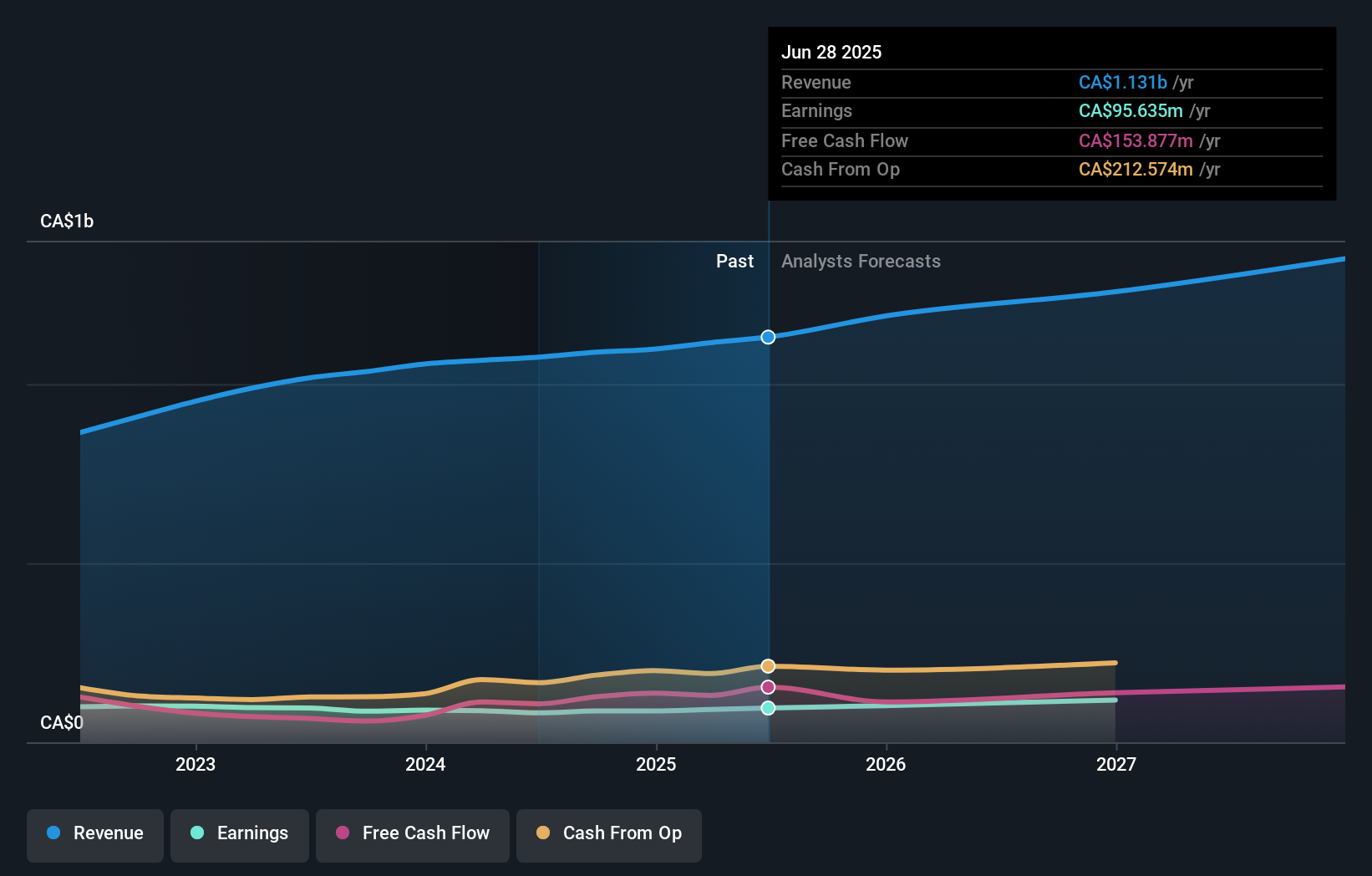

Pet Valu Holdings is projected to reach CA$1.4 billion in revenue and CA$143.1 million in earnings by 2028. Achieving these targets implies a 7.2% annual revenue growth rate and a CA$47.5 million increase in earnings from the current CA$95.6 million.

Uncover how Pet Valu Holdings' forecasts yield a CA$41.45 fair value, a 49% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Pet Valu’s fair value between C$41.45 and C$42.74, with 2 unique perspectives represented. While many see the stock as undervalued, exposure to shifts in Canadian consumer spending could affect earnings and future expectations, explore how these viewpoints differ before forming your own conclusion.

Explore 2 other fair value estimates on Pet Valu Holdings - why the stock might be worth as much as 53% more than the current price!

Build Your Own Pet Valu Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Pet Valu Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Pet Valu Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Pet Valu Holdings' overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PET

Pet Valu Holdings

Engages in the retail and wholesale of pet foods and pet-related supplies for dogs, cats, fish, birds, reptiles, and small animals in Canada.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives