Stock Analysis

Investors can approximate the average market return by buying an index fund. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Canadian Net Real Estate Investment Trust (CVE:NET.UN) shareholders over the last year, as the share price declined 39%. That falls noticeably short of the market decline of around 3.2%. However, the longer term returns haven't been so bad, with the stock down 7.6% in the last three years. Shareholders have had an even rougher run lately, with the share price down 27% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

After losing 13% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

Check out our latest analysis for Canadian Net Real Estate Investment Trust

SWOT Analysis for Canadian Net Real Estate Investment Trust

- Dividends are covered by earnings and cash flows.

- Dividend is in the top 25% of dividend payers in the market.

- Interest payments on debt are not well covered.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Trading below our estimate of fair value by more than 20%.

- Significant insider buying over the past 3 months.

- Debt is not well covered by operating cash flow.

- Not expected to become profitable over the next 3 years.

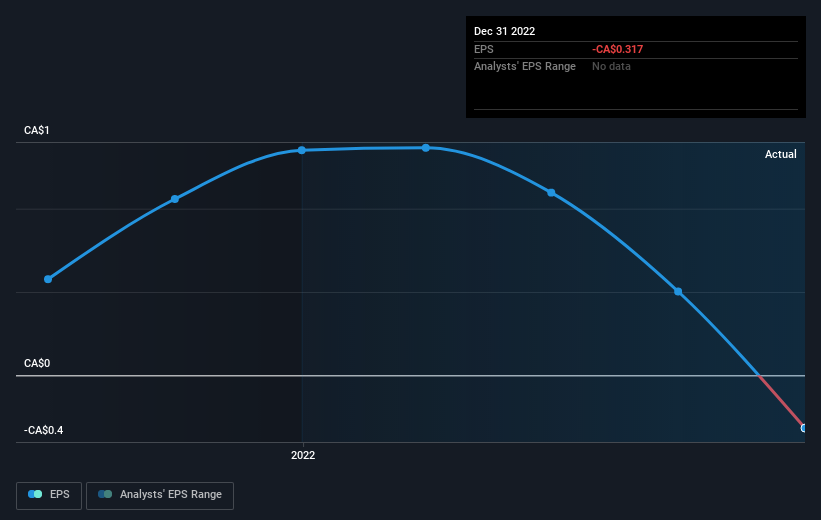

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Canadian Net Real Estate Investment Trust fell to a loss making position during the year. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. We hope for shareholders' sake that the company becomes profitable again soon.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Canadian Net Real Estate Investment Trust the TSR over the last 1 year was -35%, which is better than the share price return mentioned above. This is largely a result of its dividend payments!

A Different Perspective

While the broader market lost about 3.2% in the twelve months, Canadian Net Real Estate Investment Trust shareholders did even worse, losing 35% (even including dividends). However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 0.3% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Canadian Net Real Estate Investment Trust better, we need to consider many other factors. Even so, be aware that Canadian Net Real Estate Investment Trust is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Canadian Net Real Estate Investment Trust is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSXV:NET.UN

Canadian Net Real Estate Investment Trust

Canadian Net Real Estate Investment Trust is an open-ended trust that acquires and owns high quality triple net and management-free commercial real estate properties.

6 star dividend payer and good value.