Exploring Three High Growth Tech Stocks In Canada For Potential Portfolio Strength

Reviewed by Simply Wall St

Amidst easing inflation and better-than-expected economic data, Canadian markets have shown a strong rebound, with the TSX up over 5%, signaling a return of positive sentiment. In this environment, identifying high-growth tech stocks can be crucial for strengthening portfolios, particularly as central banks potentially continue their rate-cutting cycles.

Top 10 High Growth Tech Companies In Canada

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Docebo | 14.74% | 34.09% | ★★★★★☆ |

| Bitfarms | 72.43% | 173.10% | ★★★★★☆ |

| Constellation Software | 16.13% | 23.55% | ★★★★★☆ |

| HIVE Digital Technologies | 51.21% | 109.14% | ★★★★★☆ |

| GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

| Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

| Cineplex | 8.05% | 179.27% | ★★★★☆☆ |

| Sabio Holdings | 12.86% | 117.06% | ★★★★☆☆ |

| BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

| Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 24 stocks from our TSX High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Cineplex (TSX:CGX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Cineplex Inc., along with its subsidiaries, operates as an entertainment and media company in Canada and internationally, with a market cap of CA$671.23 million.

Operations: Cineplex generates revenue through three primary segments: Media (CA$120.16 million), Location-Based Entertainment (CA$132.08 million), and Film Entertainment and Content (CA$1.05 billion). The company's diverse operations span across various entertainment and media services both domestically in Canada and internationally.

Cineplex's recent earnings report reveals a challenging period, with Q2 sales at CAD 164.16 million and a net loss of CAD 21.44 million, compared to net income of CAD 176.55 million the previous year. Despite these setbacks, the company is forecasted to grow its revenue by 8.1% annually and expects earnings to increase by an impressive 179.3% per year over the next three years. The company has initiated a share repurchase program for up to 6,318,346 shares, indicating confidence in future prospects despite current losses.

- Navigate through the intricacies of Cineplex with our comprehensive health report here.

Examine Cineplex's past performance report to understand how it has performed in the past.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., together with its subsidiaries, acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally with a market cap of CA$89.61 billion.

Operations: Constellation Software generates revenue primarily from its software and programming segment, amounting to CA$9.27 billion. The company focuses on acquiring, building, and managing vertical market software businesses across multiple regions globally.

Constellation Software's revenue surged to $2.47 billion in Q2 2024, up from $2.04 billion a year earlier, with net income climbing to $177 million from $103 million. Their R&D expenses have consistently driven innovation across their diverse software portfolio, contributing significantly to their robust earnings growth of 33.5% over the past year and forecasted annual profit growth of 23.6%. The recent launch of Omegro consolidates multiple business units serving over 15,000 customers globally, positioning Constellation for sustained long-term growth in the software industry.

Kinaxis (TSX:KXS)

Simply Wall St Growth Rating: ★★★★☆☆

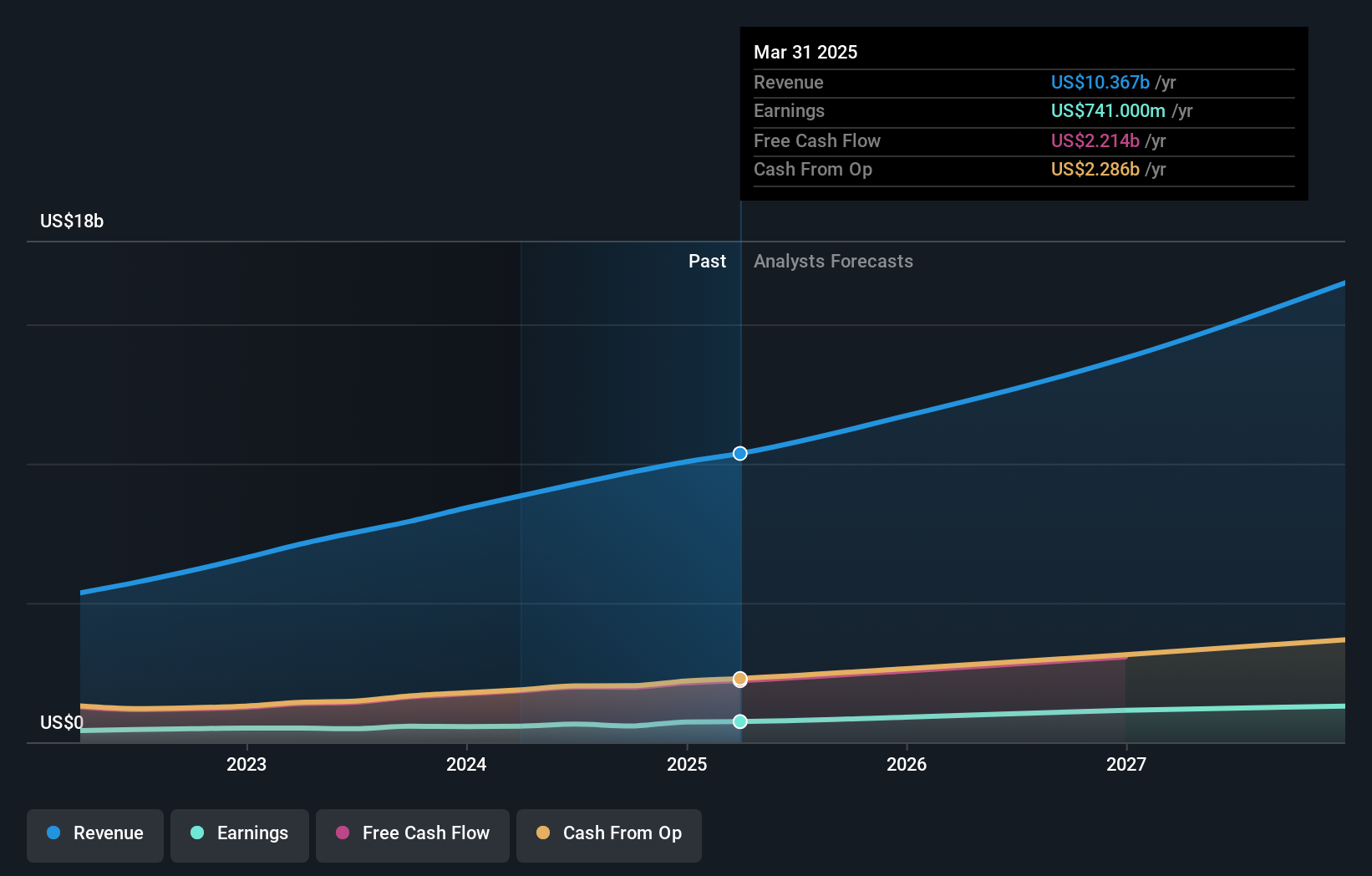

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$4.38 billion.

Operations: Kinaxis Inc. generates revenue primarily from its cloud-based subscription software, reporting $457.72 million from the Software & Programming segment. The company operates across multiple regions including the United States, Europe, Asia, and Canada.

Kinaxis, a leader in AI-powered supply chain solutions, reported Q2 2024 sales of $118.28 million, up from $105.77 million last year, with net income reaching $3.43 million compared to a loss of $2.54 million previously. The company's earnings are forecasted to grow at an impressive 48% annually over the next three years, outpacing the Canadian market's expected growth of 14.9%. With R&D expenses accounting for a significant portion of their budget—driving innovations like the Maestro platform—Kinaxis continues to enhance its competitive edge in supply chain orchestration.

- Dive into the specifics of Kinaxis here with our thorough health report.

Evaluate Kinaxis' historical performance by accessing our past performance report.

Next Steps

- Explore the 24 names from our TSX High Growth Tech and AI Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinaxis might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:KXS

Kinaxis

Provides cloud-based subscription software for supply chain operations in the United States, Europe, Asia, and Canada.

Flawless balance sheet and good value.