- Canada

- /

- Real Estate

- /

- TSX:AIF

Altus Group (TSX:AIF) Valuation in Focus After Revenue Guidance Cut and CEO Departure

Reviewed by Simply Wall St

Altus Group (TSX:AIF) shares are in focus after the company lowered its full-year revenue growth outlook to a range of 0% to 2%, and announced a series of executive leadership changes, including a CEO departure.

See our latest analysis for Altus Group.

Altus Group’s lowered growth outlook and sudden leadership shakeup have triggered a sharp negative reaction from investors, with the stock sliding 12.0% in the last day and posting a year-to-date share price return of -15.1%. Momentum has clearly faded this year, and the 1-year total shareholder return is now -17.6% following a string of operational updates and shifting guidance.

If recent events have you rethinking your portfolio, it’s a good time to broaden your view and discover fast growing stocks with high insider ownership

With shares now trading at a steep discount to analyst targets and an uncertain outlook ahead, investors are left to ask: is this weakness a rare buying opportunity, or has the market already priced in all future risks and rewards?

Most Popular Narrative: 26.6% Undervalued

Altus Group’s narrative consensus fair value lands well above the latest close, setting up a striking valuation disconnect as investors digest the company’s shifting outlook and turbulence at the top.

Accelerating client migration from ARGUS Enterprise to ARGUS Intelligence, coupled with successful adoption of new pricing models and double-digit growth in ARGUS recurring revenue, positions the company to benefit from continued demand for advanced real estate analytics. This supports sustained revenue and net margin expansion as secular industry digitization continues.

What’s really fueling this bold valuation call? The narrative hints at a transformative shift: surging recurring revenue, changing product mix, and high-stakes bets on modern analytics. Want to know which projections are turning heads this year? Dive in for the full breakdown.

Result: Fair Value of $64.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing pressure on commercial real estate, along with slower uptake of new products, could undermine Altus Group’s ambitious growth projections and margin targets.

Find out about the key risks to this Altus Group narrative.

Another View: Multiples Raise Red Flags

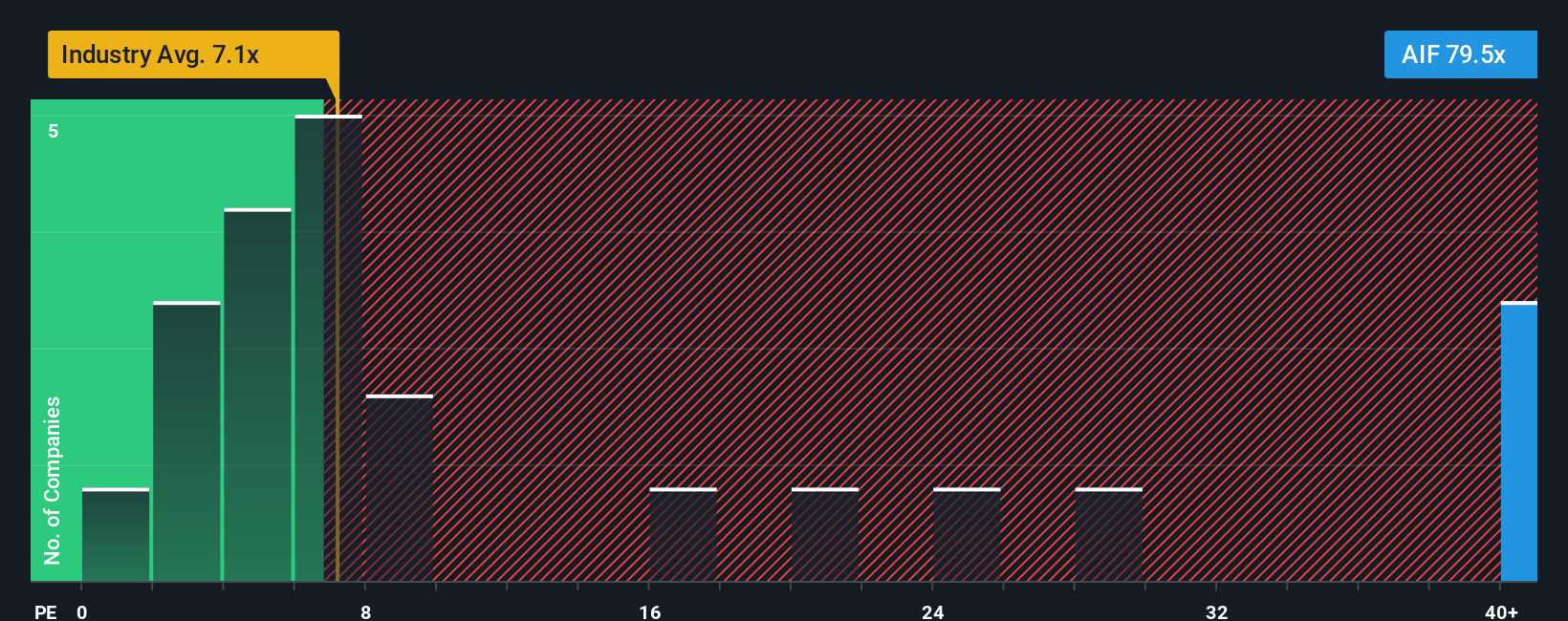

While the consensus fair value implies the stock is undervalued, a look at Altus Group’s price-to-earnings ratio reveals a different story. At 77.6 times earnings, shares trade far above both the Canadian real estate industry average (7.1x) and even peer averages (36.7x). This flags a high valuation risk if future growth falls short. Is the market’s optimism justified, or could there be trouble ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Altus Group Narrative

If you’ve got a different take on the numbers or want to dig deeper into the trends, you can craft a personalized narrative in just minutes and see how your perspective stacks up. Do it your way

A great starting point for your Altus Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart moves don’t stop with one stock. Uncover new opportunities and potential market winners with expert-curated stock screens designed to match your strategy.

- Boost your passive income by targeting strong yields with these 16 dividend stocks with yields > 3% offering robust payouts above 3% and stable financials.

- Get ahead of the AI curve by selecting these 25 AI penny stocks, tapping into the surge of artificial intelligence innovation powering tomorrow’s leaders.

- Capitalize on undervalued gems by scanning these 872 undervalued stocks based on cash flows to seize stocks trading below their fair value, before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AIF

Altus Group

Provides asset and funds intelligence solutions for commercial real estate (CRE) in Canada, the United States, the United Kingdom, France, Europe, the Middle East, Africa, Australia, and the Asia Pacific.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives