- Canada

- /

- Real Estate

- /

- TSX:AIF

Altus Group (TSX:AIF) Is Down 11.2% After Lowered Outlook and CEO Shift—What’s Next?

Reviewed by Sasha Jovanovic

- Altus Group Limited recently reported its third quarter 2025 earnings, introduced lower full-year revenue guidance, and announced a leadership transition with the departure of CEO Jim Hannon and reappointment of Mike Gordon as CEO in early 2026.

- These developments highlight a period of both operational change and business recalibration as the company manages evolving market conditions and prepares for a new phase of executive oversight.

- We’ll now explore how the lowered annual revenue outlook may influence the company’s long-term investment narrative and growth expectations.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Altus Group Investment Narrative Recap

To be a shareholder in Altus Group Limited, you need to believe in the company's ability to capitalize on the digital transformation of real estate analytics as clients migrate to cloud-based platforms and recurring software revenue streams. The recent reduction in revenue guidance reflects a cautious market environment and introduces greater short-term uncertainty, but it does not fundamentally change the main catalyst, continued adoption of Altus’ core analytics offerings, or the primary risk of unpredictable transaction activity in commercial real estate.

Among recent announcements, the revision of full-year revenue guidance to 0–2% growth stands out. This adjustment directly relates to ongoing macroeconomic headwinds and hints at a more prolonged period of subdued client spending and delayed deals, which could affect the predictability of recurring revenue and reinforce the need for steady growth in new product adoption and platform migration.

However, investors should be aware that, despite operational efforts and efficiency initiatives, the risk posed by slower client migration to upgraded platforms remains ...

Read the full narrative on Altus Group (it's free!)

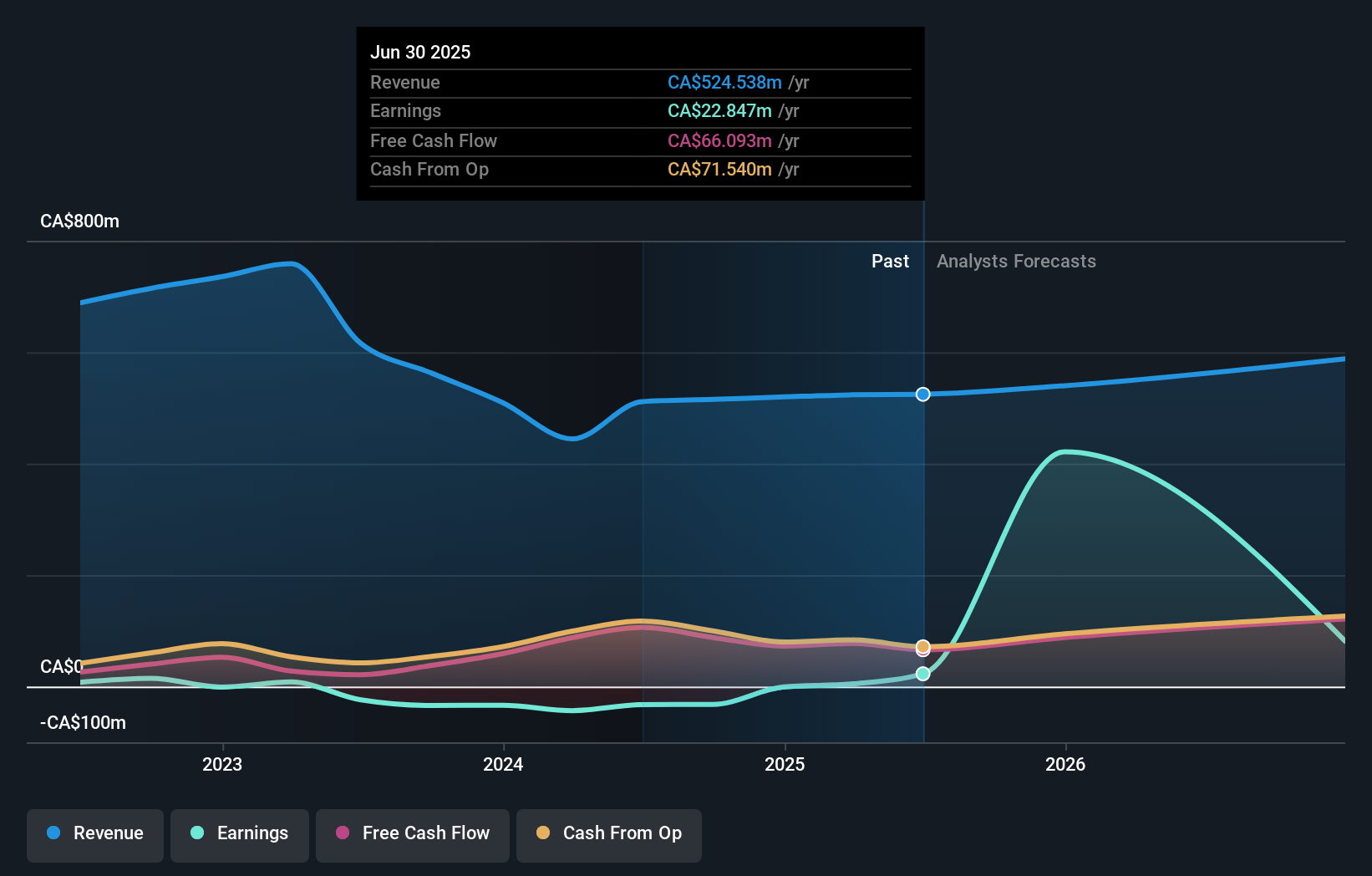

Altus Group's narrative projects CA$655.8 million revenue and CA$212.3 million earnings by 2028. This requires 7.7% yearly revenue growth and an increase of CA$189.5 million in earnings from the current level of CA$22.8 million.

Uncover how Altus Group's forecasts yield a CA$58.53 fair value, a 17% upside to its current price.

Exploring Other Perspectives

The Simply Wall St Community offered two individual fair value estimates for Altus Group Limited, spanning from CA$58.53 to CA$66.88 per share. Many recognize that uncertainty around recurring software bookings and revenue growth remains a key concern for the company's long-term outlook, so it’s worth considering several viewpoints beyond consensus.

Explore 2 other fair value estimates on Altus Group - why the stock might be worth as much as 33% more than the current price!

Build Your Own Altus Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Altus Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Altus Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Altus Group's overall financial health at a glance.

Looking For Alternative Opportunities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AIF

Altus Group

Provides asset and funds intelligence solutions for commercial real estate (CRE) in Canada, the United States, the United Kingdom, France, Europe, the Middle East, Africa, Australia, and the Asia Pacific.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives