- Canada

- /

- Office REITs

- /

- TSX:AP.UN

Are Allied Properties Real Estate Investment Trust's (TSE:AP.UN) Mixed Financials Driving The Negative Sentiment?

It is hard to get excited after looking at Allied Properties Real Estate Investment Trust's (TSE:AP.UN) recent performance, when its stock has declined 8.7% over the past three months. We, however decided to study the company's financials to determine if they have got anything to do with the price decline. Long-term fundamentals are usually what drive market outcomes, so it's worth paying close attention. In this article, we decided to focus on Allied Properties Real Estate Investment Trust's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

See our latest analysis for Allied Properties Real Estate Investment Trust

How Is ROE Calculated?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Allied Properties Real Estate Investment Trust is:

5.3% = CA$329m ÷ CA$6.2b (Based on the trailing twelve months to June 2021).

The 'return' refers to a company's earnings over the last year. That means that for every CA$1 worth of shareholders' equity, the company generated CA$0.05 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Allied Properties Real Estate Investment Trust's Earnings Growth And 5.3% ROE

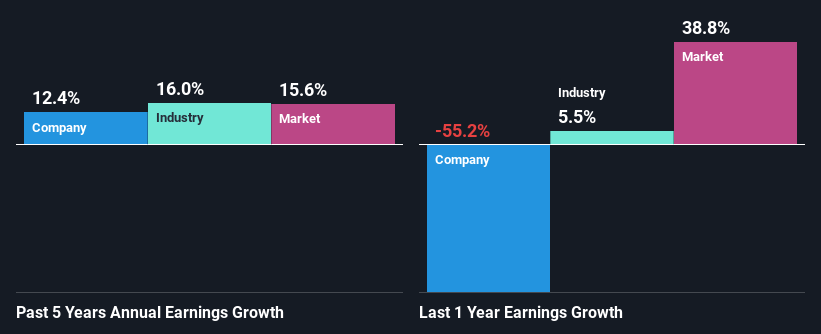

When you first look at it, Allied Properties Real Estate Investment Trust's ROE doesn't look that attractive. We then compared the company's ROE to the broader industry and were disappointed to see that the ROE is lower than the industry average of 10.0%. However, the moderate 12% net income growth seen by Allied Properties Real Estate Investment Trust over the past five years is definitely a positive. So, the growth in the company's earnings could probably have been caused by other variables. For instance, the company has a low payout ratio or is being managed efficiently.

We then compared Allied Properties Real Estate Investment Trust's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 16% in the same period, which is a bit concerning.

The basis for attaching value to a company is, to a great extent, tied to its earnings growth. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. Has the market priced in the future outlook for AP.UN? You can find out in our latest intrinsic value infographic research report.

Is Allied Properties Real Estate Investment Trust Making Efficient Use Of Its Profits?

Allied Properties Real Estate Investment Trust seems to be paying out most of its income as dividends judging by its three-year median payout ratio of 72%, meaning the company retains only 28% of its income. However, this is typical for REITs as they are often required by law to distribute most of their earnings. Despite this, the company's earnings grew moderately as we saw above.

Besides, Allied Properties Real Estate Investment Trust has been paying dividends for at least ten years or more. This shows that the company is committed to sharing profits with its shareholders. Based on the latest analysts' estimates, we found that the company's future payout ratio over the next three years is expected to hold steady at 68%.

Conclusion

In total, we're a bit ambivalent about Allied Properties Real Estate Investment Trust's performance. While the company has posted a decent earnings growth, We do feel that the earnings growth number could have been even higher, had the company been reinvesting more of its earnings at a higher rate of return. That being so, according to the latest industry analyst forecasts, the company's earnings are expected to shrink in the future. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:AP.UN

Allied Properties Real Estate Investment Trust

Allied is a leading owner-operator of distinctive urban workspace in Canada’s major cities.

Established dividend payer with reasonable growth potential.

Market Insights

Community Narratives