- Canada

- /

- Industrial REITs

- /

- TSX:DIR.UN

What Dream Industrial REIT (TSX:DIR.UN)'s Strong Quarterly Results Reveal About Its Earnings Trajectory

Reviewed by Sasha Jovanovic

- Dream Industrial Real Estate Investment Trust recently reported its third-quarter and nine-month results, posting sales of CA$126.62 million and quarterly net income of CA$45.82 million, both higher than the previous year for the same period.

- While quarterly net income saw considerable growth year-over-year, total net income for the nine months declined slightly, reflecting shifts in earnings dynamics across the reporting periods.

- We'll examine how the strong quarterly sales and earnings growth may influence Dream Industrial REIT's outlook and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Dream Industrial Real Estate Investment Trust Investment Narrative Recap

To be a shareholder in Dream Industrial Real Estate Investment Trust, you need to believe in the long-term demand for industrial and logistics properties, underpinned by robust leasing trends and ongoing e-commerce growth in North America and Europe. The latest strong quarterly earnings suggest that fundamentals for short-term revenue and net operating income growth remain intact, but the most pressing risk, rising construction and development costs outpacing rental growth in key urban markets, has not been materially shifted by this update.

Among the recent disclosures, the withdrawal of the CA$250 million follow-on equity offering in September stands out. This decision, closely following ongoing acquisitions and capital investments, means Dream Industrial REIT may need to rely more on internal cash flows and debt for expansion, which could impact its ability to capitalize on short-term catalysts linked to portfolio growth and modernization. Despite continued earnings growth, investors should be aware that persistent upward pressure on construction costs could...

Read the full narrative on Dream Industrial Real Estate Investment Trust (it's free!)

Dream Industrial Real Estate Investment Trust's narrative projects CA$611.3 million revenue and CA$350.3 million earnings by 2028. This requires 5.9% yearly revenue growth and a CA$132.7 million earnings increase from CA$217.6 million.

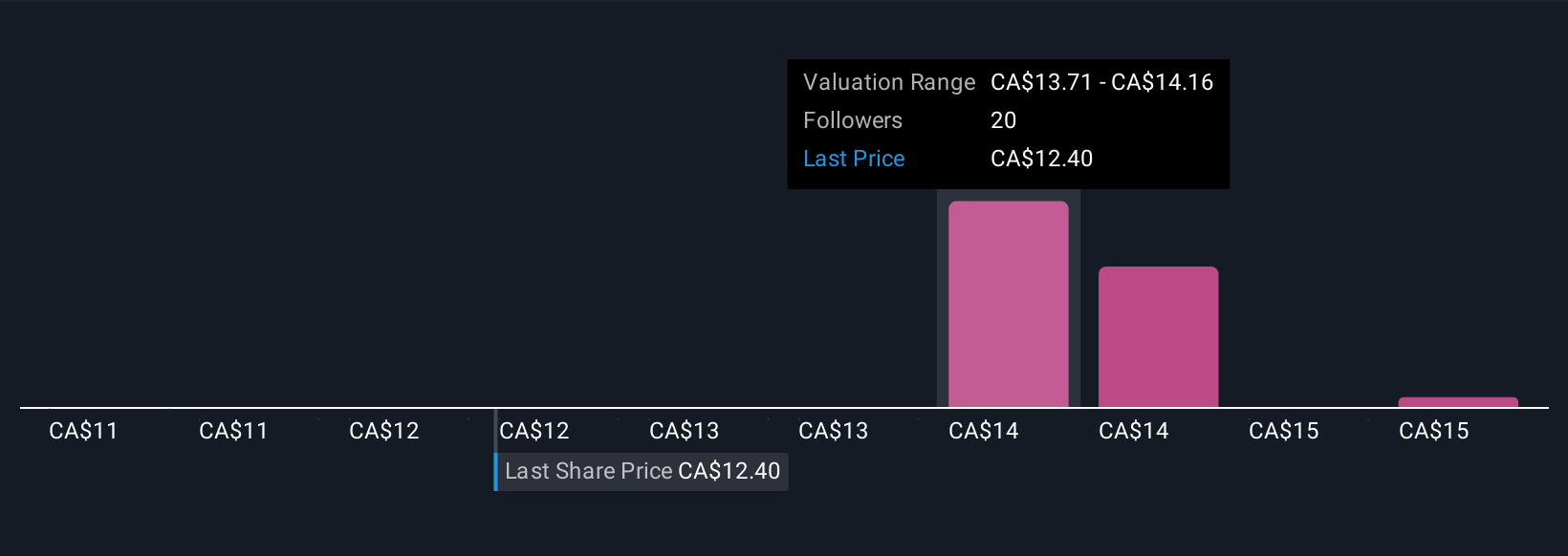

Uncover how Dream Industrial Real Estate Investment Trust's forecasts yield a CA$14.02 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community fair value estimates for Dream Industrial REIT range from CA$11 to CA$15.51, based on five independent analyses. These diverging views reflect how shifting supply and construction costs can shape broader market performance expectations.

Explore 5 other fair value estimates on Dream Industrial Real Estate Investment Trust - why the stock might be worth as much as 25% more than the current price!

Build Your Own Dream Industrial Real Estate Investment Trust Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dream Industrial Real Estate Investment Trust research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Dream Industrial Real Estate Investment Trust research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dream Industrial Real Estate Investment Trust's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DIR.UN

Dream Industrial Real Estate Investment Trust

Dream Industrial REIT is an owner, manager and operator of a global portfolio of well-located, diversified industrial properties.

Good value with proven track record and pays a dividend.

Market Insights

Community Narratives