Here's Why We're Wary Of Buying Shaw Communications' (TSE:SJR.B) For Its Upcoming Dividend

It looks like Shaw Communications Inc. (TSE:SJR.B) is about to go ex-dividend in the next four days. If you purchase the stock on or after the 12th of March, you won't be eligible to receive this dividend, when it is paid on the 30th of March.

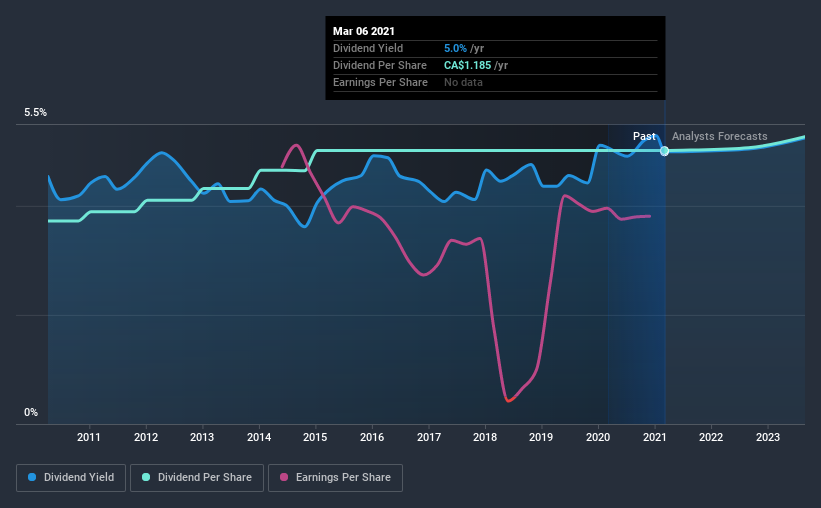

Shaw Communications's next dividend payment will be CA$0.099 per share, on the back of last year when the company paid a total of CA$1.19 to shareholders. Calculating the last year's worth of payments shows that Shaw Communications has a trailing yield of 5.0% on the current share price of CA$23.75. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to investigate whether Shaw Communications can afford its dividend, and if the dividend could grow.

View our latest analysis for Shaw Communications

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. It paid out 90% of its earnings as dividends last year, which is not unreasonable, but limits reinvestment in the business and leaves the dividend vulnerable to a business downturn. We'd be concerned if earnings began to decline. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 78% of its free cash flow as dividends, which is within usual limits but will limit the company's ability to lift the dividend if there's no growth.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. With that in mind, we're not enthused to see that Shaw Communications's earnings per share have remained effectively flat over the past five years. Better than seeing them fall off a cliff, for sure, but the best dividend stocks grow their earnings meaningfully over the long run.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Shaw Communications has delivered an average of 3.0% per year annual increase in its dividend, based on the past 10 years of dividend payments.

Final Takeaway

Should investors buy Shaw Communications for the upcoming dividend? Shaw Communications has been unable to generate earnings growth, but at least its dividend looks sustainable, with its profit and cashflow payout ratios within reasonable limits. Bottom line: Shaw Communications has some unfortunate characteristics that we think could lead to sub-optimal outcomes for dividend investors.

With that in mind though, if the poor dividend characteristics of Shaw Communications don't faze you, it's worth being mindful of the risks involved with this business. For example, we've found 1 warning sign for Shaw Communications that we recommend you consider before investing in the business.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

If you’re looking to trade Shaw Communications, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:SJR.B

Shaw Communications

Shaw Communications Inc. operates as a connectivity company in North America.

Established dividend payer with questionable track record.