- Canada

- /

- Specialty Stores

- /

- TSX:ATZ

Aritzia (TSX:ATZ): Evaluating Valuation After Joining the S&P TSX Composite Index

Reviewed by Simply Wall St

Aritzia (TSX:ATZ) has officially joined the S&P TSX Composite Index, a milestone that underscores its growing presence and operational maturity in the Canadian retail space. Inclusion in the index can draw heightened attention from institutional investors.

See our latest analysis for Aritzia.

Aritzia’s momentum is unmistakable, with a 76% year-to-date share price return and a staggering 109% total shareholder return over the past 12 months. Following its index inclusion and recent operational upgrades, confidence in the retailer’s long-term trajectory continues to grow.

Curious what other fast-moving companies fit this growth and momentum profile? Broaden your search and discover fast growing stocks with high insider ownership

But with Aritzia’s stock already up over 75% this year, the real question now is whether the current price offers room for further gains or if the market has already accounted for its growth story.

Most Popular Narrative: 6% Undervalued

With Aritzia closing at CA$94.75, the most widely followed narrative places fair value at CA$100.91 based on strong forward projections and upbeat profit expectations. This narrative sets the tone for bullish sentiment, spotlighting the company’s powerful growth drivers.

The expansion of digital initiatives is considered to be in its early stages and offers significant long-term growth potential. Upward revisions to the company’s target price are tied to its resilience and ability to deliver on key growth and profitability metrics.

Want to discover why analysts see room for more upside? The narrative is propelled by aggressive assumptions for Aritzia’s margins, growth pace, and future earnings power. The key elements that justify this premium valuation could surprise you, especially what’s powering analyst forecasts. Dive deeper to see if the optimism stacks up.

Result: Fair Value of $100.91 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain. Supply chain hiccups or underperforming new stores could quickly challenge today’s upbeat analyst outlook and valuation.

Find out about the key risks to this Aritzia narrative.

Another View: Pricing the Momentum

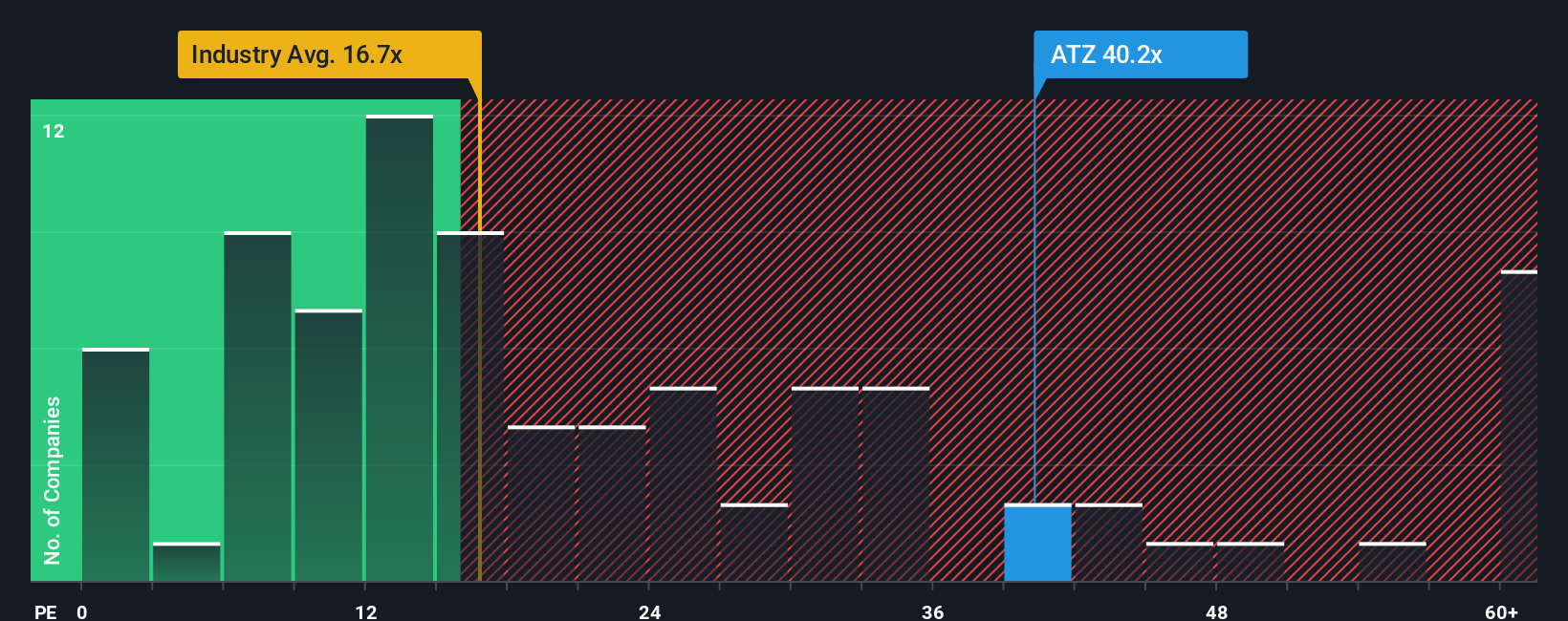

Looking at Aritzia’s valuation through price-to-earnings multiples presents a very different story from the optimistic price targets. The company trades at 38.7x earnings, which is significantly higher than both its North American industry peers at 18.5x and its fair ratio of 34.8x. This indicates there is little margin for error if growth expectations decline. Should investors be cautious of paying such a premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aritzia Narrative

If you see things differently or want to put your own spin on the story, you can build a personal narrative using the data in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Aritzia.

Looking for more investment ideas?

Smart investors never limit themselves to just one story. Take action today and give yourself the edge by uncovering fresh opportunities for long-term growth, innovation, or reliable income with these powerful research tools from Simply Wall Street:

- Spot undervalued gems right now by pinpointing companies trading well below their intrinsic value using these 883 undervalued stocks based on cash flows.

- Boost your portfolio's income potential by finding reliable payouts among these 16 dividend stocks with yields > 3% offering yields above 3% with strong fundamentals.

- Catalyze your next move in the AI revolution with these 25 AI penny stocks, surfacing top contenders at the intersection of artificial intelligence and rapid market growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATZ

Aritzia

Designs, develops, and sells apparels and accessories for women in the United States and Canada.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives