- Canada

- /

- Commercial Services

- /

- TSXV:BRM

PharmaTher Holdings And 2 Other Penny Stocks Making Waves On The TSX

Reviewed by Simply Wall St

The Canadian market is experiencing a mix of optimism and caution, with recent job growth surprising to the upside and AI-related enthusiasm driving both innovation and volatility. Amid this backdrop, penny stocks—typically smaller or newer companies—remain an intriguing investment area despite being considered somewhat outdated. When these stocks are supported by strong financial health, they can offer unique opportunities for growth at lower price points.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.20 | CA$55.62M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.50 | CA$21.61M | ✅ 2 ⚠️ 2 View Analysis > |

| Zoomd Technologies (TSXV:ZOMD) | CA$2.19 | CA$220.64M | ✅ 4 ⚠️ 1 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.42 | CA$3.51M | ✅ 2 ⚠️ 4 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.10 | CA$731.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Automotive Finco (TSXV:AFCC.H) | CA$1.08 | CA$21.4M | ✅ 2 ⚠️ 3 View Analysis > |

| Rio2 (TSX:RIO) | CA$2.17 | CA$928.32M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.81 | CA$142.62M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$2.13 | CA$201.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.73 | CA$9.08M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 417 stocks from our TSX Penny Stocks screener.

We'll examine a selection from our screener results.

PharmaTher Holdings (CNSX:PHRM)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: PharmaTher Holdings Ltd. is a specialty pharmaceutical company focused on developing and commercializing innovative delivery methods to improve patient outcomes, with a market cap of CA$11.83 million.

Operations: PharmaTher Holdings Ltd. has not reported any revenue segments.

Market Cap: CA$11.83M

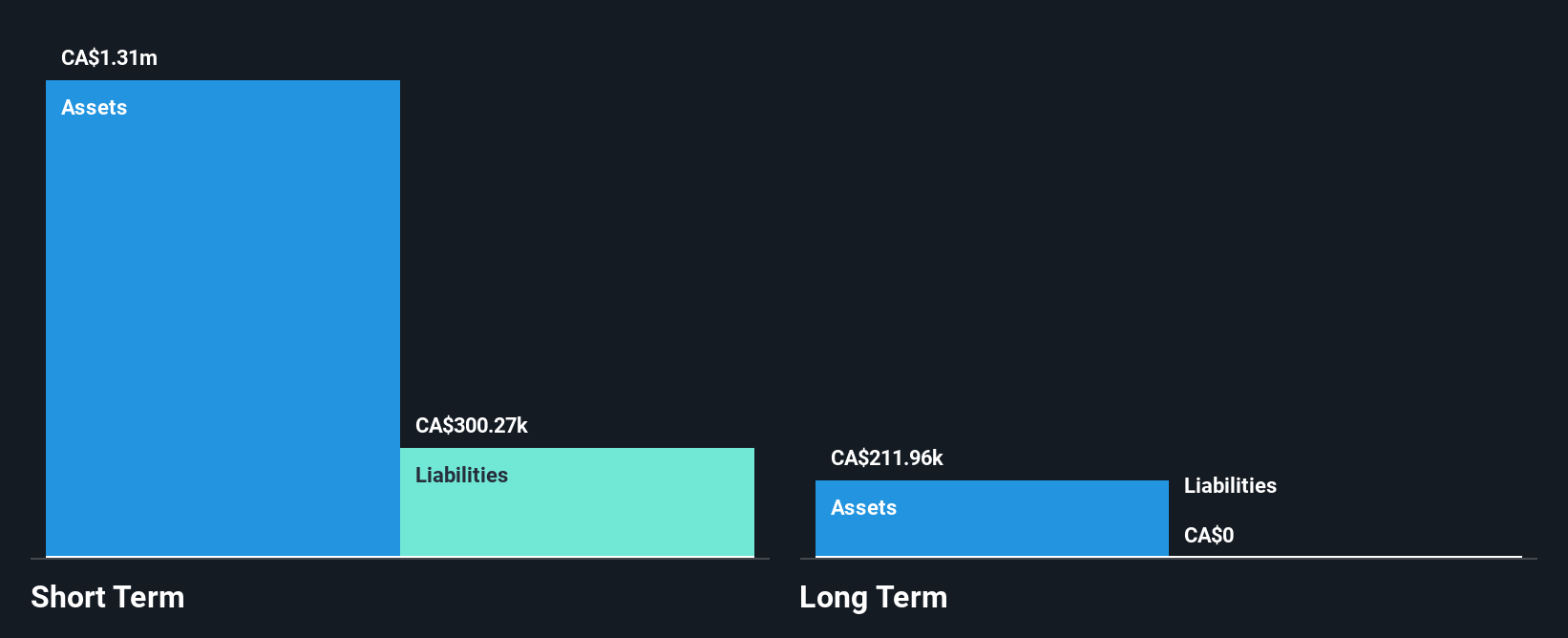

PharmaTher Holdings Ltd., with a market cap of CA$11.83 million, remains pre-revenue and faces challenges typical of penny stocks, such as high volatility and limited cash runway. However, recent developments position the company strategically within the ketamine market. The FDA's recognition of ketamine as a national priority for anesthesia could boost demand for PharmaTher's offerings, particularly following its strategic sale of a generic ketamine asset to reduce capital requirements while retaining rights to novel applications. Ongoing initiatives in Parkinson’s disease and other indications through the 505(b)(2) pathway could unlock significant growth opportunities if successful partnerships materialize.

- Take a closer look at PharmaTher Holdings' potential here in our financial health report.

- Review our historical performance report to gain insights into PharmaTher Holdings' track record.

BioRem (TSXV:BRM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BioRem Inc. is a clean technology engineering company that designs, manufactures, distributes, and sells air pollution control systems to eliminate odors, volatile organic compounds, and hazardous air pollutants, with a market cap of CA$34.72 million.

Operations: The company generates CA$38.36 million in revenue from the manufacturing and sale of pollution control systems.

Market Cap: CA$34.72M

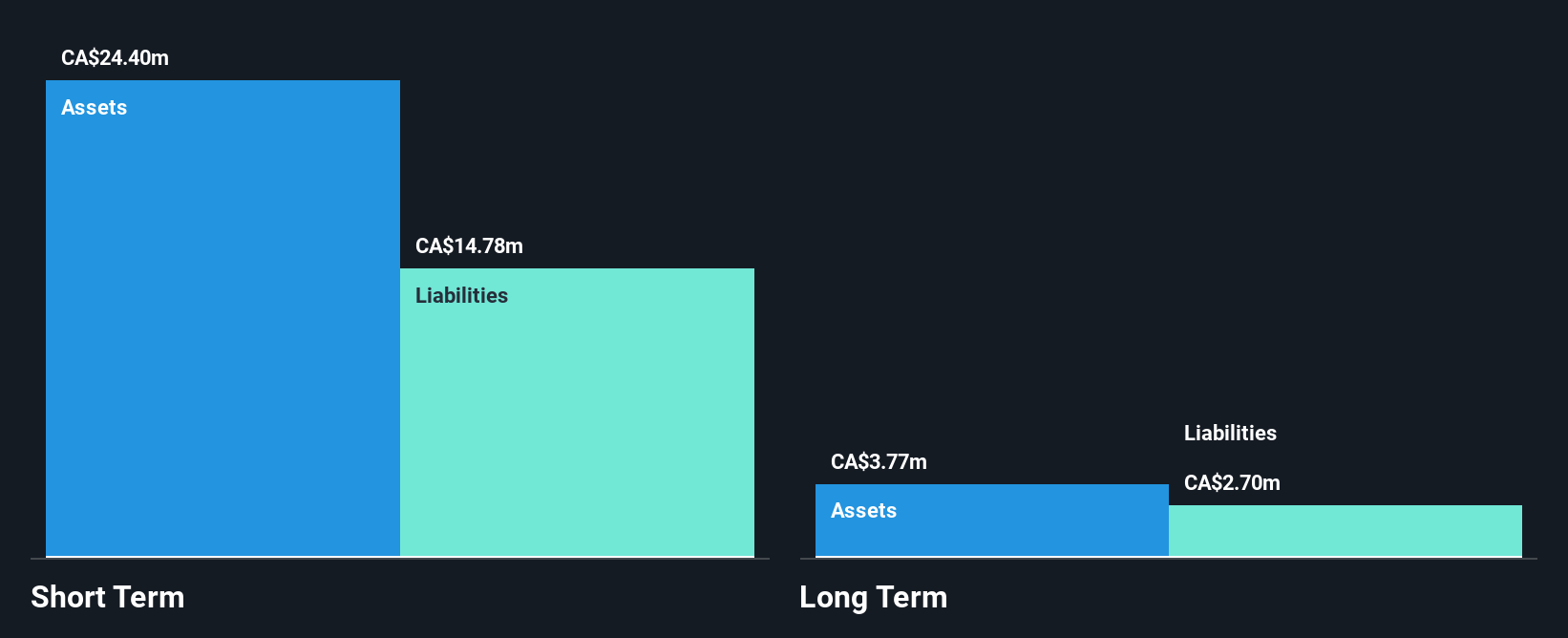

BioRem Inc., with a market cap of CA$34.72 million, demonstrates characteristics appealing to penny stock investors. The company has consistently grown profits over the past five years, supported by high-quality earnings and strong cash flow that comfortably covers its debt obligations. Its management and board are seasoned with extensive tenure, contributing to stable governance. Despite recent negative earnings growth and declining profit margins, BioRem's short-term assets exceed liabilities, providing financial stability. Trading significantly below estimated fair value suggests potential for price appreciation if operational improvements continue alongside forecasted revenue growth of 8.22% annually.

- Click to explore a detailed breakdown of our findings in BioRem's financial health report.

- Explore BioRem's analyst forecasts in our growth report.

NEXE Innovations (TSXV:NEXE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NEXE Innovations Inc. manufactures and sells plant-based single-serve coffee pods for use in single-serve coffee machines in Canada, with a market cap of CA$16.54 million.

Operations: The company's revenue is primarily derived from its Industrial Automation & Controls segment, totaling CA$0.42 million.

Market Cap: CA$16.54M

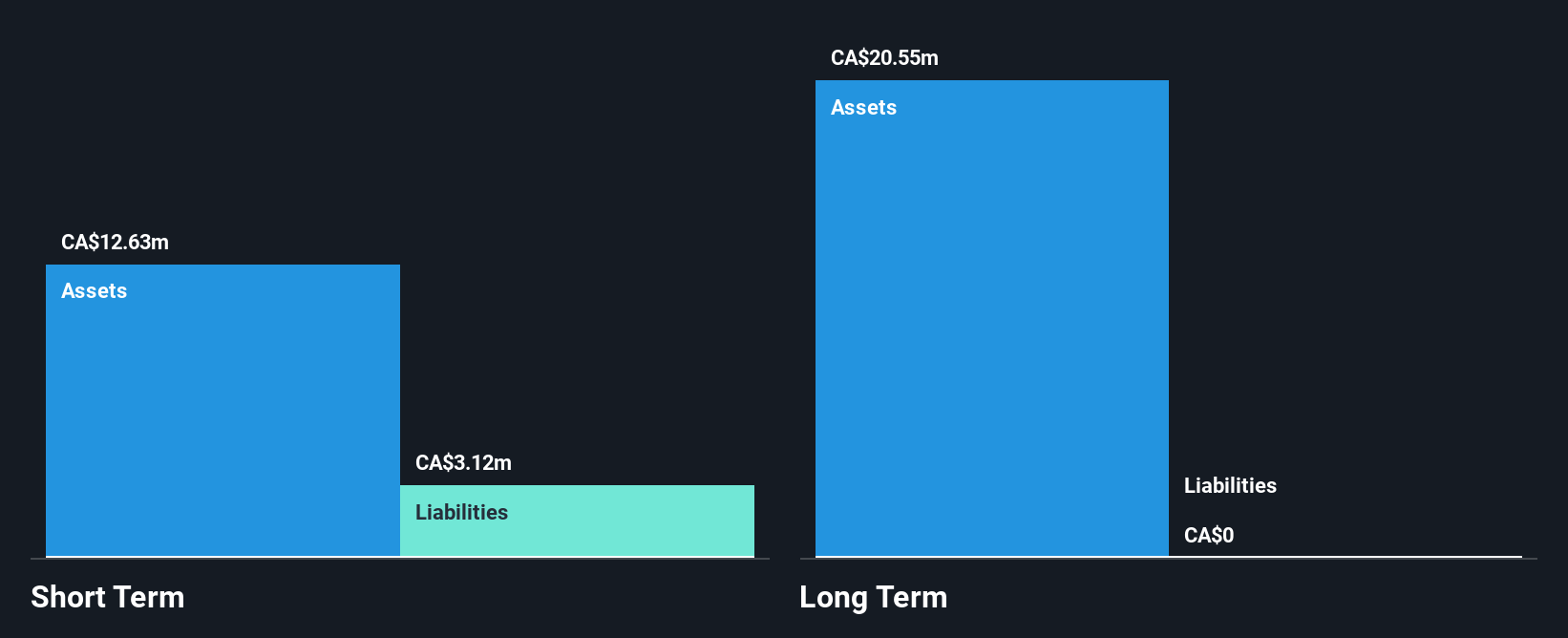

NEXE Innovations, with a market cap of CA$16.54 million, is pre-revenue but shows potential in the penny stock arena through its innovative plant-based coffee pods. The company recently secured significant orders from Bridgehead Coffee for a Costco launch and expanded its North American reach with new partnerships and product SKUs. Despite being unprofitable, NEXE has reduced losses over five years and maintains a strong cash position exceeding liabilities. Its experienced management and board contribute to strategic stability, while its proprietary compostable pod technology positions it as an emerging player in sustainable packaging solutions.

- Jump into the full analysis health report here for a deeper understanding of NEXE Innovations.

- Gain insights into NEXE Innovations' historical outcomes by reviewing our past performance report.

Taking Advantage

- Click through to start exploring the rest of the 414 TSX Penny Stocks now.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BioRem might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:BRM

BioRem

A clean technology engineering company, designs, manufactures, distributes, and sells air pollution control systems that are used to eliminate odors, volatile organic compounds, and hazardous air pollutants.

Excellent balance sheet and good value.

Market Insights

Community Narratives