- Canada

- /

- Metals and Mining

- /

- TSXV:TUO

Fresh Factory B.C Among 3 Noteworthy Penny Stocks On TSX

Reviewed by Simply Wall St

The Canadian market is navigating a period of monetary adjustments, with the Bank of Canada having reduced interest rates to support economic growth amid a softening labour market and rising inflation. In such times, penny stocks—though an outdated term—remain relevant as they often represent smaller or younger companies that can offer unique investment opportunities. This article will explore three noteworthy penny stocks on the TSX that stand out for their financial strength and potential for long-term success in today's evolving economic landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$2.40 | CA$61.45M | ✅ 3 ⚠️ 4 View Analysis > |

| Canso Select Opportunities (TSXV:CSOC.A) | CA$4.80 | CA$18.67M | ✅ 2 ⚠️ 2 View Analysis > |

| Montero Mining and Exploration (TSXV:MON) | CA$0.27 | CA$2.09M | ✅ 2 ⚠️ 4 View Analysis > |

| CEMATRIX (TSX:CEMX) | CA$0.31 | CA$47.31M | ✅ 2 ⚠️ 1 View Analysis > |

| Fintech Select (TSXV:FTEC) | CA$0.035 | CA$2.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$1.00 | CA$678.6M | ✅ 3 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$2.26 | CA$373.04M | ✅ 2 ⚠️ 2 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$4.01 | CA$198.45M | ✅ 2 ⚠️ 1 View Analysis > |

| Hemisphere Energy (TSXV:HME) | CA$1.96 | CA$188.43M | ✅ 3 ⚠️ 1 View Analysis > |

| Matachewan Consolidated Mines (TSXV:MCM.A) | CA$0.32 | CA$3.86M | ✅ 2 ⚠️ 4 View Analysis > |

Click here to see the full list of 422 stocks from our TSX Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Fresh Factory B.C (TSXV:FRSH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Fresh Factory B.C. Ltd. formulates, develops, manufactures, distributes, and sells fresh and plant-based food and beverage products in the United States with a market cap of CA$49.88 million.

Operations: The company's revenue is primarily generated from its food processing segment, which amounts to $38.79 million.

Market Cap: CA$49.88M

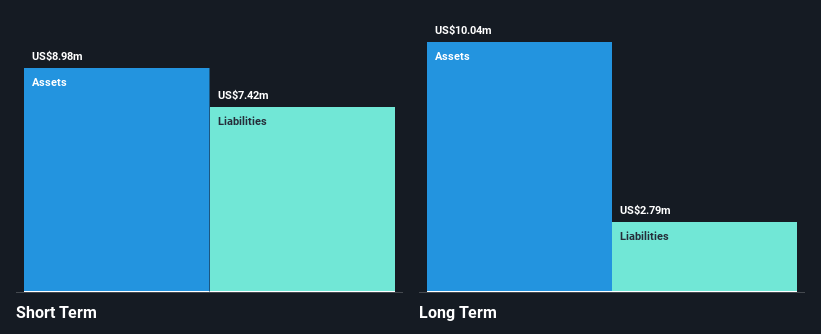

Fresh Factory B.C. Ltd. has shown promising revenue growth, with second-quarter sales reaching US$11.03 million, up from US$7.38 million the previous year, and a net income of US$0.18 million compared to a loss previously. Despite being unprofitable with a negative return on equity of -6.16%, it maintains a strong financial position with short-term assets exceeding liabilities and no debt burden. The company benefits from an experienced board and has not diluted shareholders recently, while its cash runway exceeds three years due to positive free cash flow growth, suggesting resilience in the penny stock landscape despite management's relative inexperience.

- Dive into the specifics of Fresh Factory B.C here with our thorough balance sheet health report.

- Learn about Fresh Factory B.C's historical performance here.

RenoWorks Software (TSXV:RW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RenoWorks Software Inc. develops and distributes digital visualization software for the renovation and new home construction sectors in the United States, Canada, and internationally, with a market cap of CA$21.58 million.

Operations: The company's revenue is derived from its Software & Programming segment, totaling CA$7.64 million.

Market Cap: CA$21.58M

RenoWorks Software Inc. has demonstrated financial resilience by achieving profitability, with recent earnings showing net income of CA$0.0928 million for the first half of 2025, reversing a previous loss. The company's strong return on equity of 225.9% and debt-free status highlight its robust financial health within the penny stock sector. Recent product innovations, including Renoworks LeadPOD and AI Design Assistant, aim to enhance customer engagement and streamline operations across its platform. With seasoned leadership boasting an average board tenure of 22.6 years, RenoWorks is well-positioned to leverage these advancements for future growth opportunities.

- Click here and access our complete financial health analysis report to understand the dynamics of RenoWorks Software.

- Gain insights into RenoWorks Software's historical outcomes by reviewing our past performance report.

Teuton Resources (TSXV:TUO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Teuton Resources Corp. is an exploration stage company focused on acquiring, exploring, and dealing mineral properties in Canada, with a market cap of CA$60.51 million.

Operations: Teuton Resources Corp. does not have any reported revenue segments, as it is an exploration stage company focused on mineral properties in Canada.

Market Cap: CA$60.51M

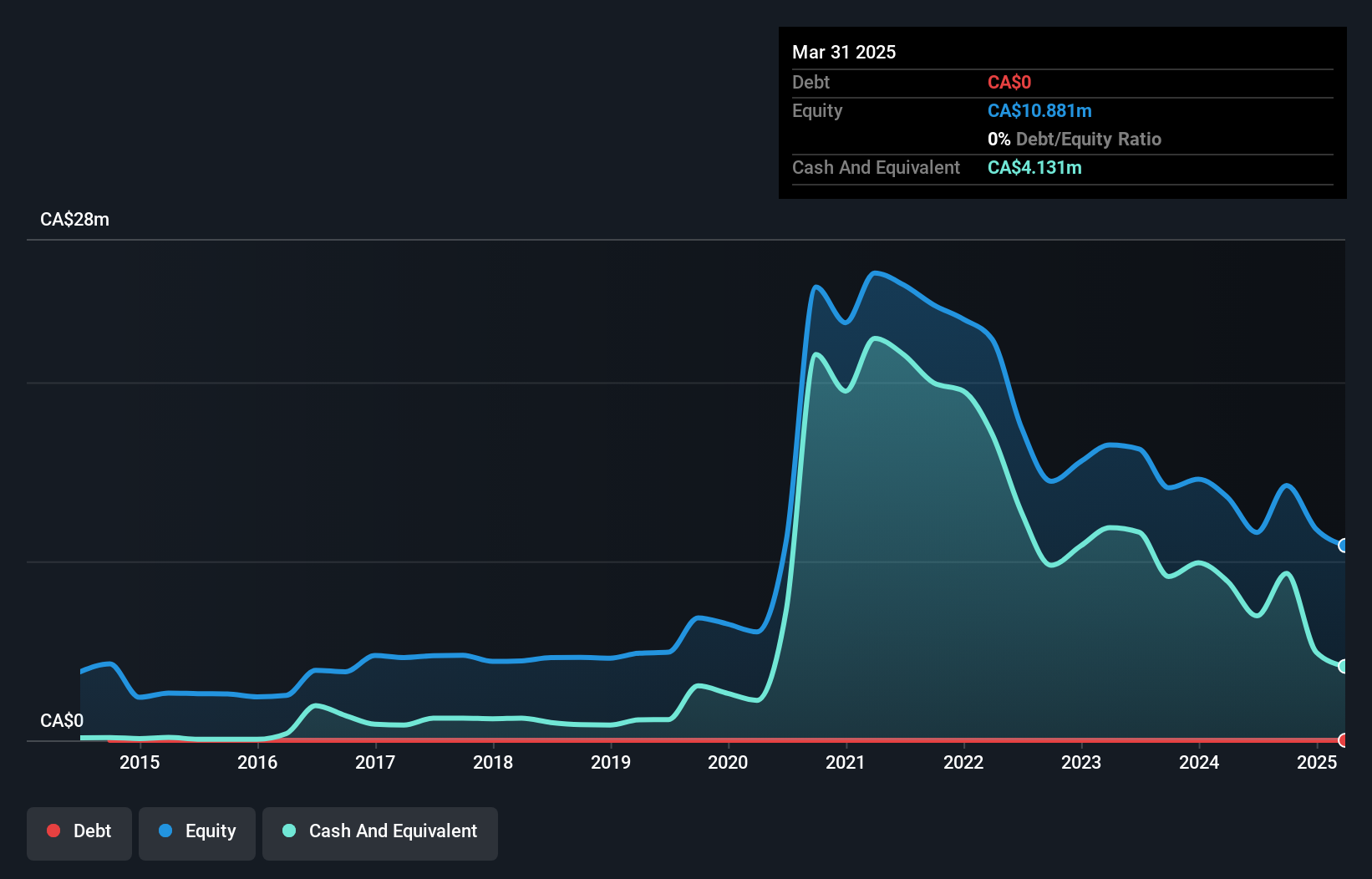

Teuton Resources Corp., a pre-revenue exploration stage company, maintains financial stability with a cash runway exceeding three years and no long-term liabilities. The company recently raised CA$1.6 million through private placements, involving insider participation, which underscores investor confidence despite its current unprofitability and negative return on equity of -25.47%. Teuton's strategic interest in the Treaty Creek Project offers potential upside; the ongoing 2025 drill program aims to expand high-grade gold zones in partnership with Tudor Gold. While losses have increased over five years, stable weekly volatility suggests consistent market perception amidst these developments.

- Jump into the full analysis health report here for a deeper understanding of Teuton Resources.

- Examine Teuton Resources' past performance report to understand how it has performed in prior years.

Key Takeaways

- Get an in-depth perspective on all 422 TSX Penny Stocks by using our screener here.

- Want To Explore Some Alternatives? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teuton Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:TUO

Teuton Resources

An exploration stage company, engages in the acquisition, exploration, and dealing of mineral properties in Canada.

Flawless balance sheet with low risk.

Market Insights

Community Narratives