Did Green Thumb Industries' (CNSX:GTII) Strike Resolution and Minnesota Launch Just Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Green Thumb Industries Inc. recently reported third quarter 2025 financial results, showing revenue growth to US$291.37 million and net income of US$23.29 million, while also resolving a historic 45-day labor strike with a new collective bargaining agreement at its Rise subsidiary.

- This period featured the launch of adult-use cannabis sales at all eight Minnesota dispensaries, authorization of a new US$50 million share repurchase program, and initiatives supporting broader THC product access outside dispensaries.

- We will examine how the revenue uptick and Minnesota market entry impact Green Thumb Industries' long-term investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Green Thumb Industries Investment Narrative Recap

To own Green Thumb Industries stock, investors need confidence in the company’s ability to grow through new adult-use markets while managing industry headwinds like oversupply and fluctuating regulations. While the recent resolution of the Rise subsidiary’s historic labor strike ensures operational stability, it does not fundamentally change the sector’s most important short-term catalyst: legalized market expansion, or the biggest risk, sustained price compression and margin pressure from increased competition.

Among recent company moves, the launch of adult-use cannabis sales at Minnesota RISE dispensaries stands out. This expansion directly relates to the key catalyst of new market entry, as increased consumer access could support top-line results and help offset competitive pressure observed in existing markets.

By contrast, investors should be aware of persistent risks such as margin pressure from systemic price compression, especially as Green Thumb continues to...

Read the full narrative on Green Thumb Industries (it's free!)

Green Thumb Industries is projected to reach $1.3 billion in revenue and $141.9 million in earnings by 2028. This outlook assumes 4.2% annual revenue growth and an increase in earnings of $112.9 million from current earnings of $29.0 million.

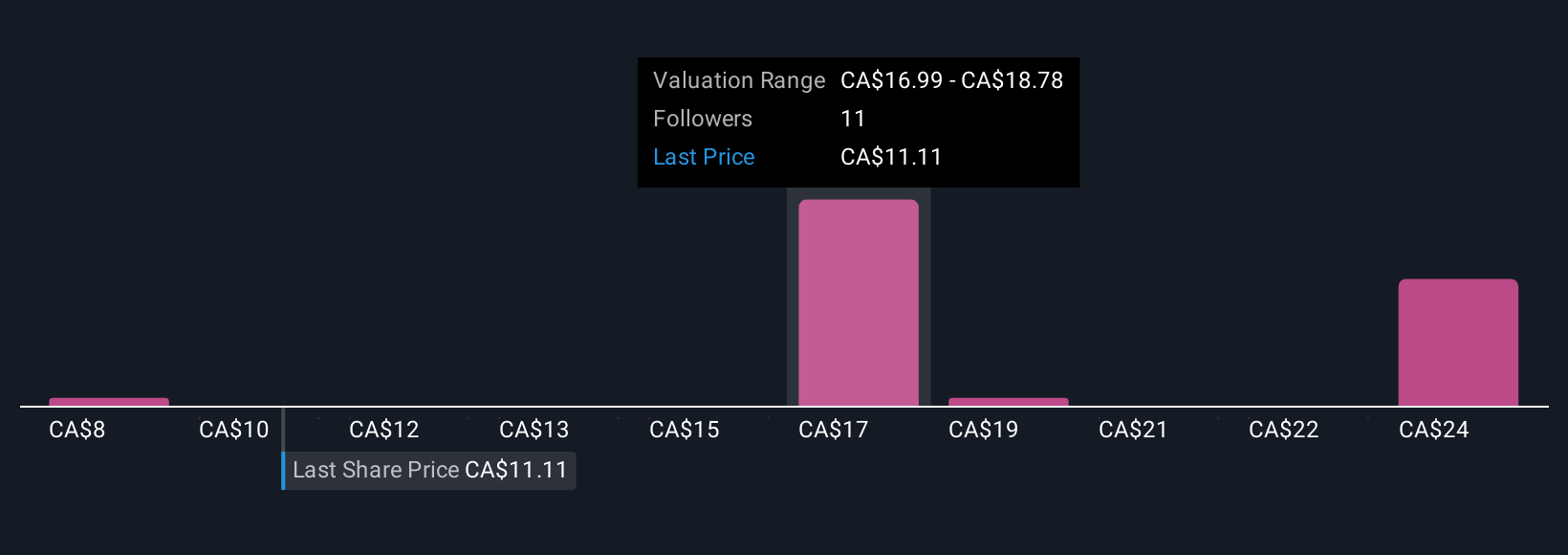

Uncover how Green Thumb Industries' forecasts yield a CA$17.00 fair value, a 73% upside to its current price.

Exploring Other Perspectives

Five private investors from the Simply Wall St Community placed Green Thumb’s fair value between US$8.05 and US$21.13. While opinions vary, recent expansion in Minnesota remains a focal point for growth potential and ongoing margin risks; consider exploring these diverse viewpoints before making up your mind.

Explore 5 other fair value estimates on Green Thumb Industries - why the stock might be worth 18% less than the current price!

Build Your Own Green Thumb Industries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Green Thumb Industries research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Green Thumb Industries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Green Thumb Industries' overall financial health at a glance.

Searching For A Fresh Perspective?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CNSX:GTII

Green Thumb Industries

Manufactures, distributes, markets, and sells of cannabis products for medical and adult-use in the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives